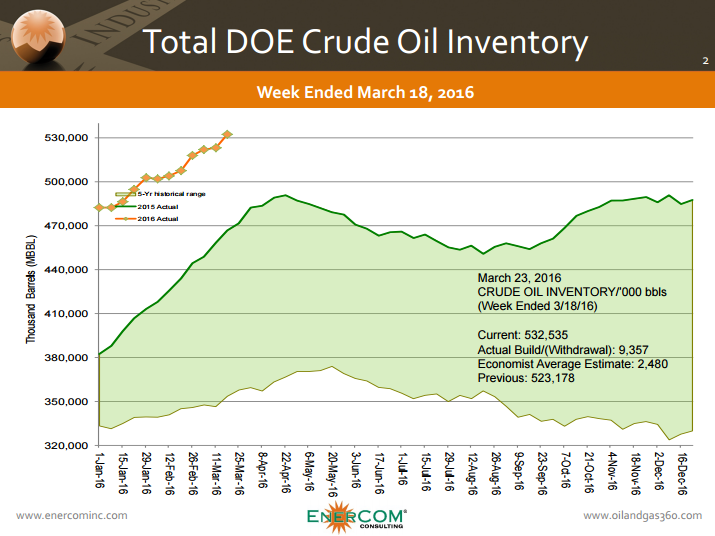

Crude oil inventory build more than three times larger than expected

Oil prices took a fall today following news from the Department of Energy that crude oil storage saw a much larger than expected build this week. The DOE reported a build to crude oil inventories of 9.4 MMBO for the week ended March 18, 2016, more than three times larger than the expected 2.5 MMBO build economists were expecting.

U.S. crude oil inventories now stand at a record-high 532.5 MMBO, far exceeding the five-year average.

News of the unexpectedly large build sent oil prices down today. U.S. benchmark WTI was down over 3% at $40.09 per barrel, while Brent was down over 2% at $40.68 per barrel at 1:13 p.m. EST.

The large build in crude inventories was partially offset by a 4.6 MMBO decline in gasoline inventories last week. Also supporting prices was lower weekly production, with the EIA reporting total output was down 30 MBOPD.

Oil traders are looking to extend or lock in new leases on storage tanks for crude and refined products as far out as the end of 2018, reports CNBC. Storage in Cushing, Oklahoma, has been filling quickly, causing some to worry that the top of the tanks may be reached soon.

Dr. Russel Evans, an economist at Oklahoma City University who provides energy forecasts for Oklahoma City, thought this fear was likely overstated, however.

“I’m a little skeptical of stories that Cushing’s physical capacity could be reached stranding oil in the field,” Evans told Oil & Gas 360® by email. “This would be a monumental failure of commercial real estate development, [and] oilfield logistics… In fact, land sales and storage facility development have been by far the biggest commercial real estate action in Payne County for at least the last five years.”