Falling Rig Count, CapEx Cuts Having Impact

Groundhog Day might have been a scare for two out of three groundhogs, but not for the world’s oil bulls.

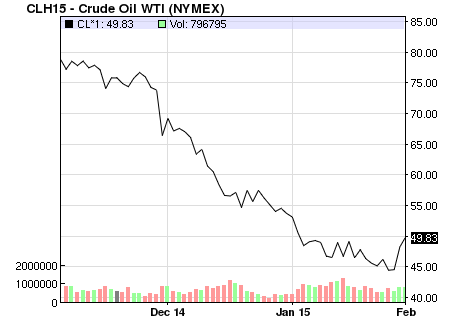

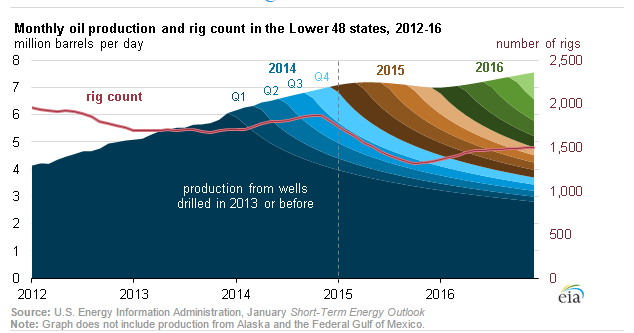

In spite of warnings of a short-lived rally from some banks, oil prices managed to climb nicely on Feb. 2, maintaining about a $5 spread between the key benchmarks, WTI and Brent. Analysts point to widespread CapEx cuts leading to falling rig count and future production slowdowns from the U.S. shale beds; i.e., reduce the supply to balance the equation. And even in the face of soft economic data for the U.S. and Canada, the world’s primary fuel source traded on a steady uptick. Coming off a day’s low of $46.67, March WTI traded as high as $50.56, trading late in the day just short of $50 at $49.83. Brent March contracts closed at $55.10.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.