Panhandle Oil & Gas (ticker: PHX) presented at EnerCom’s The OilServices Conference 14 in San Francisco on March 9, 2016. Panhandle currently owns 255,300 fee mineral acres and a working interest and/or royalty interest in over 6,100 wells. The company does not operate any wells. In the company’s year-end release, PHX reported a 31% increase in production from 2014, and reported cash from operating activities of $45.6 million, compared to expenditures of $30.8 million.

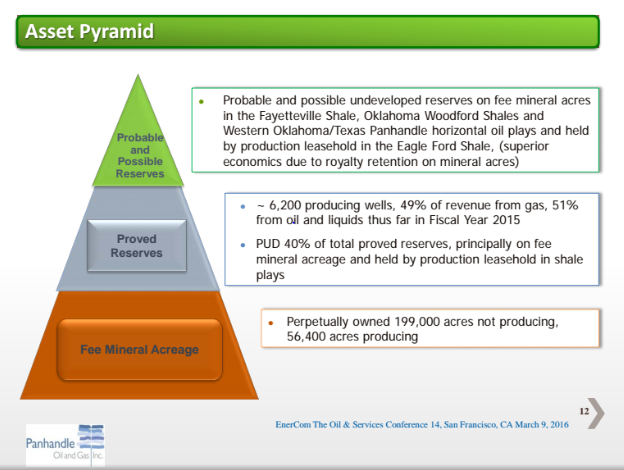

Panhandle’s current areas of focus are the SCOOP Woodford and Springer plays, plus the Stack and CANA Woodford and Mississippian plays. Positioning the company as a non-operator with a substantial acreage position has yielded the benefit of participation on a selective basis. Analyzing deals and evaluating ROI’s allows the company to select between participating in a working interest, or leasing out the acreage and obtaining a royalty interest.

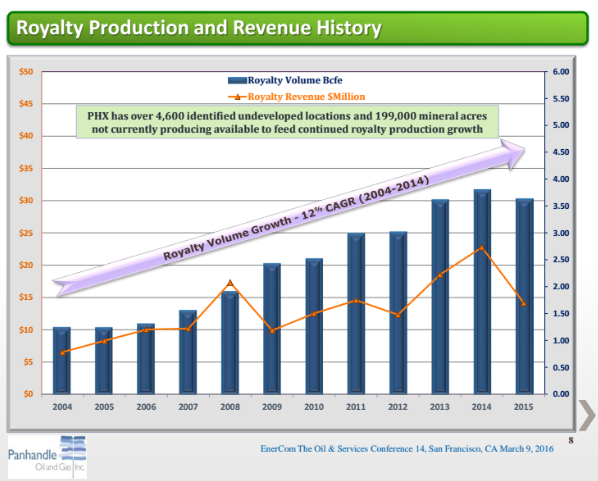

The benefit of being selective is the company has generated two revenue streams, with 73% of revenues from non-op working interest, and 27% from royalty production. Panhandle currently has 199,000 acres of mineral interest not currently producing and 4,600 locations yet to be drilled which provides them with ample opportunity for future growth.

Panhandle maintains low debt levels and as of March 4, 2016 has a debt/market cap of 22%. The company will work to generate cash flow from operations to pay down existing debt.

The company put in place a hedge program at the end of 2015 to secure the cash flow from depleted commodity pricing. Roughly 60% of the company’s production is hedged through Sept 2016. The company is optimistic that the price will rise enough to warrant not having hedges.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.