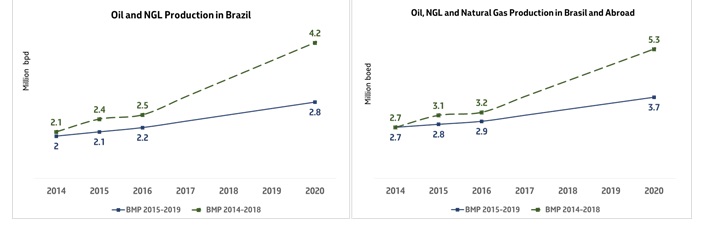

Volumes Revised Downward to 3.7 MMBOEPD from 5.3 MMBOEPD

Petrobras (ticker: PBR) has made all the headlines for all of the wrong reasons in the last several months, and the company is taking initiatives to shed its image as the most indebted oil major in the world.

In a business management plan outlining operations for 2015 to 2019, PBR set company goals of reducing net leverage to below 40% by 2018 and to 35% by 2020. Net debt/EBITDA is planned to drop to 3.0x and 2.5x, respectively, in those years.

In doing so, the company is drastically cutting back on investments. Its capital expenditure plan through 2019 is estimated at about $130 billion, which is roughly the same amount of its current debt but still 37% below its previous guidance. Additional capital-raising measures include the continued divesture and restructuring of its current business. PBR estimates proceeds to reach $42.6 billion by 2018.

The majority of the exploration and production efforts will focus largely on the pre-salt area offshore Brazil, which will expectedly supply about half of all oil output by 2020. Its production forecasts were scaled back dramatically to reflect the reduced expenditures – its 2020 guidance of 3.7 MMBOEPD is down 30% from initial estimates of 5.3 MMBOEPD.

Raymond James Analyst Commentary

* Like wiping out the Bakken: 2020 domestic production target cut by 1.4 MMbpd. Last year's business plan of Petrobras called for domestic oil/liquids production to grow by an average of 14% per year in 2016 to 2020, en route to a target of 4.2 MMbpd at the end of the decade. Today's newly released plan calls for growth of only 6% per year over the same time period, with the new 2020 target at 2.8 MMbpd, a full one-third less than before. (To be sure, virtually no one had been giving Petrobras credit for its "official" previous growth targets.) Since Petrobras is, for all intents and purposes, a pure-play on Brazil (equivalent to Ecopetrol in Colombia), that delta can also be looked as an analogous reduction in the country's overall production growth. For some perspective, 1.4 MMbpd equates to approximately 1.5% of current global oil supply - a very needle-moving change for the global supply/demand equation. Put another way, it's almost as much as we expect the entire Bakken play to be producing in 2020. A more direct comparison is with Ecopetrol, which last month unveiled its own 2020 production haircut (350 Mbpd).

* Five-year capital program slashed by a steeper-than-expected 41%. Petrobras is budgeting aggregate spending of $130 billion during 2015-2019, a 41% cut from the previous plan that had envisioned 2014-18 spending of $220 billion. This is a substantially steeper cut than the 20-25% that we (and the market) had been expecting. Looking at operating segments, downstream spending is set to take the biggest hit, with its five-year budget down a whopping 70%, from $39 billion to $12 billion. (Two years ago, the 2013-2017 downstream budget had been an even higher $65 billion.) The upstream program falls 33%, from $154 billion to $104 billion, though it now makes up 80% of the total (up from 70% a year ago). All in, the 2015 budget stands at $29 billion, followed by $25 billion in 2016 and $76 billion for the period 2017-2019 (an average of $25 billion per year).

* Alongside the much-reduced capital program, Petrobras has nudged up its target for asset sales: now expecting to divest $15 billion during 2015-2016, up 10% from the previous target of $13.7 billion. While helpful, there is no escaping the fact that leverage metrics may continue to rise for the foreseeable future. For context, we project operating cash flow of $20 billion in 2016 (assuming $72/Bbl Brent), leaving a $5 billion shortfall even with the new budget.