U.S. will have its day, but after shale peaks, OPEC will dominate by supplying 40 MMBOPD by 2040

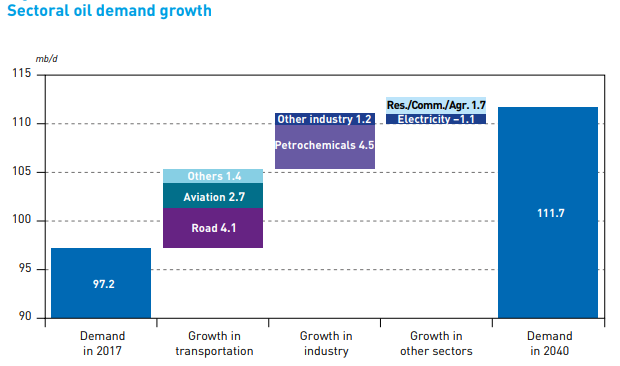

OPEC sees global demand at 111.7 MMBOPD by 2040 – a 15% increase from 2018

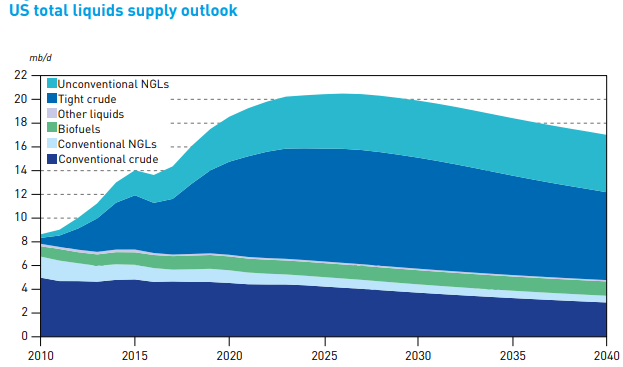

OPEC released its annual World Oil Outlook today, outlining the group’s long-term expectations for the oil industry. The cartel predicts the U.S. will supply much of the near-term growth in oil demand, driven entirely by unconventional oil development.

According to OPEC, the unconventional boom will peak around 2025 when the U.S. will be producing about 13.4 MMBOPD of crude oil, over 20 MMBPD of total liquids. While total production is expected to decline after this point, production from the U.S. in 2040 is still well above current levels.

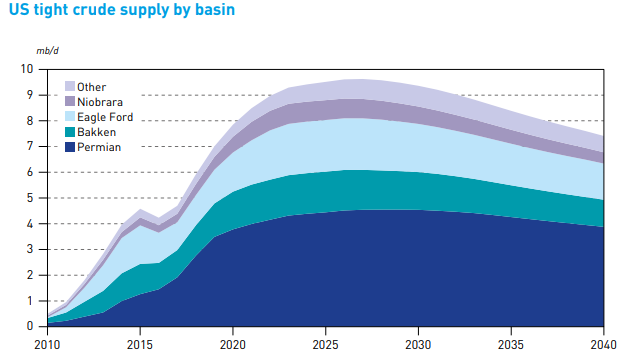

OPEC is a Permian Basin pessimist: production will peak in the Permian at 4.3 MMBOPD in late 2020s

The group is significantly more pessimistic about the potential of the Permian than most U.S. forecasters, predicting tight oil production from the basin will peak at 4.3 MMBOPD in the late 2020s. While forecasts of Permian production vary significantly, most analysts predict output well above this level.

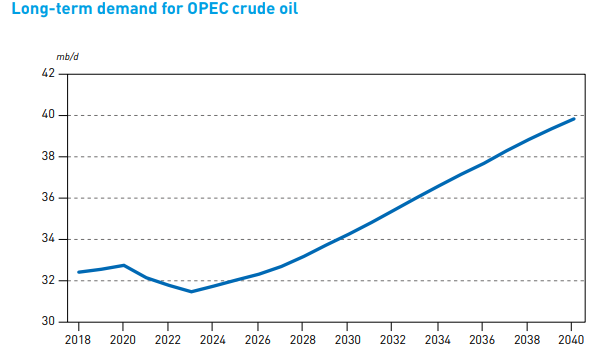

The growth in U.S. tight oil will displace OPEC production, at least for the short term. The group expects demand for its oil will fall from 2020 through 2023 dropping from 32.7 MMBOPD to 31.6 MMBOPD. However, OPEC sees shale production from the U.S. peaking in mid-2025, and the group says it will supply much of the world’s subsequent demand growth, making up for falling output in other regions. OPEC expects to be producing nearly 40 MMBOPD by 2040.

Demand for oil still strong

OPEC predicts significant growth in oil demand remains on the horizon, as Africa, India and the Middle East become more economically developed. The cartel expects oil demand will reach 111.7 MMBOPD in 2040, from 97.2 MMBOPD today. This is roughly in-line with BP’s predictions, released early this year, but falls below Exxon’s predicted liquids demand of ~120 MMBOPD in 2040.

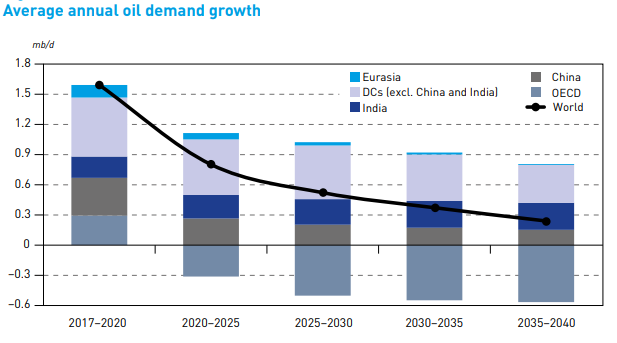

Developing countries will be responsible for virtually all growth in oil demand, as the OECD will see oil demand peak in about 2020. OPEC expects developing countries will see oil demand growth through 2040. Near the end of the forecast period total global oil demand will be nearly flat, as demand falls in the OECD at nearly the rate it is growing in the developing world.

Will EVs replace significant oil demand? OPEC says no: cartel says only 20% of cars will run on alternative fuel by 2040

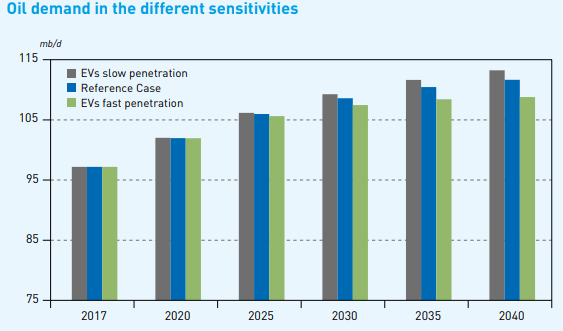

OPEC does not expect electric vehicles will have the massive impact on oil demand that has been predicted by some other forecasters. While electric, hybrid and other alternative fuel vehicles are expected to become a meaningful share of global passenger cars, the cartel expects only 20% of cars will be powered by some alternative fuel by 2040.

This shift is not expected to have a major effect on oil demand. The group’s high and low EV demand cases, in which such vehicles reach 36% or only 7% of all cars by 2040, predict relatively small changes in oil demand, 108.8 MMBOPD in the high EV case and 113.3 MMBOPD in the low EV case.