Producing 228 MBOEPD, Running 20 Rigs

Concho Resources Inc. (ticker: CXO) bought home a net income of $835 million, or $5.58 per diluted share for Q1 2018. Last year at this reporting period, Concho had a net income of $650 million, or $4.37 per share. Additionally, the company said it has reduced its total debt by $320 million in Q1 2018, as compared to year-end 2017. As of March 31, 2018, Concho had total long-term debt of $2.4 billion, with no borrowings outstanding under its credit facility.

Northern Delaware Basin Operations

From Concho.com

As for production, Concho produced 21 MMBOE, or an average of 228 MBOEPD in Q1 2018 – a ~26% increase from Q1 2017 and 8% more than Q4 2017. Concho averaged 20 rigs in Q1 2018, up 25% from Q1 2017’s 16 rigs.

The company said it is currently running 20 rigs, including nine rigs in the Northern Delaware Basin, six rigs in the Southern Delaware Basin and five rigs in the Midland Basin.

Concho expects to add one rig to the Northern Delaware Basin and one rig to the New Mexico Shelf in May 2018. Additionally, the company is currently utilizing six completion crews.

Basin play-by-play

- Northern Delaware Basin – 12 wells added in Q1 2018, with average 60-day peak rate of 1,900 BOEPD and average lateral lengths of approximately 8,544 feet

- Southern Delaware Basin – 21 wells added, with average 60-day peak rate of 1,787 BOEPD and average lateral lengths of approximately 9,204 feet

- Midland Basin – 20 wells added, with average 60-day peak rate of 1,114 BOEPD and average lateral lengths of 10,156 feet

In the fourth quarter of 2017, Concho completed the 13-well, two-mile Mabee Ranch project located in Andrews County, Texas. The project had an average 60-day peak rate of 14 MBOEPD. The company said it has been using fiber optic monitoring to gather data for full-field development optimization – several completion techniques have been transferred to other projects.

Q2 2018

Excluding the $9.5 billion RSP Permian transaction that is expected to be completed in Q3, Concho expects Q2 2018 production to be 226 MBOEPD to 230 MBOEPD.

For full-year 2018, the company raised its production growth outlook to a range of 18% to 20%, as compared to the prior range of 16% to 20%.

Conference call Q&A excerpts

Q: What about the amount of 2nd Bone Spring you’ll drill now, versus some of the Wolfcamp and others, given the success that you’re seeing?

CEO Tim Leach: Well, let me start with that, and then I’ll turn it over to Will to talk about it in more detail maybe but — that’s what’s great about the Permian, is that there is always new zones to talk about in both the Delaware and the Midland Basin. There’s new things going on all the time and it’s what makes the way we’re positioned with the acreage we have so valuable.

EVP Will Giraud: We’re excited by what we’ve seen out of the 2nd Bone, I mean, a couple quarters ago, I think we highlighted some stacked wells that we were doing in the 2nd Bone over in Lea County and in this quarter we’re highlighting the work we’re doing, drilling multiple targets over in Eddie County.

And then also, I think you’ve seen some of our peers report some pretty high popping results over in Lea County as well. So just very excited about what we’ve got there and excited to continue to work on multi-zone development of these big projects.

Q: About moving from the 2 to 4 well pads to 8 to 10… you guys are testing upwards of 20 wells at one of these pads. Can you talk about maybe what the sweet spot? Maybe, is it 8 to 10? Does 20 make sense just for cash sources and uses?

Leach: Well, I mean, when you talk about pads, it’s a little bit more complicated than that. And I think it’s better to think about it as a project, a drilling project, sometimes we’ll have four actual pads on the same project, just so we can have rigs working at the same time.

So we’ve been talking in terms mainly of half section development and we will have up to five landing zones and some of these areas and if you’re going eight across on a section, so that’s four wells in each landing times five. So in a drilling project you may have 20 wells in a half section. But then when we go to full section development, it’s twice of that.

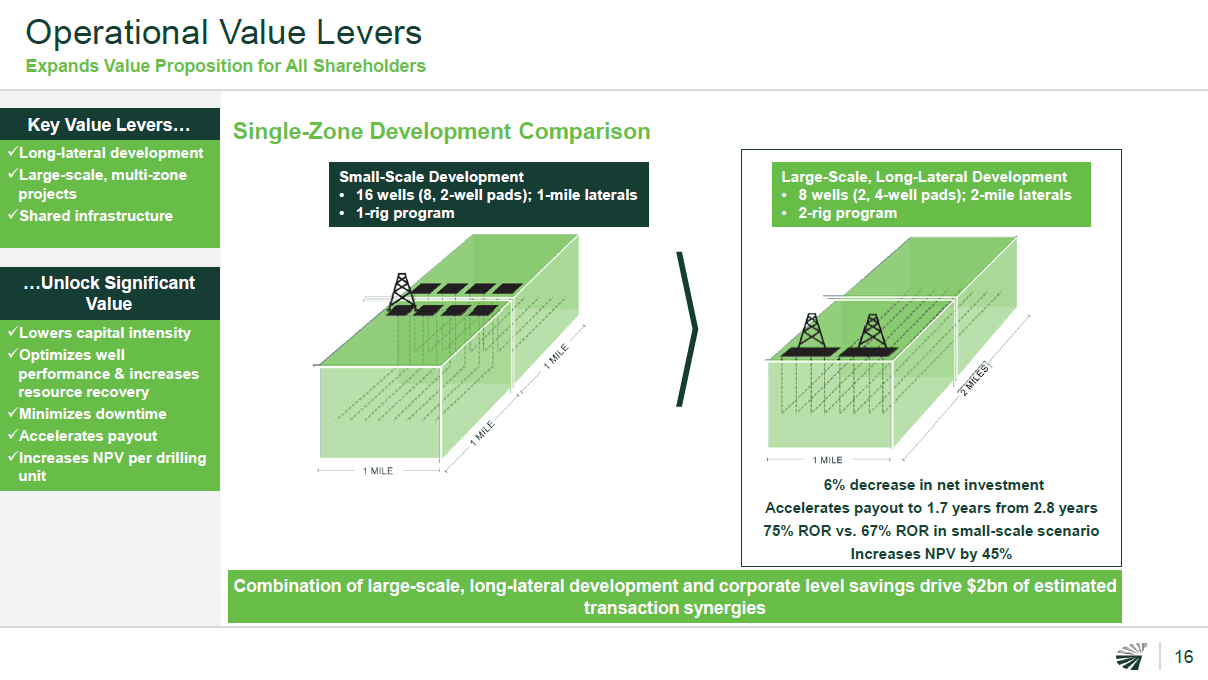

So I think the answer to your question is these kind of drilling projects are going to grow and wells in the project over time and grow dramatically and that drives a lot of value creation, as you can see on that slide 16.

Analyst Commentary

From KLR Group - John Gerdes, Head of Research

Concho Resources, Inc. (CXO)

Stronger Oil/Gas Price Net Backs Increase Fair Value

Price Target: $166.00

Price: $157.03

Investment thesis

We are increasing our CXO target price $6 to $166 per share due to higher oil and gas price realizations. As a consequence of the announced RSP Permian (RSPP, $49.62, H, $51) acquisition, Concho’s capital yield should increase ~10% to ~200%. Only three U.S. E&P business models exceed Concho’s capital yield.

Upper echelon capital yield (cash recycle ratio)

Given differential operating scale and an approximate 67% pro forma oil composition, Concho’s cash operating margin is ~35% higher than the industry median, while the company’s capital intensity is ~10% less than the industry median. Accordingly, Concho generates a capital yield of ~200% versus the industry median cash recycle ratio of ~150%.

Exceedingly complementary acquisition

Concho is acquiring RSP Permian for ~$9.5 billion in total consideration comprising 0.32 shares of CXO for each RSPP share and the assumption of ~$1.5 billion in debt. The transaction increases Concho’s Permian Basin leasehold by ~92,000 net acres to ~640,000 net acres and should close in 3Q/18.

Pro forma, the company expects to run a 27-rig Permian Basin program. Concho plans to conduct a ten-rig northern Delaware Basin and nine-rig southern Delaware Basin program. The company plans to drill ~230 Delaware Basin wells. Concho plans to conduct a seven-rig Midland Basin program and drill ~120 Midland Basin wells this year. Additionally, the company is conducting a one-rig program along the Northwest Shelf and plans to drill ~30 wells this year.

Half-cycle economic tier:

(1) Southern Delaware Wolfcamp A/XY (Loving/Winkler Counties): Wolfcamp A/XY wells (~7,500’ lateral) should recover ~1,500 Mboe (~200 Mboe/1,000’ lateral, 70%-80% oil) for a cost of ~$8 million (~$1,075/ft.).

(2) Northern Delaware Avalon/Wolfcamp A: Northern Delaware Basin wells (5,500’-6,000’ laterals) cost $5.5-$6 million (~$1,000/ft.). Avalon wells should recover ~1,300 Mboe (~225 Mboe/1,000’ lateral, ~60% oil). Wolfcamp A wells should recover ~1,300 Mboe (~225 Mboe/1,000’ lateral, ~60% oil).

(3) Midland Wolfcamp A/B/Spraberry: Wolfcamp A/B/Lower Spraberry wells (~9,000’ laterals) should recover ~1,100 Mboe (~125 Mboe/1,000’ lateral, 70%-80% oil) for a cost of ~$7.5 million (~$825/ft.).

(4) Northern Delaware Bone Spring: Second/Third Bone Spring wells (5,500'-6,000' laterals) should recover ~875 Mboe (~150 Mboe/1,000’ lateral, ~70% oil) for a cost of $5.5-$6 million (~$1,000/ft.).

(5) Southern Delaware Third Bone Spring/Wolfcamp A (Reeves/Ward Counties): Third Bone Spring/Wolfcamp A wells (~10,300’ laterals) should recover ~1,300 Mboe (~125 Mboe/1,000’ lateral, ~60% oil) for a cost of approximately $10 million (~$975/ft.).