15-country group represents 73% of global production

Fifteen countries confirmed that they will participate in a meeting April 17, set to be held in Doha, Qatar, in order to discuss a production freeze. The group, made up of both OPEC and non-OPEC countries, will likely freeze production at January 2016 levels, according to Russian Energy Minister Alexander Novak, who has been part of the production freeze talks with OPEC since the middle of February.

Documents for the meeting will be prepared during the remaining time, said Novak. “This is most likely to be a resolution or a joint declaration setting forth intentions of the parties to freeze oil production at [a] level not higher than in January 2016,” Novak told TASS.

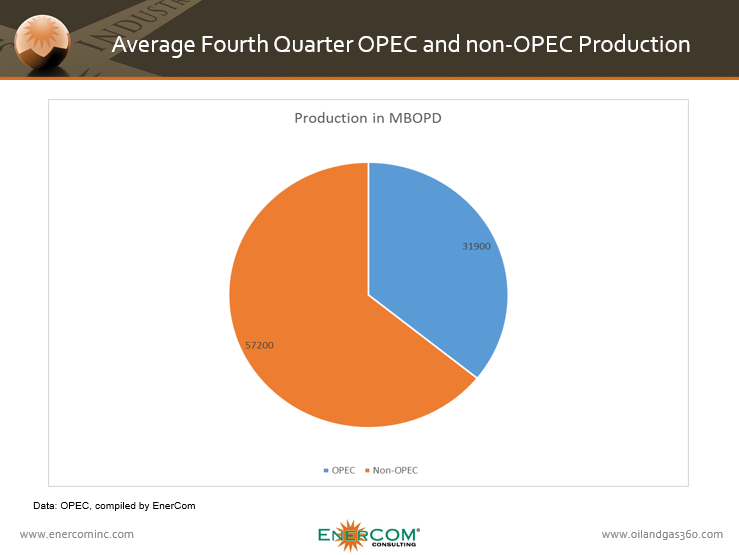

Qatari Oil Minister Mohammed Bin Saleh al-Sada said the group represents about 73% of global oil output, reports Reuters.

Currently, the countries planning to attended are unknown, but with OPEC making up roughly 36% of global production, the majority of the production freeze will be upheld from producers outside the group.

Prices fell Monday after a week of gains when Iranian Oil Minister Bijan Zangeneh said his country would not cap production below 4 MMBOPD as Iran looks to recover lost market share. Additional production from Iran is one of the major downward pressures on oil prices as production continues to outpace modest demand growth.

Other factors supporting the recovery

In addition to the April 17 meeting, oil prices are gaining momentum from slowing production in the U.S., and less hawkish statements from the Federal Reserve.

Information from the DOE this week showed a smaller than expected build in crude oil inventories last week. Crude oil reserves built 1.3 MMBO versus an expected build of 3.2 MMBO for the week ended March 11, 2016.

The U.S. Federal Reserve also announced that it will keep interest rates steady and indicated two rate hikes this year instead of the four expected.

“Easy money is always good for commodities and the Fed gave oil bulls yet another excuse to push crude prices higher,” said John Kilduff, partner at Again Capital.

Some analysts remained concerned by the state of the market, however, with fundamentals still keeping pressure on prices. Societe Generale lowered its crude price forecasts citing persistent oversupply, reasoning that recent price gains are weak and based on temporary supply disruptions.

“Markets remain well supplied, with oil and demand growth remaining modest, leading us to believe oil prices will remain relatively low for some time,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management.