Petrobras (ticker: PBR) expects to raise US$2.5 billion through the issuance of 100-year global notes, the company announced on June 1, 2015. The notes include an annual yield of 8.45% and were issued at $0.81 on the dollar, enticing about $13 billion from potential investors, according to a source of The Wall Street Journal.

Petrobras is the most indebted oil company in the world and is reaching to outside markets to fuel future development. PBR wrote off more than $16 billion from its ongoing scandal and owes more than $130 billion in current and noncurrent debt. Its investment ratings are tiptoeing the “junk” category of both Moody’s and Standard and Poor.

Upping the Ante

The New York Times reports PBR is paying an average interest rate of only 4.4% on its $76.4 billion in current debt, but recent raisings have been much higher. The “century bond” is nearly twice the average rate and follows a 30-year bond issue in January 2014 that pays a 7.25% coupon. Despite the attractive returns, the final yield was 0.4% lower than initially anticipated, stressing the positive reaction from the markets.

By comparison, the yields are much higher than Mexico’s 100-year bonds of 5.59% and 30-year U.S. Treasuries at 2.94%.

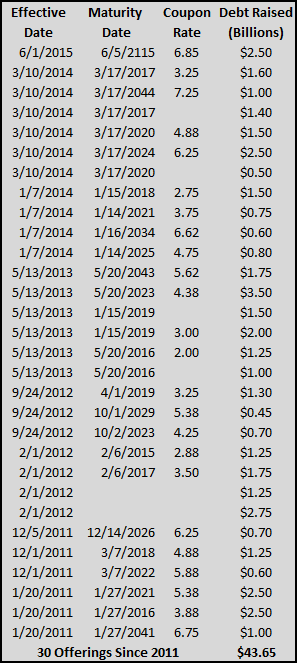

Petrobras and Its Capital Raising History

PBR’s shortcomings and recent scandal have marred its image, but the massive energy company is held in high regard by investment firms. Since the beginning of 2011, Petrobras has issued more than $43 billion in bonds. The company nearly set a record in February 2012 by selling $7 billion in bonds, only to smash that mark with $11 billion in bonds in May 2013. The “century bond” issued yesterday is the first any company has issued this year, and is the longest bond issued by an emerging market company since 1997. A total of 12 century bonds have been issued since 2011.

All of this has occurred after PBR raised more than $70 billion from an equity deal in 2010, intended to fund a five-year, $224 billion investment plan. Roughly $72 billion was planned for downstream investment alone.

Assuming the Risk

Several oil and gas companies have been active on the debt front this year, attempting to secure liquidity before the Federal Reserve increases interest rates. As described in a previous article by OAG360, 2015 debt offerings are already roughly equal to the average yearly offerings in 2013 and 2014. Private equity companies loaded up with billions to take advantage of a down market.

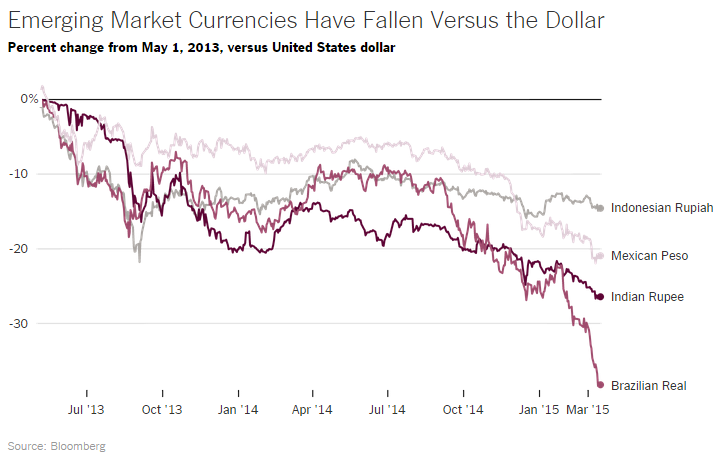

James Saft outlined potential hurdles in a column that appeared on Reuters. Aside from the most obvious issues (such as the bond length and the general history of PBR), another lesser-known obstacle could trip up investors. He explains: “Investors run the risk that Brazil may impose capital controls, as it has in the past, that judgments by courts in Brazil to enforce the guarantee of Petrobras would be paid in reais, rather than in the dollars investors will fork over, and that the company faces threats to its continued ability to access capital markets. Petrobras indeed was effectively cut out of capital markets until its recent write-down.”

Tracy Alloway of Bloomberg notes that debt has a history of coinciding with tops in the bond market. Long term debt can also become very volatile when dealing with an eventual rise in interest rates. The U.S. dollar has appreciated greatly compared to other currencies of late. “The rate sensitivity can result in huge losses,” said Patrik Kauffmann in an interview with the Financial Review. “The world is waiting for a rate increase in the U.S.” Solitaire Aquila, Kaufmann’s firm, did not purchase the rates for that exact reason.