Wattenberg-Focused E&P Lays Out Plans for 2015

PDC Energy’s (ticker: PDCE) favorite adjective in its 2015 Analyst Day was “resiliency,” as the company applied the term to its balance sheet, operations and its employees throughout the meeting on April 9, 2015.

The event, held in New York City, was almost two thousand miles away from its core operations and headquarters in Colorado, and certainly had a positive effect on the analysts and investors who attended the annual affair. Of the 26 analysts covering PDC, 23 have issued a BUY rating, according to data from Bloomberg.

A note from Wells Fargo Securities was quick and to the point: “Bottom line is PDCE hit expectations and the stock outperformed on its analyst day, which is a rarity for industry.”

Operational Overview

PDC is currently operating in the Wattenberg and Utica plays, with respective positions of 96,500 and 67,000 net acres per region. The company believes its Wattenberg position holds 2,600 proved and probable drilling locations, prospective for the Niobrara and Codell formations. Bart Brookman, President and Chief Executive Officer of PDC Energy, said 1,000 of the locations can deliver drilling returns greater than 50%.

Its midpoint production guidance of 14.0 MMBOE (38.4 MBOEPD) for fiscal 2015 would represent a 50% increase compared to 2014’s total volume of 9.3 MMBOE (25.5 MBOEPD). When referring to the company’s base case scenario, Lance Lauck, Senior Vice President of Corporate Development, said, “We’re growing the production at a very robust three-year compounded annual growth rate of 31% to 36% over this time period to a 2017 midpoint rate of approximately 60 MBOEPD.”

Its midpoint production guidance of 14.0 MMBOE (38.4 MBOEPD) for fiscal 2015 would represent a 50% increase compared to 2014’s total volume of 9.3 MMBOE (25.5 MBOEPD). When referring to the company’s base case scenario, Lance Lauck, Senior Vice President of Corporate Development, said, “We’re growing the production at a very robust three-year compounded annual growth rate of 31% to 36% over this time period to a 2017 midpoint rate of approximately 60 MBOEPD.”

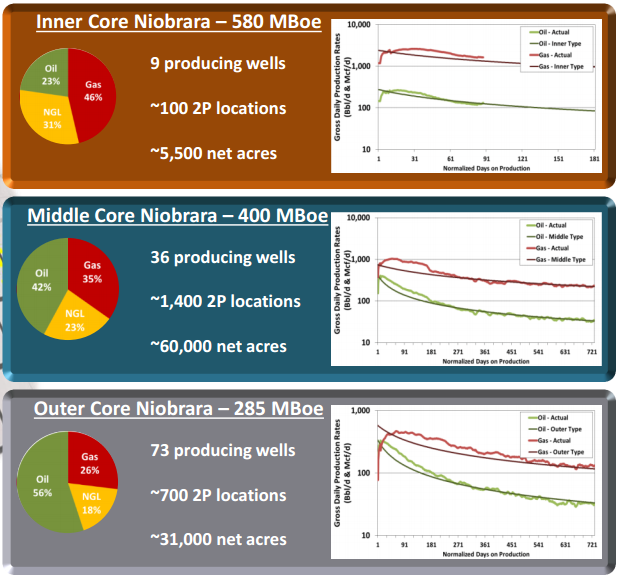

The high production increases are aided by a boost to its estimated ultimate recovery across its three Wattenberg sections. Revised EURs for its Outer, Middle and Inner Cores were established at 285, 440 and 625 MMBOE, respectively, representing increases ranging from 25 to 40 MMBOE per section. KLR Group believes the Inner Core can provide internal rate of return of 40% to 45%, while the Middle should generate 30% to 35% IRR and the Outer Core producing 20% to 25% IRR. Overall, the gains represent capital productivity improvement of 10%.

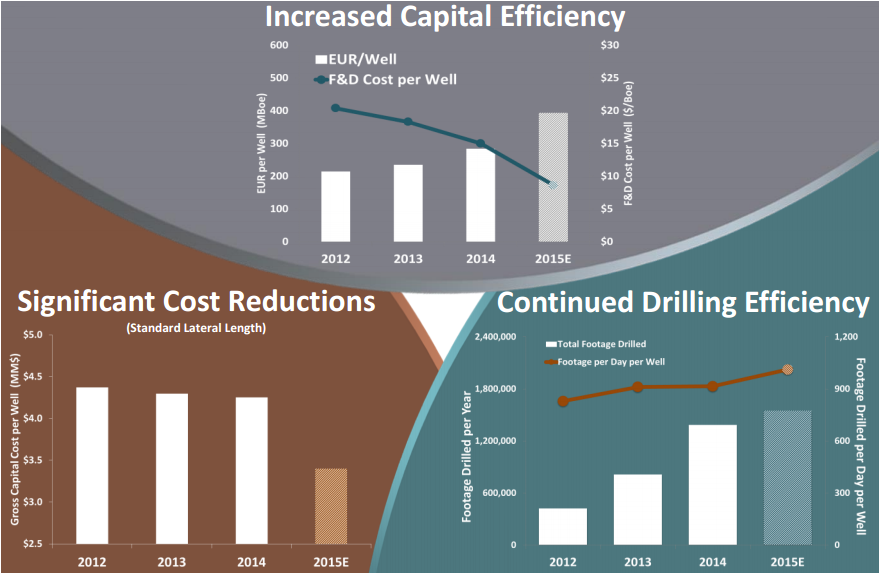

The appealing metrics are buoyed by increased efficiencies – well costs have dropped to $3.4 million gross per standard lateral – an improvement of roughly $1 million since 2012. Its “plug-and-perf” method has led to a performance increase of 35% and increased overall EURs by 10% to 20% in the Wattenberg region. The E&P will run five rigs in 2015 all focused on the Wattenberg. Development in the Utica will resume once commodity prices recover.

Proved reserves for year-end 2014 are 250 MMBOE (64% liquids) with 30% of the base classified as proved developed. The company’s Asset Intensity, defined as the percentage of every EBITDA dollar required to maintain production, is 43% – below the 60% median of 86 other companies in EnerCom’s E&P Weekly database, and even further below the 76% Asset Intensity of its 22 small-cap peers.

Balance Sheet Now an Asset

Balance Sheet Now an Asset

PDC has transformed a debt-to-market cap percentage of 70% in April 2012 (when WTI prices averaged $103/barrel) to just 31% in EnerCom’s latest E&P Weekly report. “Debt-to-EBITDA is projected to be well under 2.0 year end 2015 and our debt/flowing Boe has improved by approximately 60% in the last several years,” said Brookman. “We have forecasted modest outspends over the next several years, and we have greatly improved the interest coverage ratio for the company to over 8.0 in 2015.”

Management anticipates being close to undrawn on its $700 million revolver by year-end and does not expect any significant changes from its borrowing base redetermination. Production moving forward is hedged rather significantly at 70% to 75% of all 2016 oil production. The company holds $851 million in liquidity following a $203 million equity raise in March 2015.

Analyst Reviews

Of the 26 analysts covering PDC, 16 either reiterated or updated their rating following the Analyst Day. All of the ratings were listed as “BUY.”

Global Hunter Securities referred to PDC as a “uniquely compelling [mid-cap] investment case” in a note following the Analyst Day. The three main points, according to the firm, include:

- Strong production growth outlook (we see a ~29% CAGR on a debt-adjusted per-share basis through 2017E vs. the industry average of ~8%),

- a robust balance sheet (<2x leverage), and

- a compelling valuation (2015E EV/EBITDA of 6.5x trails the mid-cap average of 8.5x).

BMO Capital Markets complimented PDC with a combination of its asset quality and balance sheet strength, while Capital One Securities expects PDC to deliver in the near-term. “Our upside expectations for the company have been reset,” the note says. “In addition to our higher target price, we now have line of sight on what could be the next evolution of upside via the plug & perf and Biovert results as well as the downspacing tests that are scheduled to come online later this year or early in 2016.”

BMO Capital Markets complimented PDC with a combination of its asset quality and balance sheet strength, while Capital One Securities expects PDC to deliver in the near-term. “Our upside expectations for the company have been reset,” the note says. “In addition to our higher target price, we now have line of sight on what could be the next evolution of upside via the plug & perf and Biovert results as well as the downspacing tests that are scheduled to come online later this year or early in 2016.”

Attractive valuations and estimates can always add shine to companies, but in the end, demonstrated execution and growth is all that matters. PDC has executed on that aspect, as the company’s stock is up by 10% on a trailing six month basis. The median share price of 86 peer companies has dropped by 36% in the same time period, with PDC being only one of six companies in the black.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.