200 net locations added, 300 locations extended

Parsley Energy (ticker: PE) announced third quarter results today, showing a net loss of $13.3 million, or ($0.05) per share. After excluding special charges, Parsley earned $29.3 million, or $0.12 in the quarter.

Parsley produced 71.5 MBOEPD in Q2, up 11% sequentially and 66% year-over-year. Oil’s share of production fell slightly, as oil output only grew by 10% sequentially. The company drilled 38 and completed 36 gross wells. Parsley’s average completed lateral length this quarter was 7,700 feet, a number the company hopes to boost significantly. Through the end of 2018, Parsley expects that the wells it turns to production will be characterized by average lateral lengths of more than 9,000 feet.

Concentrating a scattered portfolio

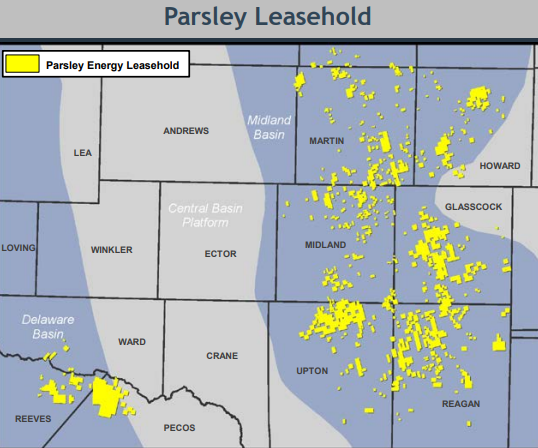

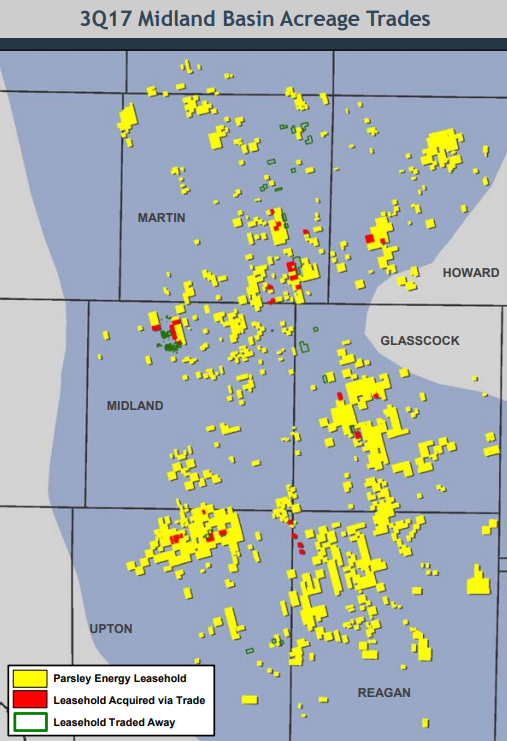

Parsley has been moving toward this goal by consolidating its acreage, in a series of trades this quarter. The company holds about 178,000 net acres in the Midland Basin, but this acreage is scattered over eight different counties.

Modern development incentivizes concentrated positions, as longer laterals generally improve the economics of a well and longer laterals require acreage to support them. Modern development incentivizes concentrated positions, as longer laterals generally improve the economics of a well and longer laterals require acreage to support them.

Consolidating acreage, therefore, can increase the total amount of lateral feet available to a company without a net change in total acreage. Parsley has been working to concentrate its opportunities, and Q3 has been the most active trading period to date. The company reports that it added more than 1.2 million net lateral feet to its drilling inventory in Q3. Since announcing the acquisition of Double Eagle Energy in February, the company’s trades have had the effect of adding over 10,000 acres to the company’s portfolio.

Raising type curve, compressing stages

Parsley is also replacing its 1 MMBOE type curve in the Midland with a 1.6 MMBOE reference curve, the result of multiple improvements. The old 1 MMBOE curve assumed a 7,000 foot lateral, while the new curve assumes a 10,000 foot lateral well. The longer lateral accounts for about 70% of the increase in the type curve, while improved gas and NGL production makes up the rest.

Parsley is also following up on the completion design tests it ran in Q2. These tests involve decreased stage spacing, dropping from 170-foot spacing to 100-foot. The company reports it used this design on six wells in Q3. Compared to the nearest offset wells using standard completions designs, the compressed stage wells have registered a 10-25% uplift in oil production, for an incremental cost of 5-7%, suggesting strong project economics. Parsley will continue to test this design in 2018.

Q&A from today’s Q3 earnings call

Q: Bryan, in your prepared remarks, you talked about the potential to become free cash flow positive if you so chose. Can you give us a little more color on how you’re thinking about that more steady pace of activity that you mentioned and then whether free cash flow neutrality is a priority for you and how you’re thinking about that going forward?

PE: Yeah. It seems the past four to six weeks has been the top theme of the investors compared to six to eight months ago as if we can get sand. But we feel like this is a subject to address. And for modeling purposes, we’re just pointing to a point in time some time in 2019, if oil prices stay at this stage flat and then we run the same amount of rigs as we are in the fourth quarter. So, to me, it’s sort of a check in the box and to show what can be done.

Now, I don’t think that would be our mentality. But for now, for over the next six to eight months, I do see us running the same amount of rigs we are running walking into the 2018. We’re not adding more rigs. I don’t know if that helps you.

Q: So you continue to highlight some really positive results from the compressed stage spacing tests. I was just wondering, how much data would you need to see to transition the bulk of the Midland Basin program to these compressed stage spaced wells next year and how quickly can that happen? Is that something you could just go to in like Q3 of next year or would it take six to nine months to transition the entire program to compressed stage spacing?

PE: It can happen very quickly. It’s a decision point on economics. You want to see these things unfold over at least six months’ timeframe. We’ll continue to feather them in the meantime. You’re testing in new areas, but nothing dramatic across the entire program. But again, you’re not – it’s just a design change that you can do on the fly. And it’s very quick, as you call out your materials needed for that design. So, I would expect a decision to – in the first half of the year for the back half of the year, I would assume.

Q: some of your peers have begun to test in-basin sand, and they’re seeing some positive uplift on savings. Can you talk about whether you are conducting similar tests and what your thoughts are on that?

PE: Yeah, we have agreements in place to steadily pump that down wells throughout Q1. We do expect some good savings on the total well costs in line with what everybody else is seeing. We’re also encouraged that just additional supply on the market will suppress the broader sand market. So the other white – premium white sand just won’t have as much demand. So it’d be nice from that front. But we are testing it in Reagan County in Q1. We actually have some in the well as we speak, but not under a price-saving agreement. That was just kind of a jump-start to get some data back and make sure nothing is out of whack on that front. But yeah, we’ll start seeing cost savings throughout the Q1 timeframe