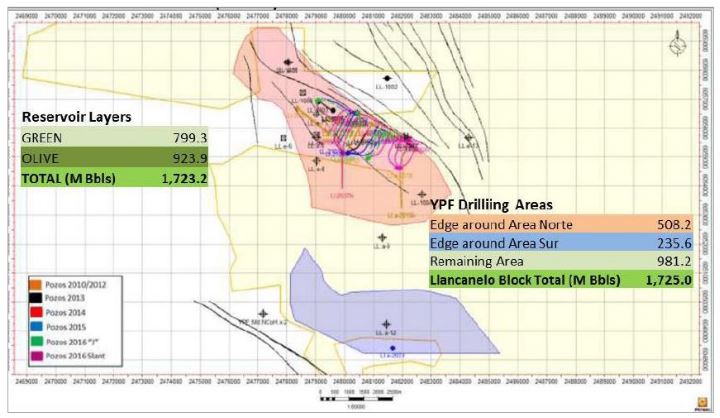

PentaNova Energy Corp. (ticker: PNO) signed the final agreement with Argentina’s National Oil Producer YPF to farm in on 11% of the Llancanelo heavy oil field. The agreement takes PentaNova to a 50% working interest partnership in the field.

A brief history of the Llancanelo field

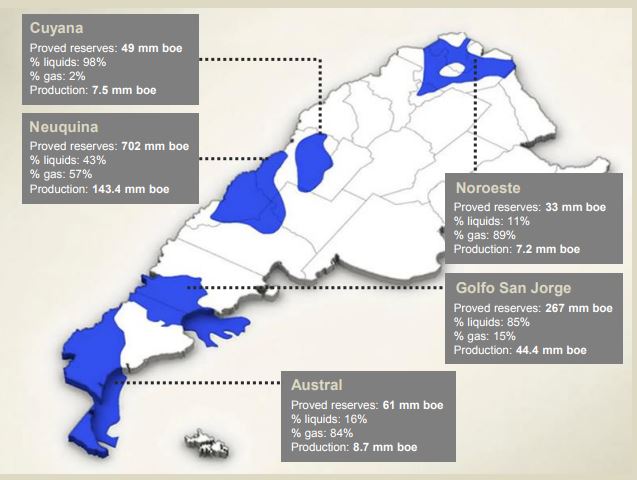

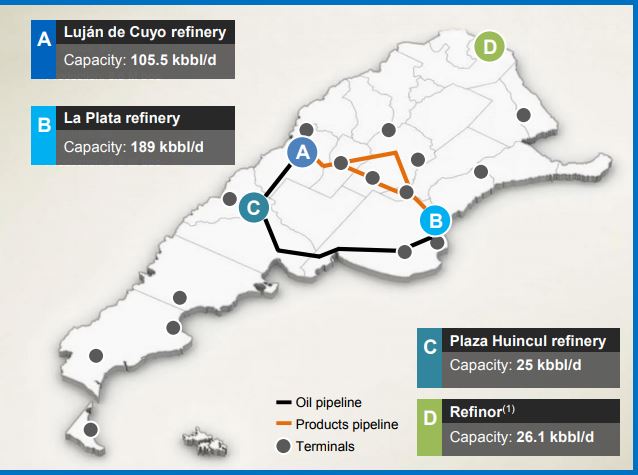

The Llancanelo area is located to the north of the Neuquen (Neuquina) Basin, in a basin-edge position in the province of Mendoza, 37 km southeast of the city of Malargue. It is located between the main producing areas of the Neuquen basin and the 106,000 bbls/day processing capacity Lujan de Cuyo refinery, which is immediately south of Mendoza city. The field is close to existing road, pipeline and airport infrastructure.

YPF discovered the Llancanelo field in 1937, and in 1980 Union Oil completed a successful steam injection pilot program before abandoning the efforts due to low oil prices. Llancanelo’s potential was fully recognized when horizontal wells were shown to be more productive, providing the current profile of cold flowing, low water cut 11-14 API crude that Llancanelo sees today. In 2016, a development campaign of horizontal wells drilled into the large heavy oil body. Currently, the field produces 1,300 bbls/day.

According to Schlumberger’s Oilfield Glossary, API gravity is “a specific gravity scale developed by the American Petroleum Institute (API) for measuring the relative density of various petroleum liquids, expressed in degrees.” Oil with an API gravity lower than 25 is often defined as “heavy oil,” while oil between 25 and 35 is “medium” and oil with an API gravity above 35 it typically called “light oil.”

Acquisition and development costs

The acquisition of Llancanelo will see PentaNova pay a $3 million deposit ($0.5 million already paid), fund a $54 million development work program over 3 years, and conditionally pay a $10 million payment on the third anniversary of the agreement. Beyond this work program, the partners will carry their proportional share of investment into the block. The farm-in terms provide rights to PentaNova over the surrounding Llancanelo R block.

PentaNova and YPF have agreed to do a comprehensive evaluation of optimal development techniques based on the work that YPF has already completed. The evaluation will be undertaken over the coming months to plan a development drilling campaign that will be initiated in mid-2018. In the meantime, a downhole heater and coil tubing unit will be mobilized in the coming weeks to complete a workover and cleanout campaign, improving production from existing wells.

PentaNova said that the management and technical teams assigned to the Llancanelo project have experience developing and rapidly scaling up production of heavy oil assets in Canada, Venezuela, Colombia, and other areas in Argentina.

U.S. imports from Argentina and Venezuela

In 2016, the U.S. imported approximately 46 thousand barrels per day from Argentina. According to the EIA’s monthly estimates, in August 2017 the U.S. imported approximately 50 thousand barrels per day.

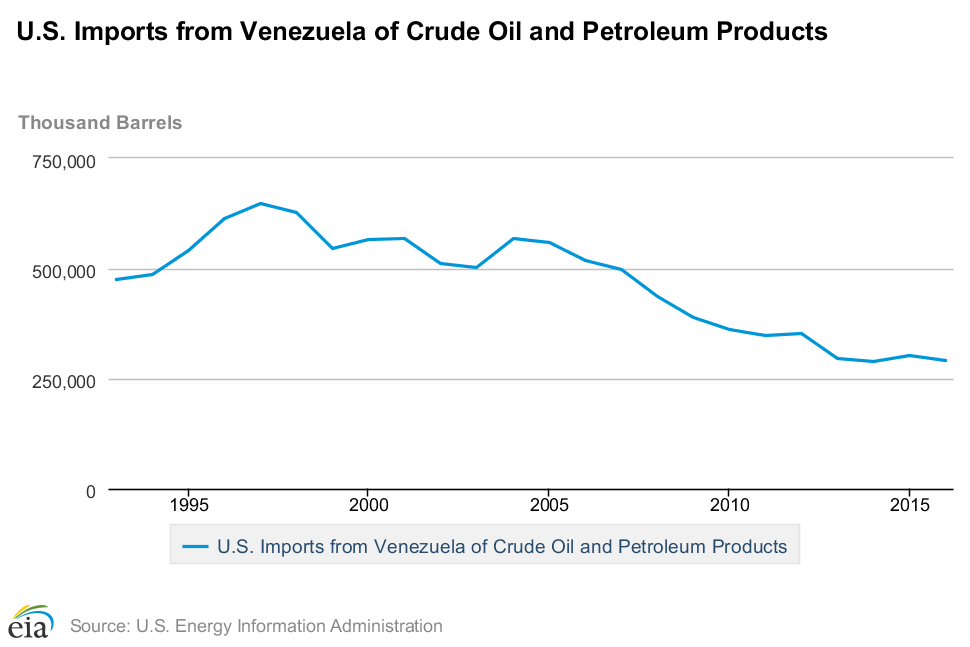

In 2016, the U.S. imported approximately 291 thousand barrels per day from Venezuela. According to the EIA’s monthly estimates, in August 2017 the U.S. imported approximately 19 thousand barrels per day.

According to data from Bloomberg, Russia signed an agreement to restructure $3.15 billion of debt owed by Venezuela, throwing a lifeline to a crisis-wracked ally that’s struggling to repay creditors. The deal gives Venezuela some much-needed breathing room as it faces the much more complicated task of restructuring its $140 billion of bonds and foreign loans, Bloomberg reported.

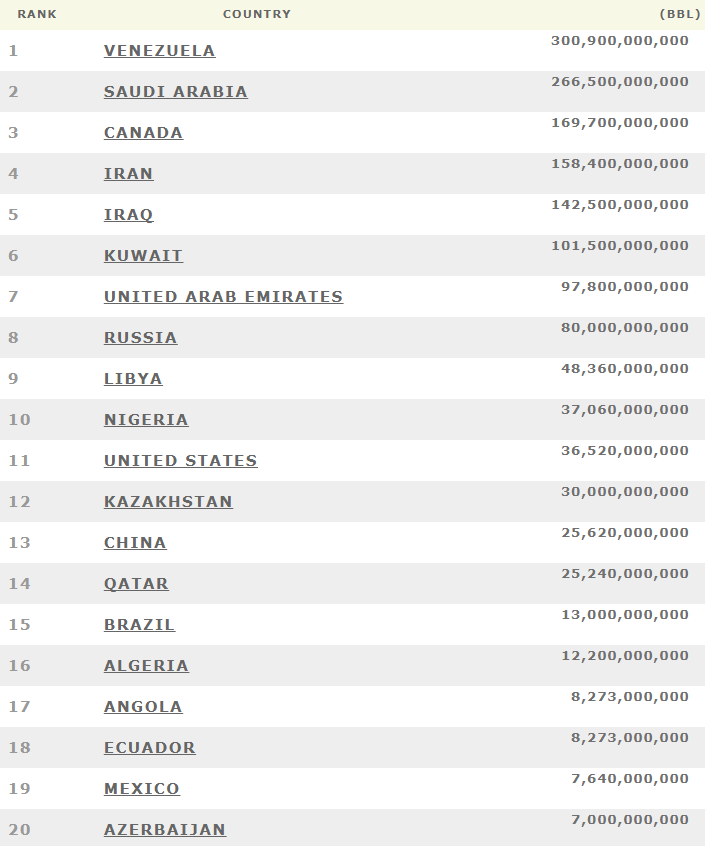

Venezuela is known chiefly for heavy oil production. According to the CIA’s World Factbook, Venezuela ranks as the world’s largest holder of proven oil reserves (estimated) with 301 billion barrels. Canada ranks third in the CIA list with 170 billion barrels, much of which is heavy oil from Canada’s vast oilsands deposits.

Argentina is in the CIA’s No. 36 ranking for estimated proved oil reserves with 2.2 billion barrels. Argentina has been in the news in 2017 for its Vaca Muerta shale deposits. YPF SA, Argentina’s state-owned oil company, is counting on the Vaca Muerta shale formation to produce more than half its oil and gas by 2022, as part of a plan to invest more than $20 billion in five years, according to Bloomberg.