Decreasing production creates demand for foreign crude

PetroChina reported fourth quarter results on Thursday, showing net earnings of ¥7.9 billion ($1.15 billion), or ¥0.04 per share. While not a loss, this is the lowest profit in the company’s history, according to the Business Times. Total revenue was down to ¥1.62 trillion, 6.3% below 2015 levels. Crude oil production decreased by 5.3% to 920.6 million barrels.

Like many other oil and gas producers, PetroChina prioritized decreasing costs in 2016 as a response to lower prices. The company reports that total oil and gas lifting costs decreased by 10.1% in 2016 to $11.67/bbl.

Total CapEx is projected to be ¥191.3 billion, up 11% from the ¥172.4 billion spent in 2016. This increase is unusual, as PetroChina’s CapEx has decreased steadily since 2012. About three quarters of this will be spent in the E&P side of the company, while the remaining quarter will be split between refining and transportation. Production will continue to decrease, however, with oil production dropping by about 4.5% in 2017.

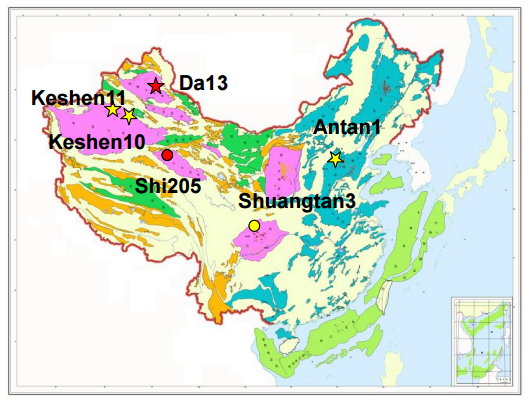

PetroChina reports that its exploration activities were highly successful last year, with multiple oil and gas fields identified. Six oil reservoirs with at least 730 million barrels of oil in place were found, and five gas field with at least 3.5 Bcf of gas in place. Spending in 2017 will continue to explore several major basins in China and begin to develop the fields discovered in 2016.

Chinese imports grew by 12.5% last year

Overall, PetroChina’s results mirror those of the other national oil companies, Sinopec and CNOOC. Each has seen production decrease in the last year as lower prices made many operations uneconomic. Overall oil production in China dropped by 8% in 2016, the first annual decrease since 2009. Demand growth in China has not stopped though, and imports rose by 12.5% in 2016.

According to Reuters, Sinopec is responding to this increase in demand by looking to new frontiers for supply. Imports from North and South America hit an all-time high in March, reaching 14% of total Chinese oil imports. While Brazil, Venezuela and Columbia currently supply most of China’s imports from the Americas, the recent growth of U.S. exported crude will make the U.S. a potential supplier also.

Refining capacity is increasing quickly to supply domestic demand. According to Reuters, China plans to add nearly 2 MMBOPD of refining capacity by 2020, growing total capacity to 12.5 MMBOPD. These increases, combined with growth in India and elsewhere in the continent, will make Asia account for one-third of the world’s total refining capacity by 2020.