PetroQuest Energy’s net daily production rate exceeded 100 MMcfe in Oct., doubling production since Q4 2016

Q3 highlights

- Oil and gas sales were $28,184,000

- Loss to common stockholders of $3,085,000, or ($0.15) per share

- Discretionary cash flow was $13,741,000

- Production was 7.5 Bcfe

- Lease operating expenses (LOE) increased to $8,863,000

- Production taxes totaled $1,112,000

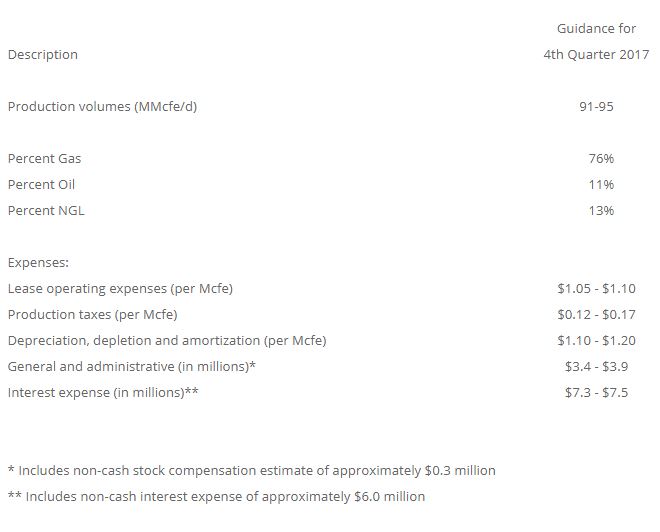

Q4 guidance

PetroQuest said that the production guidance for Q4 2017 takes into consideration the deferral of completions on two drilled Cotton Valley wells into 2018. The deferred completion aligned the company’s capital budget with estimated cash flow. Additionally, one month of downtime is expected at West Delta 89 due to third party pipeline maintenance in Q4. There was also downtime for all of PetroQuest’s Gulf of Mexico fields as a result of Hurricane Nate in Oct.

The mid-point of the company’s current Q4 2017 production guidance would represent an approximate 86% increase from the average daily production during Q4 2016.

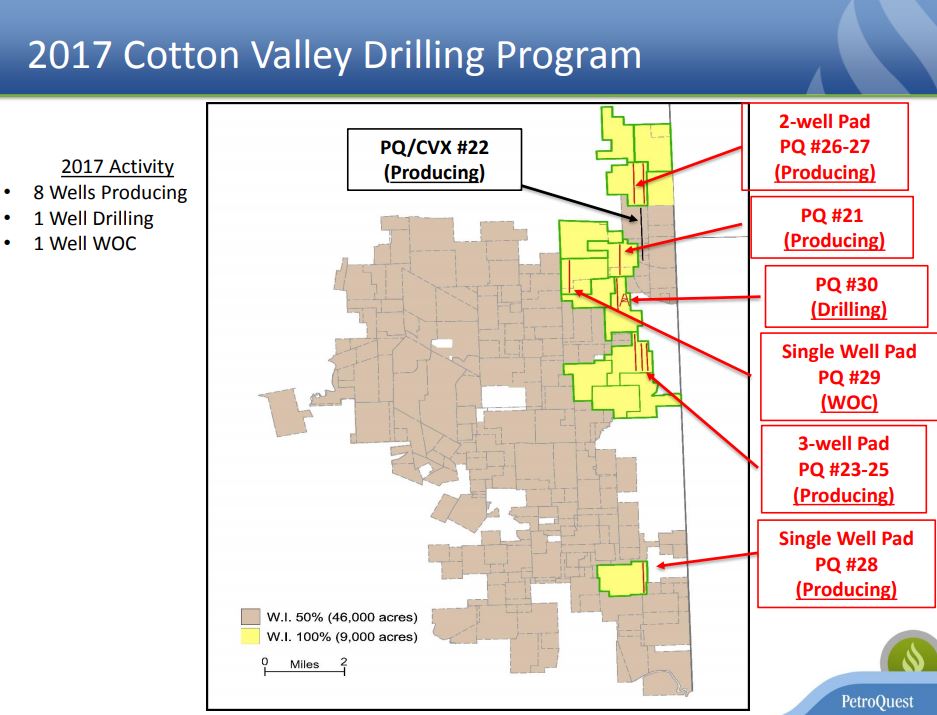

Cotton Valley inventory

Since the beginning of 2017, PetroQuest has increased the acreage held within its joint venture area from approximately 6,000 net acres to nearly 8,200 net acres. As a result of the nearly 40% growth in acreage, as well as the results from the 2017 drilling program, the company is increasing its drilling inventory within its entire Cotton Valley acreage position from 601 gross locations to 838 gross locations. PetroQuest believes that 1,200 foot spacing is more appropriate now, versus the original 1,500 foot spacing estimate.

Conference call highlights

- Drilled 8 wells this year, spending $34 million

- 2017 drilling program was completed ahead of schedule

- Three new Cotton Valley wells, initial 24-hour gross production of 41 MMcfe/day

- PQ #26 and PQ #27 wells were completed, initial production 24-hour rates of 12.7 MMcfe/day and 13.3 MMcfe/day, respectively. PQ #28 reached the maximum 24-hour rate of 15.3 MMcfe/day

- PQ #27 and PQ #28 were completed using a significantly higher density completion design and were comprised of greater than 1,000 pounds of proppant per lateral foot, versus PetroQuest’s traditional 700 pounds to 800 pounds proppant per lateral foot. Cost per lateral foot was $893 for the higher density completion design.

Conference call Q&A

Q: Can you talk a little bit more about the increase in net acreage, what that does for you in terms of increased inventory, and how much of it was due to spacing?

PetroQuest: A big chunk of what we were able to pick up relative to the JV acreage was done with trades. When you add in the trades, somewhere around $600 an acre all-in, we were able to add a couple of thousand acres. During 2017, we were trying to optimize what the spacing would ultimately be.

Early in the program, we tested a well down to around 900 feet spacing through our micro-seismic. We’ve confirmed that when you look at the spacing, the spacing levels at 1,200 hundred feet are probably more appropriate to avoid any kind of interference versus the 1,500.

Q: Regarding the deferred Cotton Valley completions, was that purely to manage cash flow and CapEx?

PetroQuest: We’ve doubled our production this year already and at some point in time you say enough is enough. We’ve gotten our leverage down and it’s allowed us to take a breath.

Also, part of that was that we were falling back on our first two wells in Centennial. Those were the first wells up there and we can move in there to drill six well pads in the future, potentially.

Q: You highlighted the leasing activity in your press release, added about 2,200 net acres. Is that leasing activity ongoing?

PetroQuest: On the JV acreage, yes, there are a lot of stranded tracks where somebody might have 640 acres and really can’t mount a horizontal drilling campaign on it. So they’ve come to us or we’ve gone to them, and that will be 10 or 12 locations. We’re taking advantage of a situation that is very advantageous to us and others that are focused in the Haynesville.

We really never had a painful position that we could have developed out there. For example, if we had 25 acres here or 100 acres there, that would only be a partial non-operating interest in the Haynesville – that’s not our kind of plan, so we would transfer or trade rights.

This is something that’s been going on throughout the year. We just felt we wanted to update our inventory before the end of the year. So we felt like this was the right time to do this. But if you look at our maps, generally our JV acreage is highlighted in yellow. You can see what we’re trying to do pretty easily. There are little small gaps and holes as we try to link up positions and generate operational efficiencies in terms of using saltwater disposal and existing infrastructure.

So we’re just sort of filling in the gaps there, very small positions at a time, and when you look at the total 2,000 acres, we’ve probably done 10 separate deals to get there. So just a very small little bolt-on block – blocking and tackling to fill in a position in order to generate better economics of scale, and in a lot of cases, to help us drill longer laterals.