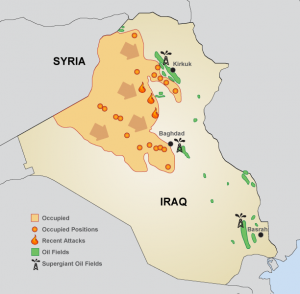

Yesterday energy analysts warned of a significant global price jump for oil if Iraq’s southern oil fields are captured and shut down, but commodity prices appear to be disconnected this week from the potentially serious threat to Iraq’s oil production, after posting a four percent gain during last week’s escalation of hostilities.

Raymond James’ Managing Director Marshall Adkins said that a two million BOPD interruption to global supply could send the price of Brent crude as high as $150. “I am surprised at the lack of movement given the potential for supply disruption,” Adkins told Oil & Gas 360® yesterday.

Today NBC News reported that “Brent rose 17 cents to $113.62 a barrel by 1445 GMT. U.S. crude however was 6 cents lower at $106.30 a barrel after a smaller than expected draw in domestic stocks.”

Iraq’s two million barrels of crude oil per day coming from its southern oil fields represent roughly two-thirds of the country’s output. Iraq held the fifth largest crude oil reserves in the world at the end of 2012, according to the EIA. BP, Exxon Mobil, Shell and Chevron (ticker: CVX) are working in the southern Iraqi oil fields.

Other experts have expressed similar price concerns. “The continued advances of ISIS into Baghdad and southern Iraq could seriously disrupt Iraq’s oil industry with quite devastating effects on the global economy,” said John Hannah, advisor to Vice President Dick Cheney and the State Department under Presidents George H.W. Bush and Bill Clinton. Speaking further about Iraq in an interview with Newsmax, Hannah said, “Right now, the direct threat to Iraqi oil production is limited. However, if you’re a Western oil operator with people and equipment on the ground, and you see the barbarian hordes approaching the gates of Baghdad and southern Iraq [where Iraq’s major oil fields are located], you’re going to want to get out fast.”

According to Reuters: “Almost all Western oil majors work with Baghdad on joint projects including Exxon Mobil (ticker: XOM), BP (ticker: BP), Royal Dutch Shell (ticker: RDS.B), ENI (ticker: E), Russia’s Gazprom Neft (ticker: SIBN.ME), Lukoil (ticker: LKOH) and Chinese firms. BP said it had sent non-essential staff in Iraq home and its operations there have not so far been affected. Lukoil and Gazprom said the fields they operate in Iraq are distant from the fighting and there is no need to fear disruption to output. The Kirkuk oilfield is the basis of Iraq’s northern production. Kirkuk is connected to world markets by pipeline to Turkey’s port of Ceyhan. Exports have been shut since early March due to attacks on the pipeline.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long-only position in Royal Dutch Shell.