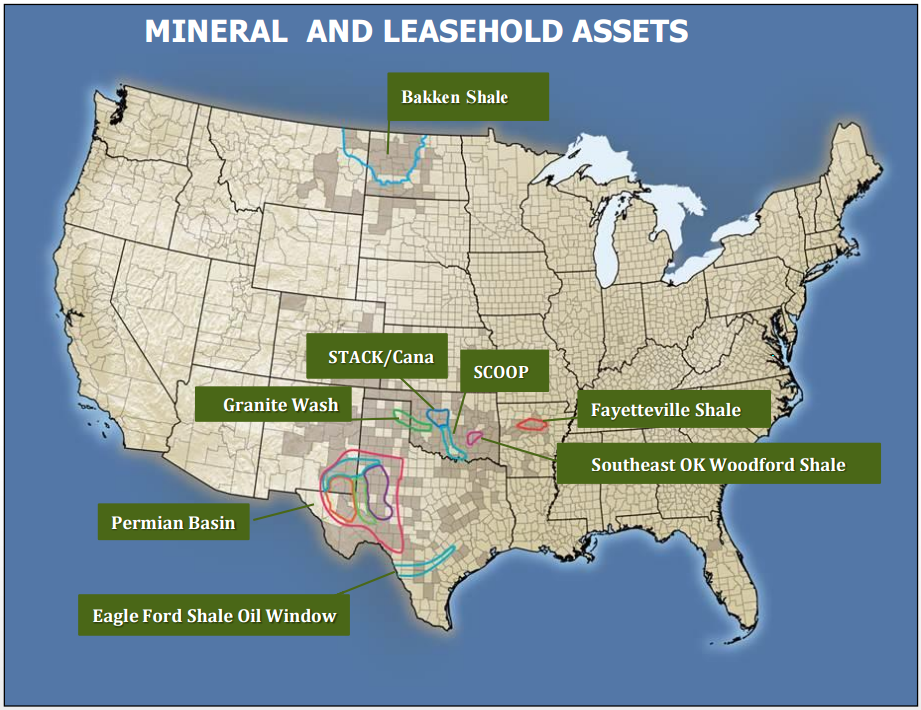

Founded in Oklahoma City in 1926, Panhandle Oil and Gas (ticker: PHX) boasts a foundation of 255,000 net acres of perpetually owned mineral rights spread primarily over Arkansas, Oklahoma, and Texas.

Panhandle is in the position of holding large tracts of prospective acreage without operating that acreage. Instead, Panhandle allows large independent companies to lease and explore its holdings. Of its 255,000 holdings, 56,723 net acres are producing, 14,268 net acres are leased, and 184,038 net acres are open. Approximately 19,400 net acres of its leasehold are also held by production.

Panhandle conducts geologic, engineering and economic analysis for its active areas, and participates as a working interest in drilling when it determines that the risk-weighted rate of return is appropriate. Otherwise, the company leases its mineral acreage for the highest possible lease bonus and royalty percentage. When acquiring new mineral and leasehold interest, Panhandle uses the same geologic, engineering, and economic analysis to determine the value of the potential resource.

As of mid-2017, the company reported proved reserves of 140.4 Bcfe, 67% of which—93.9 Bcfe—is proved developed. The company estimates that approximately 4,800 proved, probable, and possible (3-P) undeveloped locations exist on its acreage—amounting to approximately 570 Bcfe of undeveloped (3-P) reserves.

Panhandle owns interest in 6,200 gross producing wells. Of those, Panhandle holds working interest in 2,200 wells; the remaining 4,000 wells have a royalty interest only. The wells with some degree of working interest provide Panhandle with 75% of its revenue, with the remaining 25% coming from royalty interests.

Panhandle has diversified its acreage holdings across most major producing fields, namely the STACK/Cana, SCOOP, Permian Basin, Granite Wash, Eagle Ford Shale, Woodford Shale, Fayetteville Shale, and the Bakken Shale.

STACK, CANA, and SCOOP Plays

Panhandle owns approximately 14,544 acres between the STACK/CANA and the SCOOP plays. Approximately 3.4 Mmcfe per day is produced from 256 wells in the company’s STACK/CANA and SCOOP acreage, by primarily large producers such as Devon, Cimarex, Continental, Newfield, and XTO.

New development in this region includes cooperation with Cimarex in six STACK/CANA Woodford wells, operated by Cimarex. Panhandle claims a 17.5% working interest in the wells and a 16.25% net revenue interest. The wells have all been drilled, with completion operations beginning shortly and production to follow in late June, 2017.

Woodford Shale interests

In Panhandle’s Woodford acreage, the majority of the 271 wells are operated by Newfield, BP, and XTO—producing approximately 7.1 Mmcfe per day. The acreage itself is comprised of 7,409 total acres. The company is currently participating in a total of eight wells operated by BP, with an average of 20% working interest and 27.4% net revenue interest. The eight wells have been drilled, with four wells producing approximately 4,000 Mcf per day net to Panhandle, and the remaining wells being completed as of mid-May and beginning production in late May.

Eagle Ford Shale

Panhandle’s Eagle Ford acreage is currently producing approximately 616 BOEPD out of 73 wells. The company maintains an average of 14.6% working interest and 10.9% working interest in 104 undeveloped locations. After the successful completion of a previously drilled and uncompleted well in July, 2016 an operator in Panhandle’s acreage developed a ten well drilling program, with all ten wells expected to be producing by Q4, 2017.

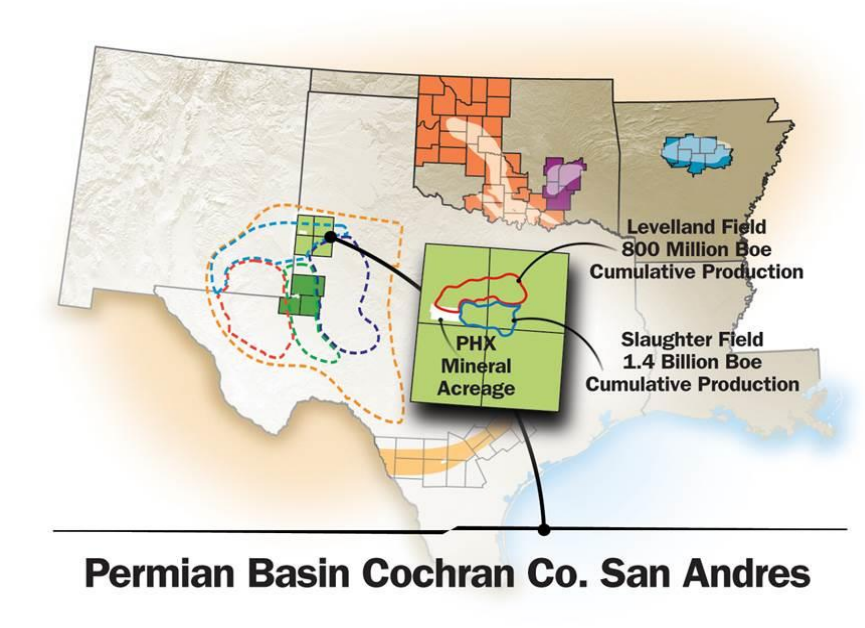

Big leases in the Permian Basin

As of Q1, 2017, Panhandle leased approximately 2,440 net acres in the Andrews and Winkler Counties and generated $1.2 million in lease bonus revenues from the lease. The terms to the company leasing the property are that Panhandle receive 25% of the production in the form of royalty payments.

In another Permian lease, Panhandle leased 4,050 net acres to Element Petroleum, and earned $2.1 million in lease bonus. Similarly, Panhandle stipulated that it would receive 25% of the production in the form of royalty payments.

Panhandle’s strength

Panhandle has developed a considerable economic advantage with its position as a non-operator. The fact that it owns mineral rights allows it to hold the land indefinitely without drilling. The company typically contracts with larger independent operators and—when participating as a working interest—choses wells that it wants to participate in. Panhandle has the advantage of not being involved in geoscience, engineering, and land costs; and only pays drilling, completion and wells costs when it holds a working interest.

Panhandle Oil and Gas Inc. is presenting at EnerCom’s The Oil & Gas Conference® 22

Panhandle will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.