Panhandle Oil and Gas Inc. (ticker: PHX) released its Q4 results today along with an operations update.

Highlights for the periods ended September 30, 2017

- Recorded a fourth quarter 2017 net income of $1,039,134, $0.06 per share, compared to a net income of $737,190, $0.05 per share, for the 2016 fourth quarter

- Recorded a fiscal year 2017 net income of $3,531,933, $0.21 per share, compared to a net loss of $10,286,884, $0.61per share, for fiscal 2016

- Generated cash from operating activities of $20.8 million for the year, as compared to capital expenditures of $25.8 million

- Collected lease bonus proceeds of $5.2 million in fiscal 2017

- Generated 2017 fourth quarter and twelve-month EBITDA(1) of $7,250,826 and $24,556,609, respectively

- Year-end 2017 proved reserves increased 36% to 168.6 Bcfe as compared to year-end 2016 proved reserves

- For full financial details, see the full press release here

(1) This is a non-GAAP measure

Management commentary

President and CEO Paul F. Blanchard Jr. said, “The company invested $25.8 million in drilling activity in 2017, with the vast majority in the core areas of the STACK, Cana, SCOOP, SE Oklahoma Woodford, and the Eagle Ford Shale. The average finding cost for the wells from this program, which began production in 2017, is estimated at an attractive $0.92 per Mcfe. This activity materially grew the company’s production as these wells began to produce in the third and fourth quarters of 2017. As a result of this investing activity, the company’s fourth quarter 2017 production exceeded second quarter 2017 production by approximately 40%.

“In 2017, the company leased 2,473 acres of its mineral holdings, primarily in the expansion areas of STACK and SCOOP, for $5.2 million in lease bonuses and an average royalty of 21%. Our analysis suggests that the lease bonus plus royalty received from this leasing will exceed the value the company would have generated from taking a working interest participation, thereby maximizing value while minimizing drilling risk.

“In October 2017, the company renegotiated and extended its credit facility with very favorable terms and a new maturity date of Nov. 20, 2022. The borrowing base was maintained at $80 million and on Nov. 30, 2017, our debt was $49.9 million.”

Q4 fiscal results

For the 2017 fourth quarter, the company recorded a net income of $1,039,134, or $0.06 per share. This compared to net income of $737,190, or $0.05 per share, for the 2016 fourth quarter. Net cash provided by operating activities was $6,436,955 for the 2017 fourth quarter, versus $2,085,857 for the 2016 fourth quarter. Capital expenditures for the 2017 fiscal quarter totaled $7,796,176.

Total revenues for the 2017 fourth quarter were $12,896,932, an increase of 27% from $10,157,985 for the 2016 quarter. Oil, NGL, and natural gas sales increased $3,293,913, or 37%, in the 2017 quarter, as compared to the 2016 quarter. This revenue increase was a result of increased oil, NGL and natural gas volumes of 19%, 46%, and 20%, respectively, and increased oil, NGL and natural gas prices of 12%, 58% and 6%, respectively.

Average sales price per Mcfe of production during the 2017 fourth quarter was $3.70, a 12% increase from $3.31 in the 2016 fourth quarter. Oil production increased in the 2017 quarter to 93,027 barrels, versus 78,398 barrels in the 2016 quarter, while gas production increased 20% to 2,330,838 Mcf, and NGL production increased 46% to 65,034 barrels. Additionally, losses on derivative contracts were $0.4 million in the 2017 quarter compared to a gain of $0.8 million in the 2016 quarter.

Operations update

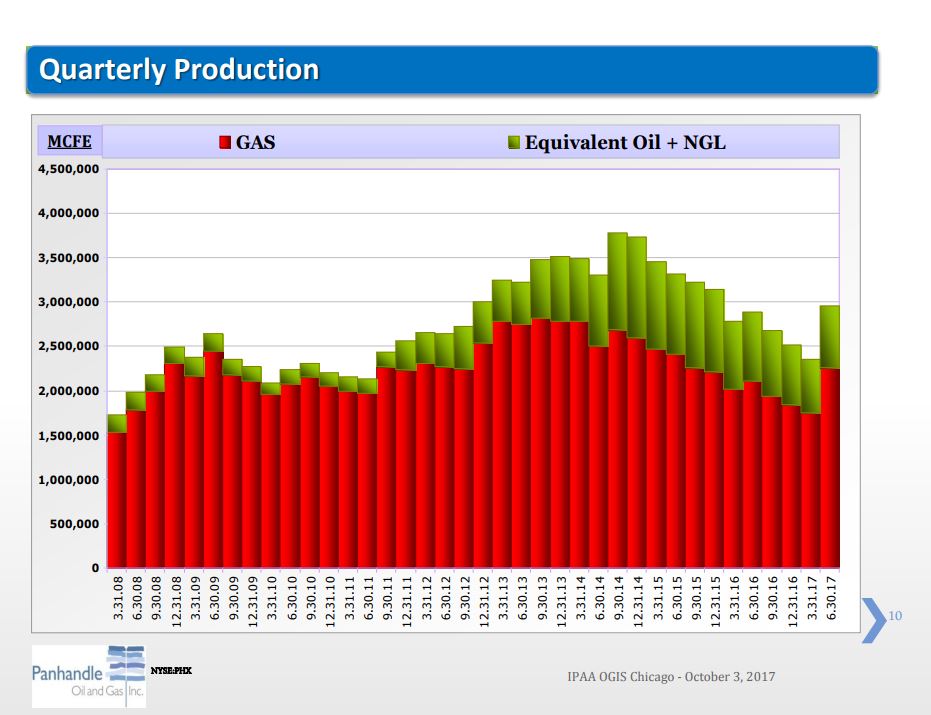

The 2017 drilling capital expenditures of $25.8 million were primarily invested in the cores of three low-risk resource plays: southeastern Oklahoma Woodford, STACK/Cana Woodford, and the Eagle Ford. The first material production response from this program was seen in the third quarter, when production grew 26% from the prior quarter. Production in the fourth quarter grew another 11% above the third quarter to 36.0 MMcfe/day. This is the highest quarterly production for the company since the third quarter of 2015.

Panhandle participated in eight significant wells operated by BP (ticker: BP) in the southeastern Oklahoma Woodford in 2017. Four of the wells began producing late in the second quarter, and the remaining four began producing in the third quarter. These eight wells, which have an average 20% working interest and 27.4% net revenue interest, produced 6,340 Mcf/day net to Panhandle in September.

The company participated in six significant STACK/Cana Woodford wells operated by Cimarex (ticker: XEC), with a 17.5% working interest and 16.25% net revenue interest. The six wells began producing in late July and produced 8,258 Mcfe/day net to Panhandle in September.

The company also participated in 10 wells in the Eagle Ford Shale in south Texas. Two wells started producing in April, four wells began producing in August, and the four remaining wells began producing in mid-November. September production from the first six wells totaled 421 BOEPD net to Panhandle. The four wells that began producing in mid-November are currently producing 181 BOEPD net to Panhandle.