Iran and Iraq Rivalry Will Decide the Outcome

The chance of a credible OPEC agreement this Wednesday is 50-50, or a coin-flip according to a recent report by Societe Generale analyzing OPEC’s complex negotiations since its September 28 Algiers meeting.

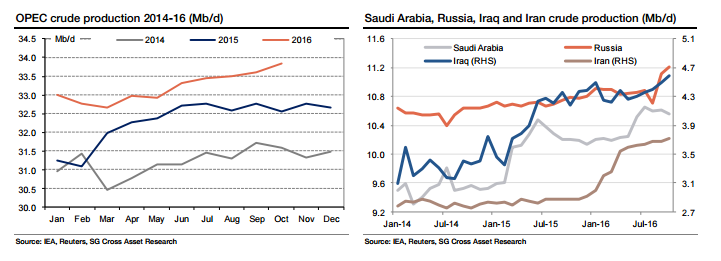

Optimism for a deal has fallen due to Iran and Iraq’s resistance to curbing their output, Saudi Arabia and the Gulf States’ reluctance to bear the brunt of cuts, and non-member Russia’s announcement that it would not attend the OPEC meeting.

Changing Saudi Role in OPEC

Aside from a framework agreement on a new crude production target of 32.5 to 33.0 MMBOPD, the meeting in Algiers saw a “180 degree change in tone and substance from Saudi Arabia,” according to SocGen. Under the agreement, Saudi Energy Minister Khalid al-Falih granted Libya, Nigeria, and Iran permission to produce “at maximum levels that make sense” due to these countries’ “special conditions” of major disruptions and sanctions.

This was intended to set a positive tone for negotiations by addressing these countries’ concerns, which were seen as the main obstacles to a deal. In the days after, the Saudis and Iranians closed in on an output target agreement, with Saudi saying they would cut 4% and Iran lowering their 4.0 – 4.2 MMBOPD end of year target to 3.7 to 3.9 MMBOPD.

A recent Bloomberg article notes that historically the Saudis have shown their hands last in OPEC negotiations, letting other countries put forward proposals and waiting to see what kind of support they receive. In the run-up to Algiers, the Saudis showed their hand early by signaling their willingness to consider cuts after two years of produce-at-will.

Iraq Throws a Spanner in the Works

SocGen argues that most of the problems since Algiers have been related to Iraq, which first argued that it should be exempt from cuts along with Libya, Nigeria, and Iran. It then said that it would consider cuts if they were based on production figures that were 300 MBOPD higher than OPEC’s numbers. Essentially, the country was double counting its production from Kurdish-controlled oil fields in the north of the country.

Source: Societe Generale

Why inflate production numbers? The state oil company SOMO and the Kurdish Regional Government (KRG), responsible for its own production, have clashed for years over how to divide revenues from oil exports transported out of the Iraqi Kurdistan Region. SocGen suspects SOMO is worried they will be forced to bear the brunt of any required cuts and that the KRG will not do their share.

Secondly, Iraq and Iran’s historical rivalry means that they don’t want to give up market share to the other. Iraq’s insistence on starting their cuts from inflated numbers possibly pushed Iran away from the 3.7 to 3.9 MMBOPD range, deteriorating negotiations.

Saudi Back to Managing the Market?

SocGen cites a number of reasons for the Saudis changing their strategy back to active market management.

- They believe that their low price market share strategy has succeeded in slowing and even temporarily reversing growth in production and investment from the U.S. and other expensive, non-OPEC sources.

- The financial pain in Saudi Arabia is starting to be felt and is real.

- Higher oil revenues are needed to pay for reforms to diversify the economy away from oil.

- Higher oil revenues are needed to pay for an assertive foreign policy.

- Higher prices will help the partial IPO of Saudi Aramco, planned for some time in 2018.

- Higher prices will reduce the risk of domestic political instability within Saudi Arabia.

Saudis Won’t Push for an Agreement at any Cost

Despite these reasons for strategy change, the bank does not believe that the Saudis are desperate for an agreement and will not push for one at any cost.

“They started out in Algiers by making a very significant compromise but at this point they must feel that their gesture has not been met with reciprocity from key players such as Iraq and Iran. In the end, there is a limit to how far the Saudis will go — and that limit is that they will not cut alone.”

Minister Al-Falih has indicated his belief that oil prices will stabilize next year without OPEC intervention, increasing market pessimism about whether the Saudis will take the short end of the stick. Of course, in the poker game that is OPEC negotiations maybe that’s just what they want Iran and Iraq to think…

Not Just “Deal or No Deal”

Even if an agreement is announced on Nov. 30, a strong catalyst would be the release of country-specific details as to baseline production levels, cuts, and new production targets for all 14 members. When individual country figures have not been decided upon in the past, organization-wide baselines, cuts, and targets have been released to less effect on prices. Either way, the industry should have some indications of change or status quo in the next 24 hours.