Forecast Pushed Back in 2016

Earnings season is underway, but you’d have a hard time believing we’re in the first week of quarterlies judging from a headline from Bloomberg this morning. It reads, “$6.5 Billion in Energy Writedowns and We’re Just Getting Started.”

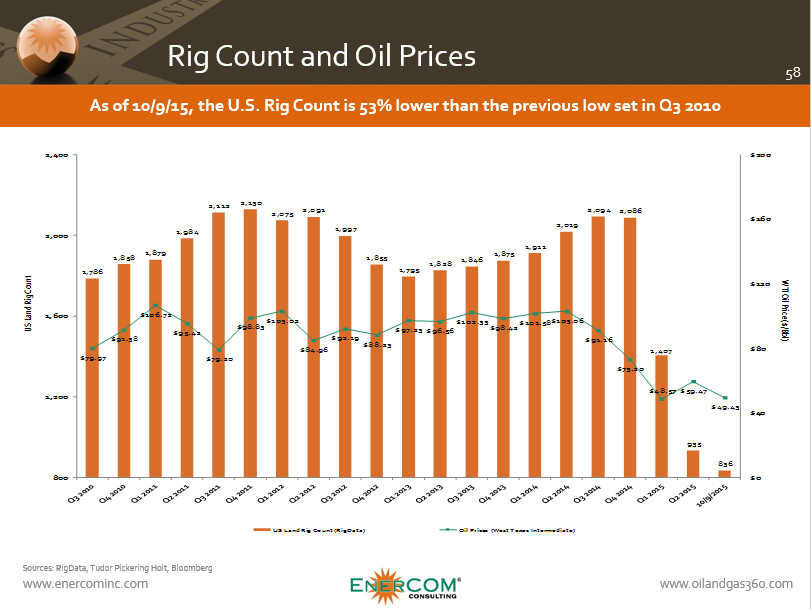

Investors and executives in search of good news didn’t get any from the industry’s two oil service giants of Halliburton (ticker: HAL) and Schlumberger (ticker: SLB). The global revenues of the two respective companies have declined 36% and 33% on a year-over-year basis. In North America, revenues are down by 47% apiece in the same time frame – a clear reflection of the activity slowdown, as oil rig counts are 63% below levels from one year ago.

State of the Union

Schlumberger started the somber party when it released its results on October 15, 2015. “[This] is shaping up to be the most severe downturn in the industry for decades,” said Paal Kibsgaard, Chairman and Chief Executive Officer of SLB. “As we enter the last quarter of the year, the oil market is still weighed down by fears of reduced growth in Chinese demand and the expectations regarding the timing and magnitude of additional Iranian supply.”

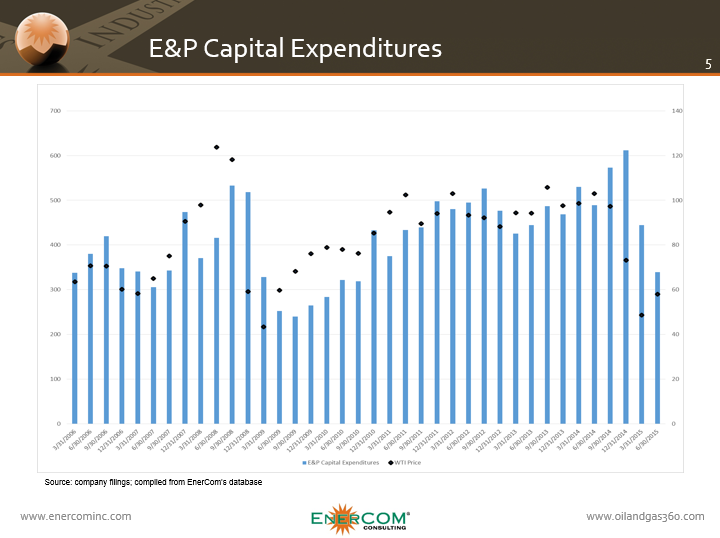

SLB expects further E&P investment cuts in 2016, marking the first time since 1986 that overall E&P expenditures have dropped consecutive years. The renewed focus of focusing on top tier plays and waiting out the commodity storm has had unintended consequences on the market, explains Kibsgaard. “While production is starting to come down, I think there are also significant efforts to maximize production within each of these basins by in some cases taking more short-term actions to maximize production, which might actually have a negative impact on long-term recovery,” he said, adding that a “likely recovery” now seems to be in 2017.

When Will the Recovery Begin?

Dave Lesar, Chief Executive Officer of Halliburton, was much more optimistic in the latest call – a stark difference from when he described the environment as a “damn tough market” in HAL’s Q2’15 results.

“We believe that customer budgets will reload in the first quarter and anticipate activity to ramp up in the second half of 2016,” he said. “The real key is going to be the production declines you see. These companies will get to the point where they have to start drilling or they have to start dismantling their companies, and they’re not going to want to do that.”

Despite the optimism of a recovery, both of the service giants admitted the lack of transparency in the upcoming quarter. SLB management is reverting to operating the company on a quarter-by-quarter basis, while Lesar admitted that visibility is “murky at best.”

Kibsgaard and SLB management added the market may be overestimating how quickly the industry can respond to a commodity rebound. He explains: “Four quarters into very low oil prices, the financial strength of many of our customers is significantly weakened and their appetite to invest is also a bit down. Any improvement in oil prices will likely initially to go towards strengthening the balance sheet and then the oil companies will likely assess how sustainable are these increases in oil prices before they start investing.”

Core Lab Standing Its Ground

Core Laboratories (ticker: CLB), a Houston-based oilservice provider focused on reservoir optimization, production enhancement and reservoir description, made waves in the industry in Q1’15 by declaring a “V-shaped” recovery was in the works. CLB management pushed that assessment back into 2016, but still holds on to the belief that a rapid rebound is building.

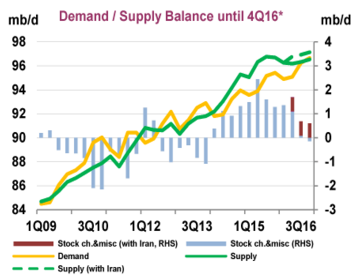

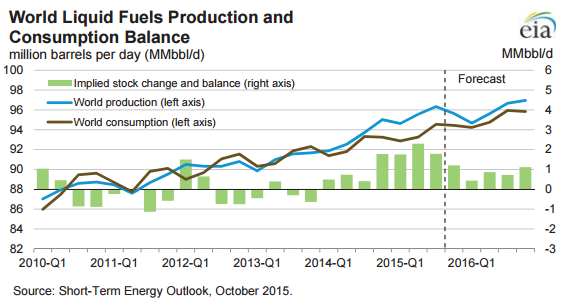

The gist of the belief: U.S. production has rolled over, the supply/demand imbalance is tightening, the Middle East is already producing at maximum amounts and decline curves from shale will ultimately spur a rapid investment to meet demand. U.S. shale creates estimated decline curve rates of 7.8%, roughly 150% higher than the global decline rate of 3.1%, which, by the way, was just revised upward by 60 basis points. CLB believes the decline rates will remove 900 MBOPD in the North American market in 2016, on a year-over-year basis. This is after production already began to decline in April 2015.

In the midst of the downturn, oil’s affordability has boosted its appeal to consumers. The International Energy Agency believes worldwide demand will increase by as much as 3,000 MBOPD in 2015 and 2016 in response to the lower prices. North America is projected to drop 1,600 MBOPD of production in the same time frame. Taking into account the global decline rates, Core believes more than 2,600 MBOPD must be produced in 2016 to maintain current volumes. “That’s just not going to happen, said David Demshur, Chairman and Chief Executive Officer of Core Lab, in a recent conference call.

Demshur also added there is plenty of running room remaining in existing wells, as the completion technique is “not even close” to being optimized. “We know we can push a long chain hydrocarbon about 120 feet in an average tight oil reservoir,” he said. “If that is indeed the case, we should have a stage every 240 feet or so apart. Today, stages are still more than, on average, 400 feet apart.”

Halliburton’s Optimism

Halliburton backed Core’s activity recovery assessment, explaining that customer budgets will reload in the first quarter and contribute to activity ramping up in the second half of 2016. Current budgets are nearly drained (CLB and SLB both used the term “exhausted”) and borrowing base redeterminations are still being issued, leaving E&Ps at the end of their drilling rope for 2015. HAL management said 2016 may look like a mirror image of 2015 as the buildup in capital will lead to revitalized drilling operations.

“We’re not going to try to call the exact shape of recovery, but we do believe that the longer it takes, the sharper it will be,” said Lesar. “And when that recovery comes, we expect North America will offer the greatest upside.”