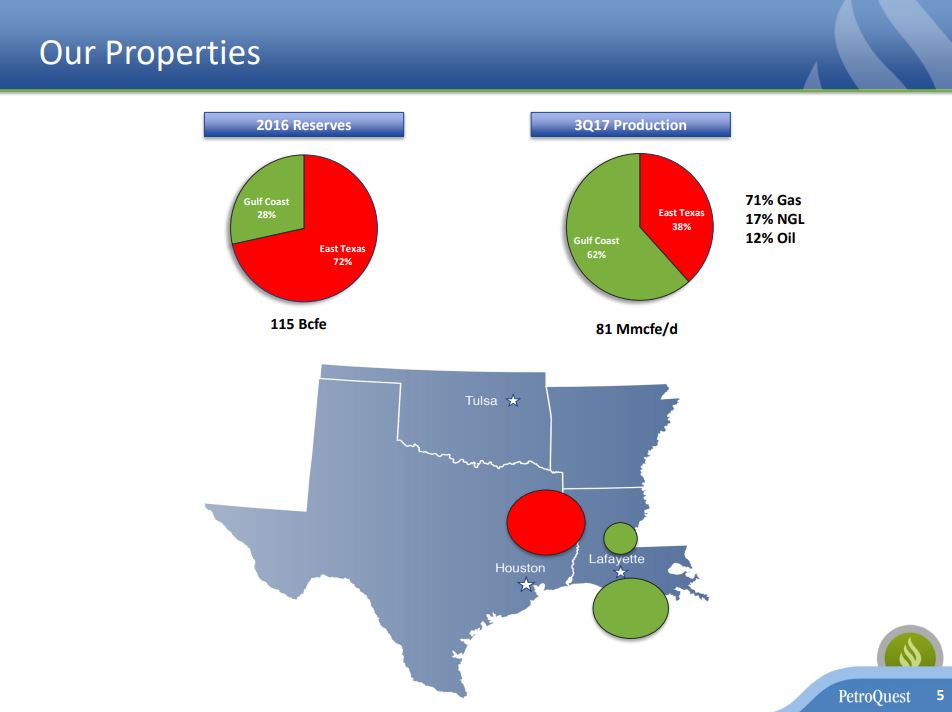

EnerCom Dallas presenting company PetroQuest Energy (ticker: PQ) was founded in 1985 as a Gulf Coast oil and gas company. From 1985 to 2002 PetroQuest grew its reserves located principally onshore in Louisiana and offshore in the Gulf of Mexico. The company is headquartered in Lafayette, Louisiana.

Central Louisiana Austin Chalk acquisition

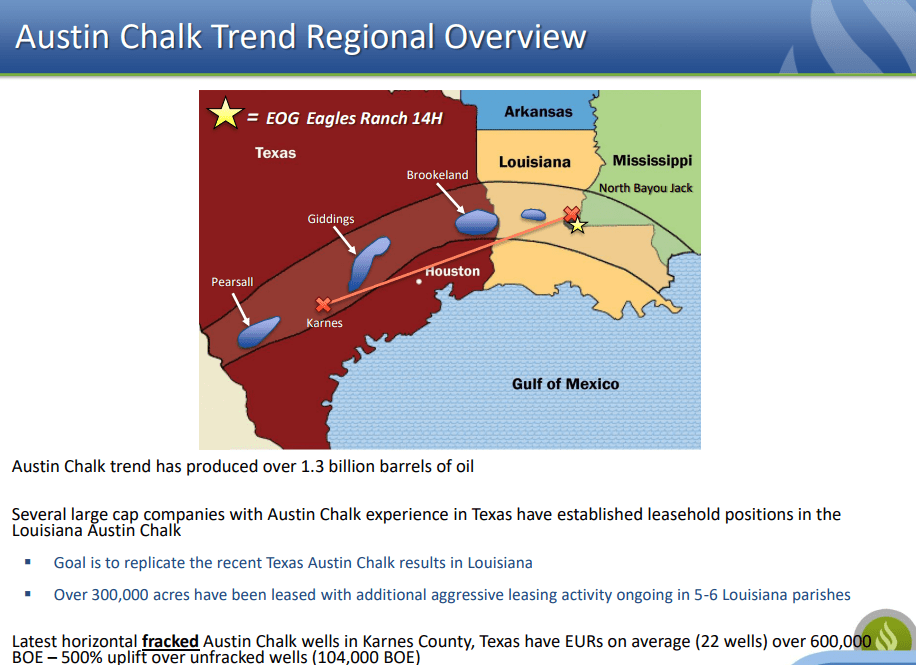

The company recently entered the Central Louisiana Austin Chalk formation. PetroQuest plans to acquire interest in 24,600 gross acres, for a purchase price of about $18 million. According to PetroQuest, the acquisition closed on December 18, 2017. The company is looking to replicate the improvements seen in the Karnes County Austin Chalk. In Karnes County, the average horizontal well drilled before 2013, before fracing was widely used, produced 104 MBOE.

PetroQuest believes it can replicate these results. The average unfractured horizontal well in Avoyelles Parish, near PetroQuest’s new acreage, produced 119 MBOE. If implementing modern methods is able to produce a comparable uplift, modern wells may produce 732 MBOPD. The company reports that even if the uplift from modern operations is not as high, and new wells produce only 600 MBOPD, each well will have an IRR of 60%.

Q3 highlights

- Oil and gas sales were $28,184,000

- Loss to common stockholders of $3,085,000, or ($0.15) per share

- Discretionary cash flow was $13,741,000

- Production was 7.5 Bcfe

- Lease operating expenses (LOE) increased to $8,863,000

- Production taxes totaled $1,112,000

Q4 guidance

| Description | ||

| Production volumes (MMcfe/d) | 91-95 | |

| Percent Gas | 76 | % |

| Percent Oil | 11 | % |

| Percent NGL | 13 | % |

| Expenses: | ||

| Lease operating expenses (per Mcfe) | $1.05 – $1.10 | |

| Production taxes (per Mcfe) | $0.12 – $0.17 | |

| Depreciation, depletion and amortization (per Mcfe) | $1.10 – $1.20 | |

| General and administrative (in millions)* | $3.4 – $3.9 | |

| Interest expense (in millions)** | $7.3 – $7.5 | |

| * Includes non-cash stock compensation estimate of approximately $0.3 million | ||

| ** Includes non-cash interest expense of approximately $6.0 million | ||

PetroQuest said that the production guidance for Q4 2017 takes into consideration the deferral of completions on two drilled Cotton Valley wells into 2018. The deferred completion aligned the company’s capital budget with estimated cash flow. Additionally, one month of downtime is expected at West Delta 89 due to third party pipeline maintenance in Q4. There was also downtime for all of PetroQuest’s Gulf of Mexico fields as a result of Hurricane Nate in October.

The mid-point of the company’s current Q4 2017 production guidance would represent an approximate 86% increase from the average daily production during Q4 2016.

EnerCom Dallas conference presenter

PetroQuest Energy will be presenting at the EnerCom Dallas investment conference, Feb. 21-22 at the Tower Club in downtown Dallas. Institutional investors, portfolio managers, financial analysts, CIOs and other investment community professionals who invest in the energy space should register now.