Recycled water program shows promise

Parsley Energy (ticker: PE) announced third quarter results today, showing earnings of $113.3 million, or $0.41 per share.

This result is significantly improved from Q3 2017, when the company lost $13.3 million, but falls slightly short of the $119.2 million Parsley earned in Q2 2018. This decrease is primarily due to derivative losses, as after these are excluded Parsley earned an adjusted $126.2 million in Q3 and $106.4 million in Q2.

Parsley produced 116.2 MBOEPD in Q3, up 8% quarter-over-quarter. The company brought 46 wells online this quarter, primarily two-mile lateral wells. Parsley completed over 420,000 lateral feet this quarter, a new record for the company.

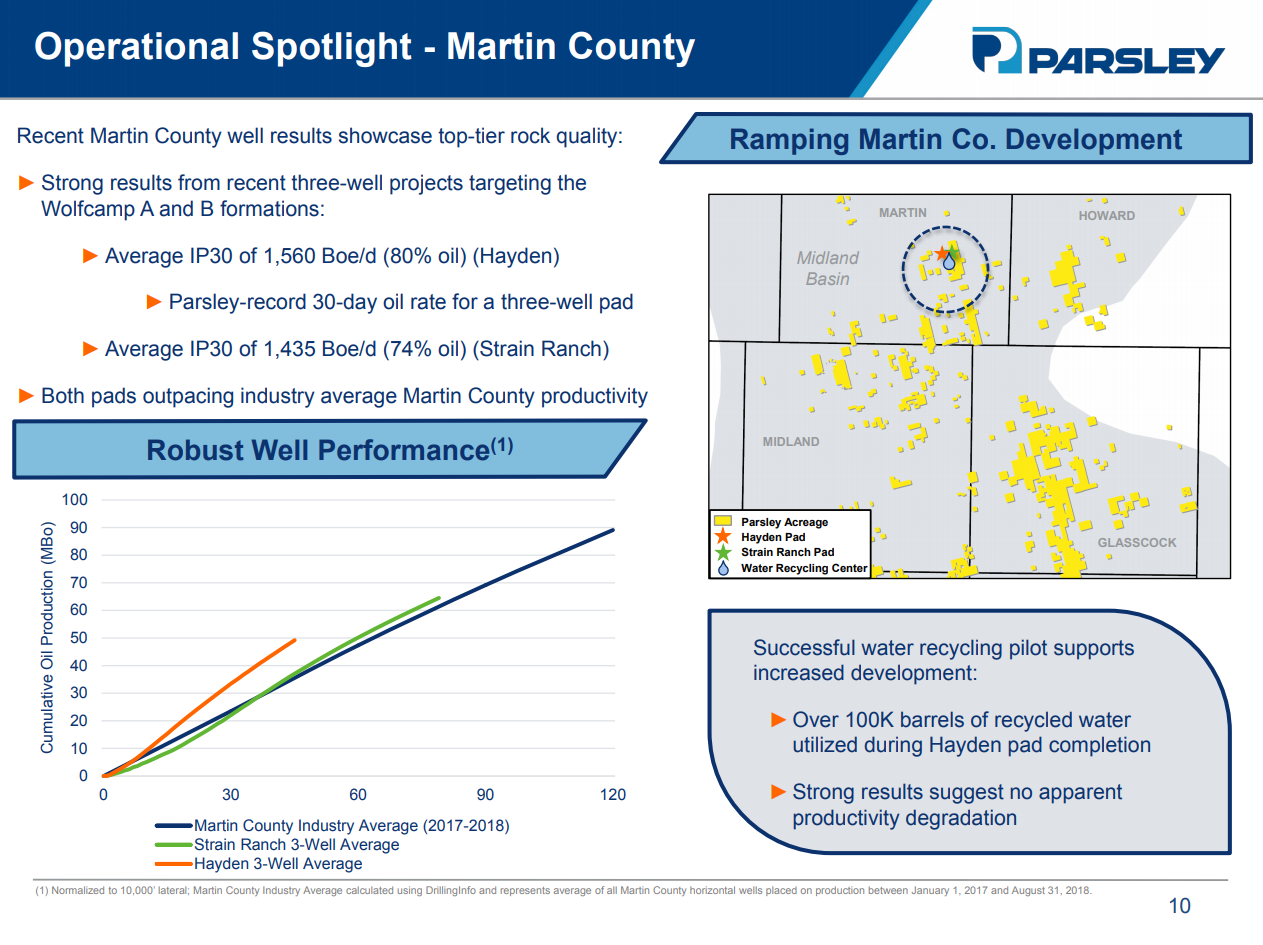

One of these two-mile lateral pads, the Hayden in Martin County, produced an IP30 of 1,560 BOEPD from each well, a company record for a three-well pad. While these are strong results, the water used during completions may have a more wide-ranging effect. The Hayden pad used over 100,000 barrels of recycled water during fracturing operations in the company’s first water recycling pilot program. The strong production from the Hayden pad suggest recycled water does not have an adverse effect, and Parsley plans to ramp up use of this water over the next few quarters.

Unlike many companies that reported this quarter, Parsley reaffirmed its CapEx guidance for Q4 and the full year. The company expects to spend $1.65 to $1.75 billion in the year, suggesting it will spend $305 to $405 million in Q4. This is a significant drop from the spending level through the rest of the year, as Parsley spent an average of $450 million per quarter this year. The company’s drilling and completing activity will be determined by what the budget can support, meaning activity will likely drop in Q4.

Parsley expects to continue operations at roughly the current pace through 2019, focusing efforts on efficiencies and cost control. This plan calls for Parsley to generate free cash by the end of the year.

Divests non-core acreage for $170 million

Parsley divested a portion of its acreage this quarter, selling 11,850 acres in the Midland Basin for $170 million. This acreage is currently producing about 1.2 MBOEPD, meaning the transaction values Midland acreage at an unadjusted $14,350/acre, or $10,800 after adjusting for production. Parsley reports that the divested acreage was on the tail end of its portfolio and was not scheduled for significant development any time soon.

Bryan Sheffield, Parsley Chairman and CEO, commented on the results, saying “Parsley’s development program in 2018 has centered on operational continuity, and that focus has made us a more efficient organization. Since stabilizing our activity levels 12 months ago, Parsley has built operational momentum while expanding operating margins to company-record levels. Looking ahead, we intend to keep a disciplined eye on cost control and operational efficiency while maintaining a steady development pace until we are in position to fund incremental activity with operating cash flow. This plan accelerates our progress toward a self-sustaining organic growth model, and at current commodity prices we expect to generate free cash flow by the end of 2019.”