Crude oil inventory build offset by refined product draw, supporting prices above $50 per barrel

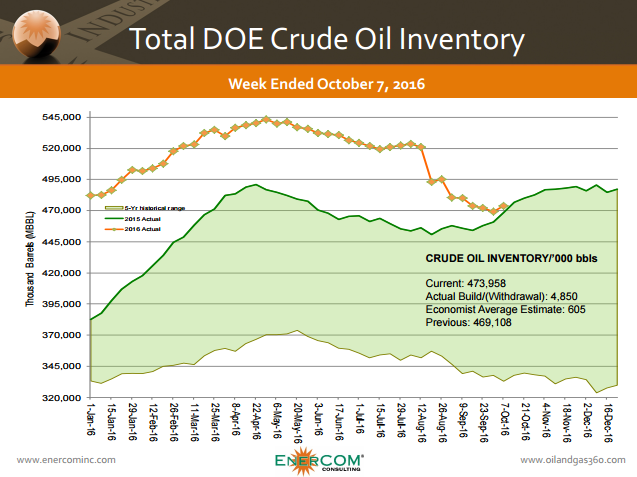

Both Brent and WTI crude prices are up after falling earlier in the day on expectations of a 3 MMBO crude oil build. The build exceeded expectations, with the U.S. adding 4.9 MMBO to its inventory according to the EIA, but prices recovered following the report on news that distillates fell this week as well.

This week’s build was the first in six weeks, an unusual pattern for this time of year. Typically, crude oil inventories build consistently between summer and winter as the driving season ends and before cold weather increases demand for heating. The previous five weeks of inventory builds have helped to push oil prices back above $50 per barrel, but the build announced today was not enough to damage the gains made in recent weeks.

U.S. gasoline stockpiles fell by 1.9 MMBO, and distillate fuel oil in storage dropped by 3.7 MMBO, helping to offset the larger-than-expected crude build, which brought total crude oil in storage to 474 MMBO. Analysts attribute the strength in crude prices today to U.S. refiners processing more fuel than usual as pipeline outages and glitches at refineries that included three fires and one shut-down kept profit margins up.

OPEC production continues to climb

Data from abroad was also sending competing signals to markets today, with OPEC showing increased production in September despite the group’s assurance that it plans to cap production near 33.0 MMBOPD, and China reported increased crude oil imports.

OPEC’s report, released Wednesday, increased production from August to September, with the group’s total output reaching 33.4 MMBOPD, the highest level in at least eight years. Additional production came primarily from Iraq, Libya and Nigeria, which added 105 MBOPD, 93 MBOPD and 95 MBOPD, respectively. Production in Saudi Arabia, OPEC’s largest producer fell approximately 88 MBOPD month-over-month, according to secondary sources cited in the report.

OPEC also raised its forecast for 2017 non-OPEC supply growth, indicating that the glut could persist longer, putting more oil into storage in the future.

The big opportunity is in prices going up: Andurand

While the news was bearish, some traders remained optimistic about the future of oil prices.

“In 2014 the big opportunity was in prices going down and now the big opportunity is in prices going up. That’s the way I see it,” hedge fund manager Pierre Andurand told the Reuters.

China importing more oil

Increased imports into China also helped to offset higher production from OPEC this week, with the People’s Republic reporting crude oil imports of roughly 8 MMBOPD. The data indicates that imports are up 18% year-over-year, and made China the world’s top buyer of foreign oil for the third time this year, eclipsing the United States.

Crude imports were a bright spot in the Chinese data this week, which showed a 10% fall in exports and a 1.9% drop in imports.