Achieved 44% yearly production growth

PDC Energy (ticker: PDCE) announced fourth quarter results and reserves today, showing earnings of $77.6 million, or $1.18 per share. The company reported a net loss for the full year of $127.5 million, or ($1.94) per share. PDC’s results this quarter saw a boost from the new tax law, which reduced the company’s deferred tax assets and liabilities by $114.4 million.

PDC produced an average of 94.1 MBOEPD in Q4, and 87.2 MBOEPD through the full year. This represents a year-over-year growth rate of 44%, slightly above the company’s early-year estimate of 42%.

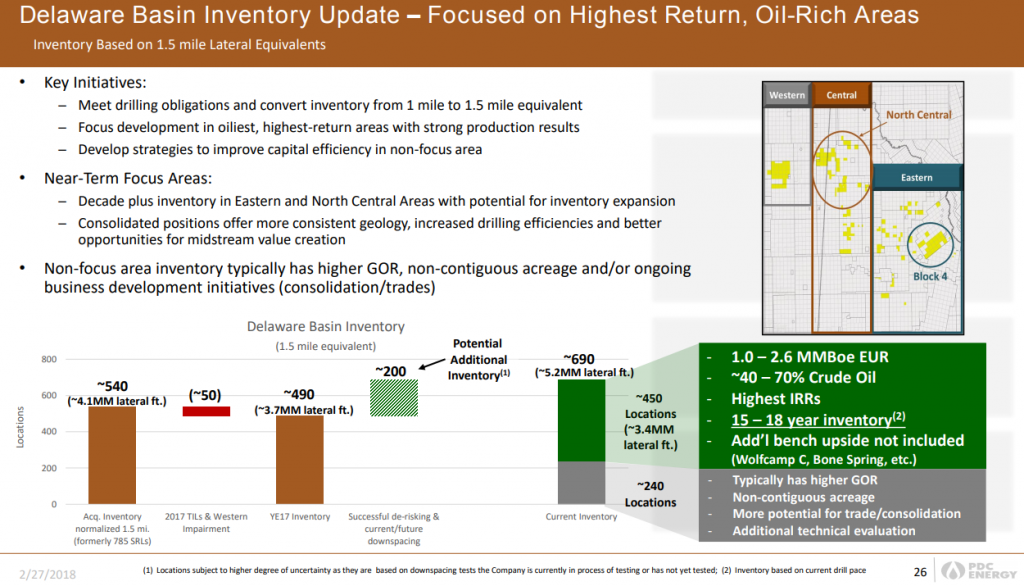

Downspacing tests planned

PDC intends to continue testing its Delaware acreage in 2018, examining the effects of downspacing in multiple zones. In the company’s eastern acreage, PDC is planning a six-well test, that will evaluate 12 wells per section in the Wolfcamp A. PDC also reports Wolfcamp C test is scheduled for this year, potentially expanding the number of zones the company can target.

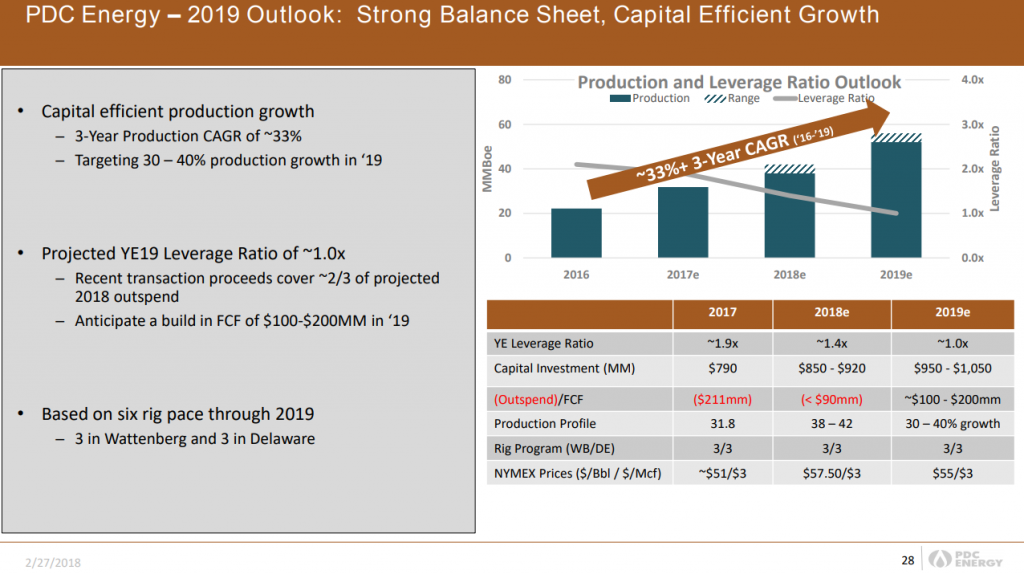

Cash flow positive in second half of 2018

PDC plans to spend around $875 million this year, an investment that should result in 26% production growth. PDC expects it will achieve improvements in Delaware Basin drill times, which will allow it to accelerate its development plan, bringing additional wells online. Timing effects mean the company will likely report limited production growth in Q1 2018, but will see more rapid advancement in the second half of the year.

PDC expects it will slightly outspend its 2018 adjusted cash flow from operations for the full year, but will be cash flow positive in the second half of 2018.

Reserves up 33%

PDC’s reserves grew by about one third this year, rising to 452.9 MMBOE. This was primarily driven by the company’s Wattenberg acquisition in September and revisions and extensions of PDC’s Permian acreage. PDC now holds nearly 100 MMBOE in the Delaware, an increase of 200% from 2016 reserves. The company achieved an organic reserve replacement ratio of 184% in 2017.

PDC also announced the sale of its Utica Shale assets today, divesting its non-core properties. The company expects to receive about $40 million from the transaction, which is expected to close late in Q1. In total, PDC is divesting about 43,000 net acres and 1.6PDC also received about $24 million in January in relation to an extension and modification of a Wattenberg pipeline commitment.

PDC President and CEO Bart Brookman commented, “The fourth quarter was a great way for us to end another extremely successful year, while also serving as a spring board into 2018.

“Our Delaware Basin team continues to improve our operational execution and build positive momentum. This is highlighted by improvements in our drill times, our ability to deliver truly impressive well results and strong production growth for numerous quarters. In Wattenberg, our team anxiously awaits the upcoming midstream expansion and the opportunity to unbundle our production.”

“In 2018, we are once again focused on delivering tremendous returns to our shareholders with development in two of the most economic plays in the industry. Financially, the company expects to operate in a cash flow positive environment in the second half of the year while simultaneously expecting to improve our leverage ratio to approximately 1.4 times by yearend.”

Q&A from PDCE conference call

Q: I want to think about how you’re thinking about the priorities for the use of your excess cash flow in 2019 if your forecast is correct.

PDCE: We’ve got a 35% midpoint production in our outlook and that’s with three rigs and three rigs as he covered. So, I think we’re really comfortable with that level of production growth. I think when we get to the budget process, if we’ve got free cash flow, we’ll give some consideration to adding some docks in accelerating and then we may give some consideration late in the year to adding some rigs which would really be a 2020 move on our production growth.

So, those are those are two capital spend moves that will give some consideration, but I don’t think we want the market looking at us for trying to ramp that 35% midpoint growth up dramatically next year. Then the second thing I think that is a big focus for the company is our 2-milers. And Lance and his team, I think have strong focus in both basins of trying to block up some acreage to give us additional inventory A and give us the ability to continue to drill the 2-milers which I think everyone understands are the most capital efficient.

So, I think those are the two priorities. And then lower priorities which we seem to be getting questions around, which is new for a company our size, but that is share repurchases and dividends. And, right now, I would say those two moves are probably lower on our priority list.

Q: The 2018 activity [in the Delaware Basin], very concentrated, how can we think looking to 2019, maybe putting rigs in other parts of your eastern or central block? I mean, how – what are your thoughts on kind of getting more delineation work done across those properties?

PDCE: There’s a lot of work to be done yet, I think is the answer to your question across not only the acreage that we have maybe that we’re not as focused on this year, but also in the other zones. So, as we look, we’re doing that constant decision-making process around, do we do we drill a C bench in the lot 4 or do we venture into a different part of the acreage. The Bone Spring was brought up today. Another one of those things that we haven’t had a chance to test yet and it’s a constant process of – okay, what do we need to know for those next steps we need to maintain our acreage.

How can we go about doing that in the most effective form or fashion that we can execute on cleanly. And so it’s all of those choices that go together that we’re really faced with on a constant basis and our teams are doing a good job not only looking at the data we’re acquiring as we log these various wells both in the pilot holes and vertical sections as well as the laterals themselves.

We’ve done some lateral logging as well, and coupling that with our peers out there that are doing a bunch of work. So, we’re really watching all of that and making the decisions around it. It’s a very complex puzzle to put together. Again back to when each one of these things happened is really difficult for me to say.

We’ve pretty well laid out 2018 but our teams are already starting to think about what do we need to do in 2019 to deal with all the different expectations that we have. And you’re obviously pointing to one of those.