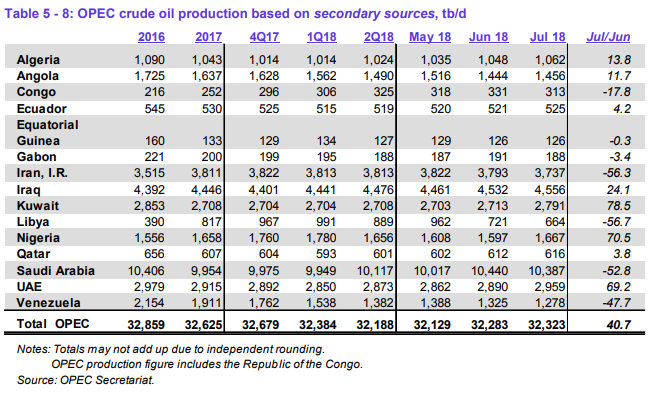

Total cartel production up 40.7 MBOPD

OPEC has released its Monthly Oil Market Report, outlining the cartel’s assessment of the state of the international oil industry.

OPEC produced a total of 32,323 MBOPD in July, up moderately from last month. Cartel production increased by a net 40.7 MBOPD in July, a smaller change than seen in the past month. Nearly every member of the group saw a large change in oil production in July, as many different events altered output.

Kuwait, UAE, Iraq comply with new agreement

The largest increases in production came in Kuwait, UAE and Iraq, likely as a result of these countries responding to the cartel’s agreement to increase production. Kuwait, UAE and Iraq are some of the few OPEC members that are in a position to meaningfully increase production, as many others are at or near their productive capacity. The three countries added a combined 171.8 MBOPD in July, providing a major boost to the cartel’s total output.

Nigeria provided the group’s other major production boost, adding 70.5 MBOPD. Output from the African producer has mostly recovered from the disruptions seen in previous years but is still unstable. Smaller production increases were seen in Algeria, Angola, Ecuador and Qatar.

Saudi, Iran, Libya and Venezuela all fall

Surprisingly, Saudi Arabian production declined in July, after increasing sharply in June. The country produced 52.8 MBOPD less than in June, a surprising shift considering Saudi Arabia was perhaps the most forceful proponent of increasing cartel output.

The other countries that showed significant declines in oil production were much more predictable, Iran, Libya and Venezuela. Iranian production will likely decrease over the next several months, as sanctions approach. While several countries, like Turkey and China, are likely to continue buying Iranian oil despite the new U.S. sanctions, which are set to take effect in early November, most analyst predict Iranian output will decline significantly. Recent estimates predict Iranian oil shipments will decrease by 700 MBOPD to 1 MMBOPD.

The Libyan decline is likely due to the major disruption seen in the country in the early portion of July, when major ports were closed to oil exports. This caused Libyan production to decrease rapidly, until the situation was resolved in mid-July.

The drop in Venezuelan production has become all too predictable, as even the rate of decline becomes expected. Venezuelan production dropped by 47.7 MBOPD to 1,278 MBOPD, the country’s lowest oil output in decades. Production in Venezuela has dropped by an average of 52.7 MBOPD in 2018 and is unlikely to recover in the near future. The current challenge for Venezuela is simply stopping the current decline, as at current rates the country would have negligible oil production in only two years.