West Texas Intermediate and Brent crude prices are both up today with strong U.S. economic data and hopes of OPEC production cuts possibly coming on Thanksgiving day, but experts are divided on whether prices will continue to climb. WTI traded at $76.63, a 1.03% gain, and Brent rose 1.49% to $81.51 on Friday.

Factory activity in the U.S. mid-Atlantic region grew at its fastest pace in two decades, U.S. home resales jumped to their highest in more than a year in October, and a gauge of future U.S. economic activity gained more than expected last month, all of which bolstered crude prices, reports CNBC.

The OPEC Wild Card

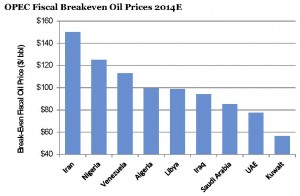

Perhaps more important to crude prices than positive U.S. economic data are hopes that OPEC might cut production after its meeting next week. There have been an increasing number of talks among members of the Organization of the Petroleum Exporting Countries in advance of next week’s meeting, which some experts believe is a sign that the organization is preparing for cuts. But opinion remains divided on whether or not this is actually the case.

Austrian consultancy JBC Energy said it expects OPEC to reduce at least 1 million BOPD to clear some of the inventory overhang. JBC even said the cuts may be even greater. Bank of America Merrill Lynch said it expects OPEC to agree on a 500,000 BOPD cut after next week’s meeting, reports CNBC. ”They’re running around like chickens without a head, but they’re going to do something,” said Francisco Blanch, Bank of America Merrill Lynch head of global commodities derivatives research.

New York-based consultancy Eurasia Group is less optimistic about the potential for a cut next week. “It is increasingly likely that an agreement on a ‘headline’ production cut will not materialize, despite the current flurry of pre-meeting diplomacy,” it said.

OPEC members Iran, Venezuela and Libya have urged fellow crude producers to support oil prices, which are down 30% from June and are trending along four-year lows. Kuwait and Iran have said a cut is unlikely. Saudi Arabia also signaled that it is not interested in cutting production. Daniel Yergin, vice chairman of IHS, said “I think the Saudi position is different than the other countries because what they want to do is defend their market share.”

Talks next week in Vienna will go a long way to decide future oil price moves, but the current direction is unclear.. John Kilduff of Again Capital said, “people don’t know which way [the price] is going to go, but it’s going to go a long way in either direction,” Suggesting that prices could rise or fall dramatically after the OPEC meeting.

Barron’s said $75 oil prices were plausible back in March due to the unfixed production costs. The article says most tight oil is still economic at $75 a barrel, but several E&Ps have announced slight reductions in their 2015 drilling plans in the recent earnings season. The Wall Street Journal doesn’t expect changes from OPEC until Brent prices reach $70 per barrel.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Wells Fargo Securities 11/21/2014

Key Takeaway--OPEC Front And Center. The last couple of months have

been unkind to oil bulls. Weaker-than-expected 2014 global oil demand trends,

meaningful non-OPEC production growth, and OPEC producing above its selfimposed

quota have created fears of a growing surplus in 2015. In our view, it is

becoming clearer that 2015 global E&P capex will be well below prior expectations

of meaningful growth. Additionally, U.S. demand appears to have turned the

corner in 2014 and lower oil prices should provide a modest tailwind to global

demand expectations for 2015. Thus we expect oil prices will rebound from

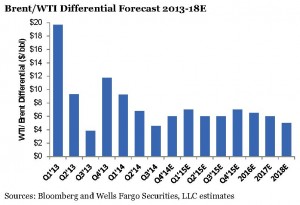

current levels as soon as Q2 2015. Our new/old WTI per barrel forecasts are

$94.80/$96.80 for 2014, $83.25/$91.50 for 2015, $87.50/$93.50 for 2016,

$86/$90 for 2017 and $85/$90 for 2018. Our new/old Brent per barrel forecasts

are $101.20/$103.45 for 2014, $89.25/$98 for 2015, $94/$100 for 2016,

$92/$96 for 2017 and $90/$95 for 2018.