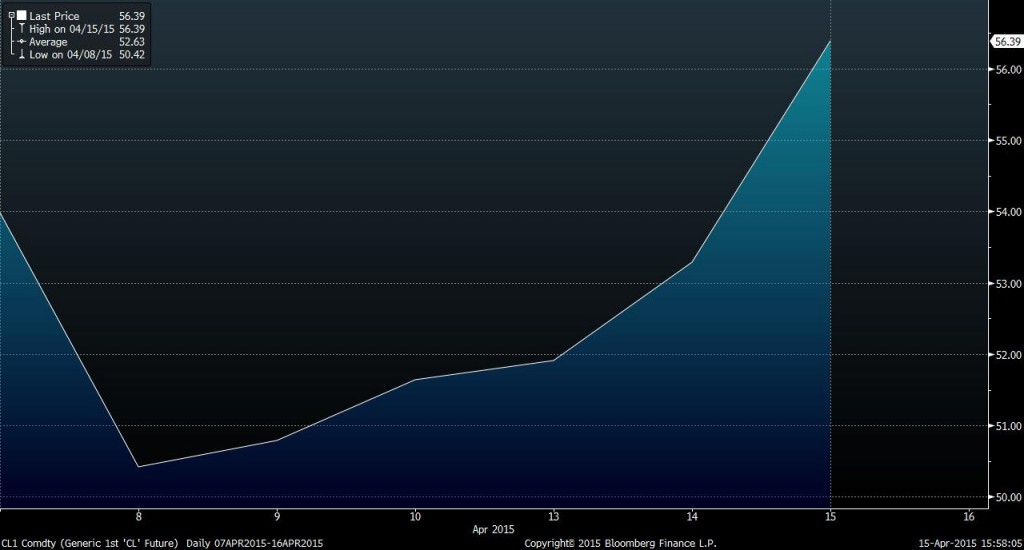

Data showing slowed U.S. production and slightly higher demand sees oil prices climb

Prices for West Texas Intermediate (WTI) and Brent crude were both up on news that U.S. oil production is continuing to slow. Light, sweet crude for May delivery settled up $3.10, or 5.8%, to $56.39 per barrel on NYMEX, while Brent gained $1.89, or 3.2%, to $60.32 per barrel.

U.S. production slowed down 2% from the prior week, reports The Wall Street Journal, sparking one of the biggest one-day rallies for U.S. oil prices in two months. Production declines also helped lower storage additions, which rose 1.3 MMBO in the week ended April 10 – the least of the year.

These factors are reducing fears that the country is running out of storage space for oil, a fear that played a big role in falling oil prices, said Greg Sharenow, a portfolio manager at Pacific Investment Management Co. “That’s the biggest driver of what’s going on here,” he said. “The market has become more balanced.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.