“There is no sense in wasting our time seeking production cuts” – Ali al-Naimi

Both U.S. and international benchmark crude tumbled more than 4% this morning after making gains in the last week. The culprit was the comment from Saudi Arabian Oil Minister Ali al-Naimi that production cuts are not coming from OPEC’s largest producer. Hopes that a surprise deal to freeze production among Saudi Arabia, Russia, Qatar and Venezuela might be the first step towards eventual production cuts were overturned as Naimi made clear that Saudi Arabia would not seek to cut production.

“Freeze is the beginning of a process, and that means if we can get all the major producers to agree not to add additional balance, then this high inventory we have now will probably decline in due time. It’s going to take time,” Naimi said in Houston today.

“It is not like cutting production. That is not going to happen because not many countries are going to deliver even if they say they will cut production — they will not deliver. So there is no sense in wasting our time seeking production cuts,” he added.

The proposed production freeze also lost some of its luster when Iran and Iraq, the two OPEC members responsible for the most production growth in the group, said that they supported the deal, but had no intentions of freezing their own production.

“We are doing what every other independent representative in this room is doing,” he said to an audience of U.S. oil and gas executives at a conference in Texas. “We are responding to geology and market conditions and seeking the best possible outcome in a highly competitive environment.”

“We have not declared war on shale or on production from any given country or company, contrary to all the rumors you hear and see,” said Naimi. The market will determine where the cost curve of marginal oil production lies, the oil minister said. Drillers with higher costs must find ways to become more efficient, borrow cash, or liquidate, he added.

“The oil market is much bigger than OPEC. We tried hard to bring everyone together — OPEC and non-OPEC — to seek consensus. There was no appetite for sharing the burden, so we left it to the market as the most efficient way to rebalance supply and demand,” Naimi said.

“It was, it is, a simple case of letting the market work.”

OPEC unsure of how to coexist with shale

In comments yesterday at the same conference, OPEC Secretary General Abdalla Salem el-Badri said the organization is unsure of how best to coexist with shale production. “I don’t know how we are going to live together,” el-Badri said yesterday.

Shale production’s ability to rapidly react to changes in prices has made it difficult for OPEC to anticipate. “Any increase in price, shale will come immediately and cover any reduction,” OPEC’s secretary general said.

U.S. tight oil production is expected to take the brunt of lower prices over the next year, with the IEA anticipating 800 MBOPD less of production through 2017. Despite this, the IEA still believes tight oil production from U.S. shale will still be the main source of production growth through 2021 as prices recover.

“Anybody who believes that we have seen the last of rising [light tight oil] production in the United States should think again,” the agency said in its Medium-Term Oil Outlook.

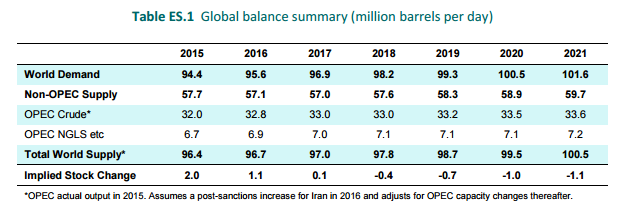

The IEA forecast predicts OPEC production remaining relatively flat through 2021, while non-OPEC supply grows from 57.7 MMBOPD to 59.7 MMBOPD after touching a low-point of 57.0 MMBOPD in 2017.

Meantime U.S. shale producers are reporting Q4 results, with revenues down, as expected, from dropping commodities prices, but many continue to show increases in production due to efficiency gains. Rig count continues dropping as capital expenditures for drilling and field development have been slashed by most shale producers due to the price environment.