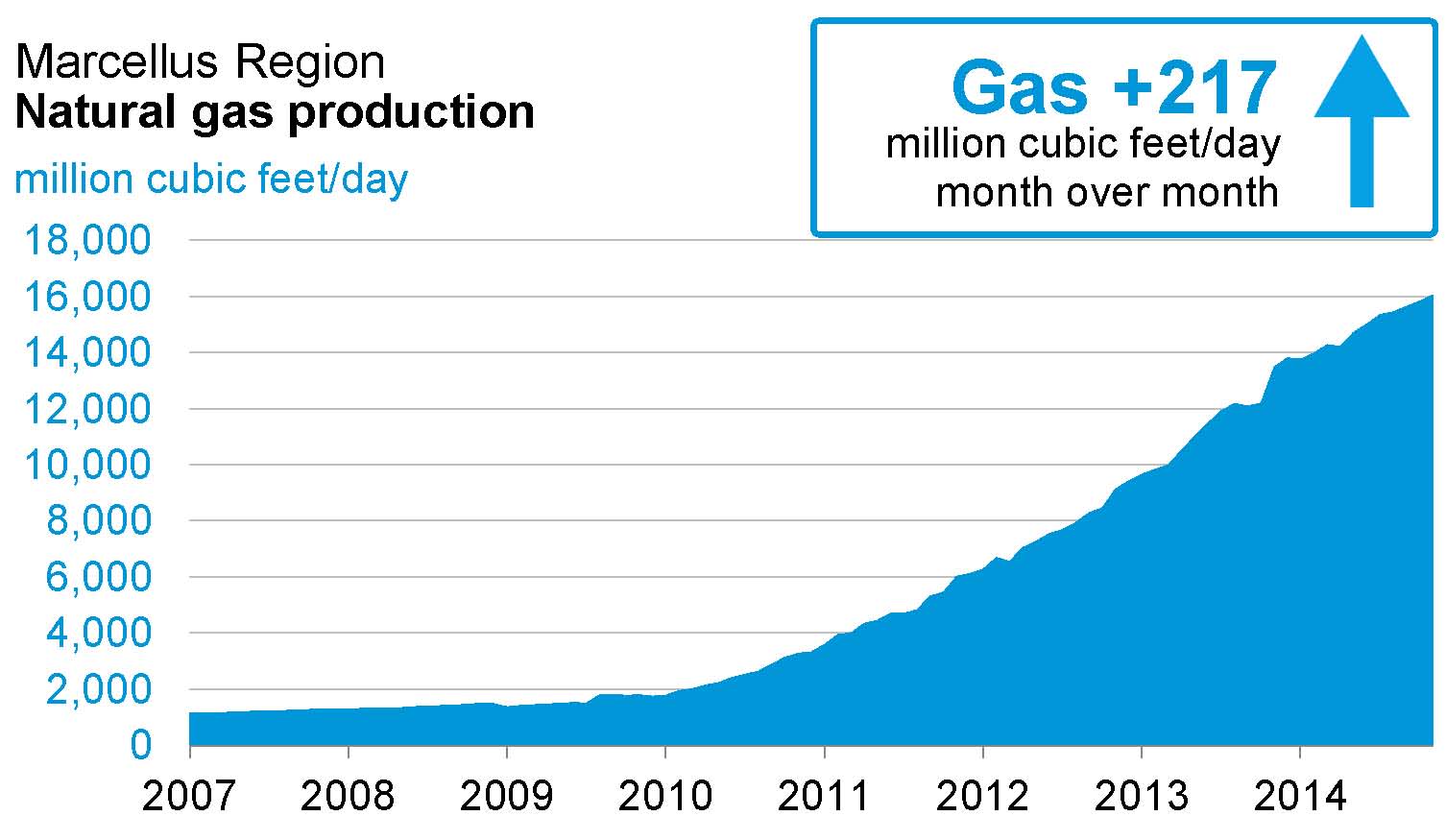

The Marcellus shale represents almost 20% of U.S. natural gas production. Ten years ago it was zero.

Jeff Ventura is well aware of the oil and gas history associated with the state of Pennsylvania.

Titusville, 1859—Edwin Drake drilled the first commercially successful oil well to a depth of 69 feet. That well gave birth to the global petroleum industry. A hundred forty-five years later, lightning struck again in Pennsylvania. This time it was 150 miles south of Titusville, near Mt. Pleasant Township in October of 2004, when Ventura made a single decision.

With one year under his belt as Chief Operating Officer of Range Resources (ticker: RRC), Ventura was approached by a company geologist named Bill Zagorski who had returned from a visit to Texas’ Barnett shale, the birthplace of the shale revolution.

Zagorski said he had a ‘eureka moment’ after his visit with a colleague working in the Barnett. At the meeting he told his COO that he knew of a shale that he believed was much like the Barnett—the Marcellus shale in Pennsylvania. “The advantage being that the Marcellus covered a lot bigger area and came with a lot more upside,” as Ventura would later sum things up.

At the meeting, Zagorski proposed to Ventura that the company go back into an unsuccessful exploration wellbore that had sucked up millions of the company’s capital, thus far to no benefit. The bore, known as Renz #1, already had its surface area restored and was slated to be plugged and abandoned. Zagorski’s idea was to go back into the well and specifically target the Marcellus shale layer using a hydraulically fractured well completion.

“Bill presented the idea and he presented it very well,” Ventura said when retelling the tale to the American Association of Petroleum Geologists as the organization’s 2013 Halbouty lecturer.

“The conventional wisdom was: don’t test, it won’t work, it’s been tried before… . Decades of drilling through [the Marcellus] show that it’s water sensitive, it’s not going to work.” But Zagorski was positive about the prospect and had ample data to back up his idea, including documentation of numerous gas shows for the Renz #1 and other wells in the area. As Ventura later summed it up, “creativity with strong scientific basis topped conventional wisdom.”

After a lengthy discussion with the Range exploration team, Ventura approved Zagorski’s idea and told the Range team to “put a big, Barnett style water frac on it.”

That single business decision resulted in the discovery of what would become the largest producing natural gas field in the U.S., estimated to be the second largest on the planet, behind only the South Pars gas field in the Persian Gulf. The Marcellus shale boom was officially born.

“Looking back, it was one of the best decisions of my life,” Ventura, now CEO of Range, said.

Source: EIA

How Big is the Marcellus?

No matter how you slice it, the Marcellus is big. The Marcellus and its cousin, the Utica shale, sprawl across the northeast U.S. and underlie approximately 80% of Pennsylvania, almost all of West Virginia, more than half of New York, and about half of Ohio.

Some estimates say the Marcellus might hold as much as 500 trillion cubic feet (Tcf) of recoverable natural gas. For framework purposes, U.S. natural gas domestic consumption hit a peak when the country used 3.2 Tcf of natural gas in January of 2012. If the 500 Tcf prediction is accurate, the Marcellus by itself could produce enough recoverable natural gas to supply 13 years of demand at January 2012 consumption levels. To put it in further perspective, the EIA reports U.S. gas withdrawals were just above 2 Tcf for the month of October 2004 when the Renz #1 discovery well kicked off Marcellus development. U.S. withdrawals were 2.65 Tcf for July 2014.

“Five years ago, the Marcellus produced barely 2 Bcf of gas per day. Now it pumps 16 Bcf/day, a fifth of America’s gas. It is at the heart of the U.S. shale gas revolution…,” Reuters recently reported. “The Henry Hub in southern Louisiana, which connects to more than a dozen on- and offshore pipelines from Texas and the Gulf of Mexico, has been surpassed as the most active place for trading physical U.S. natural gas by hubs in shale-rich Pennsylvania.”

Ventura’s decision to put a million-gallon frac on the Renz #1 and other Marcellus discovery wells opened up the floodgates to a tidal wave of drilling activity in Pennsylvania and West Virginia.

The result? For the past decade the Marcellus has boosted the country’s essential natural gas supplies and fueled low-carbon electricity and heat for U.S. families and businesses, led to the creation and/or support of more than 240,000 jobs in Pennsylvania alone, and delivered the foundation required to revive U.S. manufacturing—cheap, reliable energy.

Range Looking to Triple Production

Range Resources has reestablished itself on the back of the Marcellus. The company today has approximately one million net acres in Pennsylvania that are prospective for shale, including the Upper Devonian, Utica/Point Pleasant and the Marcellus. The stacked pay potential places the company’s acreage closer to 1.9 million net acres with potential for natural gas production.

In its Q2’14 earnings release published at the end of July, Range reported record-high production volumes averaging 1,105 MMcfe/d, a 21% increase over the prior-year quarter. Its quarterly net income increased 19% to $171 million. The company also increased future firm transportation capacity by 400,000 MMBtu/d and signed two LNG supply agreements.

Over the past four years, the company has moved 6.4 Tcfe of resource potential into proved reserves. Range says in its October 3 investor presentation that it has all the parts in place—the identified wells, planned infrastructure and contracted takeaway capacity—to profitably grow production to 3 Bcfe/d and it believes it can be cash flow positive in 2016, assuming current strip pricing.

Source: RRC 10/14 Presentation

Large Marcellus producers like Range Resources, Antero Resources (ticker: AR), Cabot Oil & Gas (ticker: COG), Chesapeake Energy (ticker: CHK), EQT Corporation (ticker: EQT), Chevron (ticker: CVX) and Anadarko Petroleum (ticker: APC) are betting on U.S. natural gas demand growth from sources beyond domestic heating and cooling demand. Expectations for demand growth include global LNG exports, rising petrochemical demand, increasing numbers of new natural gas-fired power plants replacing carbon-intensive coal-fired generation, continued growth in U.S. manufacturing and a growing use of natural gas as transportation fuel.

The Marcellus Effect: Welcoming Industry Back to the Rust Belt

France’s Vallourec (ticker: VK) recently completed a million-square-foot plant in Youngstown, Ohio, that will make steel pipe for the energy industry. It’s “the first mill of its kind to open here in 50 years,” the New York Times reported. “The facility, which cost $1.1 billion to build, will be joined next year by a smaller $80 million Vallourec plant making pipe connectors. … Here in Ohio, in an arc stretching south from Youngstown past Canton and into the rural parts of the state where much of the natural gas is being drawn from shale deep underground, entire sectors like manufacturing, hotels, real estate and even law are being reshaped. A series of recent economic indicators, including factory hiring, shows momentum building nationally in the manufacturing sector,” the Times reported.

Global Customers: Preparing to Send U.S. Gas to Europe and Asia

The boost from the Marcellus gas production has helped shape the U.S.A. into a muscular energy player on a global scale, having an effect on world commodity prices and geopolitical decisions. The EIA’s International Energy Statistics report compares gas producing countries’ output through 2012. For 2012, U.S. natural gas production was 29.5 Tcf, the entire Middle East was 25.4 Tcf, and Russia was 23.1 Tcf. No other country or region comes close.

The Marcellus’s natural gas could bring energy stability to Europe and Japan over the next decade, when U.S. LNG export volumes are expected to kick into high gear as about a dozen proposed U.S. LNG export plants are planned to come online. On Oct. 8, 2014, Texas Gov. Rick Perry called for unlimited natural gas and oil exports, saying it would help the American economy and aid American allies threatened by Russia’s control of European natural gas supplies, the AP reported.

“The first order of business to restore balance in Europe is for America to build an energy shield to protect our strategic allies,” Gov. Perry said at Mississippi Gov. Phil Bryant’s Energy Summit. “That means we must accelerate our exports of America’s vast energy resources.”

The International Monetary Fund recently discussed the global implications of the U.S. shale boom. “In 2000, shale gas accounted for merely 1% of U.S. natural gas production. Today, shale gas production now accounts for about half of the total U.S. natural gas production, according to the IMF,” in a MarketWatch report. “The U.S. shale revolution … has been able to help stabilize international energy prices. With the disruptions seen in the geopolitical landscape, the increase in shale gas production has helped offset shortages, keeping prices lower than they would have been otherwise.

“The IMF reports that the shale revolution has given the U.S. an advantage in the natural gas arena, allowing it to be more competitive in non-energy products,” the report said.

“The Marcellus shale has fundamentally altered the outlook for the U.S. natural gas industry. The U.S. is emerging as a low-cost chemicals producer and is poised to become an exporter of natural gas—a feat unthinkable just 5 years ago when it was widely believed that increasing LNG imports would be needed to meet domestic demand,” the Oil & Gas Journal reported.

Source: RRC 10/14 Presentation

“The Best is Yet to Come”

It’s been 10 years since the Range team deliberated whether they should even test the Marcellus. The go-ahead decision from the company’s COO led to a world class natural gas basin that has accelerated the shale revolution and turned the U.S. into the world energy leader.

So what’s next for Range Resources and the Marcellus? Oil and Gas 360® asked that question today to Matt Pitzarella, Range’s director of communications and public affairs.

“Despite being the largest producing natural gas field in the United States, the best is still yet to come from the Marcellus and Range,” Pitzarella said. “We have the ability to grow 20-25 percent for many years on our way to tripling current production to 3 Bcfe/d net, driven largely by the Marcellus.”

What’s next for the Marcellus?

If Range succeeds in tripling its current production, Pitzarella sees these probable effects: “continued job creation, tax revenues for state and local governments, royalties for landowners, and possibly a new manufacturing renaissance for the Marcellus region.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.