Restructuring eliminates $5 billion in debt

Peabody Energy emerged from bankruptcy today, ending a year-long Chapter 11 process. The company trades under the stock ticker: BTU.

Peabody entered bankruptcy just under one year ago, on April 13, 2016. Declining demand certainly squeezed coal producers, but other factors were also important. Several regulations introduced by the Obama administration provided major pressure on coal companies. The Mercury and Air Toxics Standards rule and the Clean Power Plan both placed restrictions on emissions, largely targeting the use of coal.

Additionally, the U.S. shale boom quickly provided serious competitor to coal: inexpensive natural gas. Unconventional natural gas production drove down prices in the U.S., giving power generators an alternative to coal.

Beyond the industry-wide pressures, Peabody specifically had difficulties. The company acquired Macarthur Coal in Australia in 2011 for about $5.2 billion, near the peak of Australian coal prices. This transaction added a significant amount of debt to Peabody’s balance sheet. Reducing this debt was a major goal of its Chapter 11 restructuring.

Peabody will resume trading as BTU

Peabody reported that it had reduced debt by more than $5 billion from before it entered bankruptcy. Current debt is just under $2 billion, a far more sustainable value than the $7 billion before filing Chapter 11.

Along with reduced debt, the company will introduce new equity. During bankruptcy proceedings, company stock was traded under the ticker BTUUQ. This stock was extinguished with no value at market close on Monday, and Peabody began trading under the ticker BTU today.

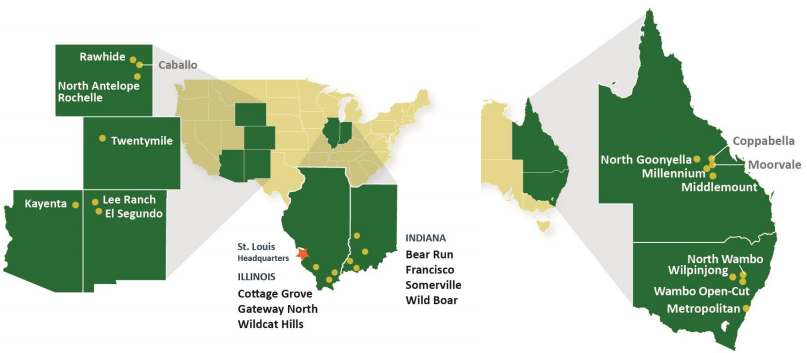

Looking forward, Peabody is seeking to capitalize on its opportunities as the only global pure-play coal investment. The company is the largest coal producer in the United States and also has major operations in Australia. The Powder River basin, Peabody’s largest single revenue segment, currently supplies 38% of U.S. coal, and will grow to 40% by 2021. The current administration is in the process of rolling back many environmental regulations that significantly hampered the coal industry.

Coal has to compete with natural gas

However, the problem of natural gas remains. U.S. shale activity is still providing plentiful natural gas to the American market. The rise of LNG exports is allowing this gas to fuel markets worldwide. Coal for power generation will need to compete with natural gas for market share going forward and prices for the two commodities will vie for market share in the power generation sector.

Peabody is ready to compete with gas based on the geography of its coal

Peabody estimates that Powder River basin coal is competitive with natural gas when the NYMEX gas price is above $2.50 to $2.75/MMBTU. Illinois basin coal is competitive when gas is above $3.00 to $3.50/MMBTU, and Central Appalachian coal can compete when gas is above $3.75 to $4.25/MMBTU. For reference, the NYMEX natural gas prices have averaged $3.28/MMBTU in 2017.