PetroQuest Energy (ticker: PQ) is an independent energy company engaged in the exploration, development, acquisition and production of oil and natural gas reserves in the Arkoma Basin, East Texas, South Louisiana and the shallow Gulf of Mexico. The company has largely transitioned from gas drilling to focusing on liquids-rich projects and expects 2014 to be its best year in company history.

PetroQuest presented at EnerCom’s London Oil & Gas Conference™ 6 on June 10, 2014.

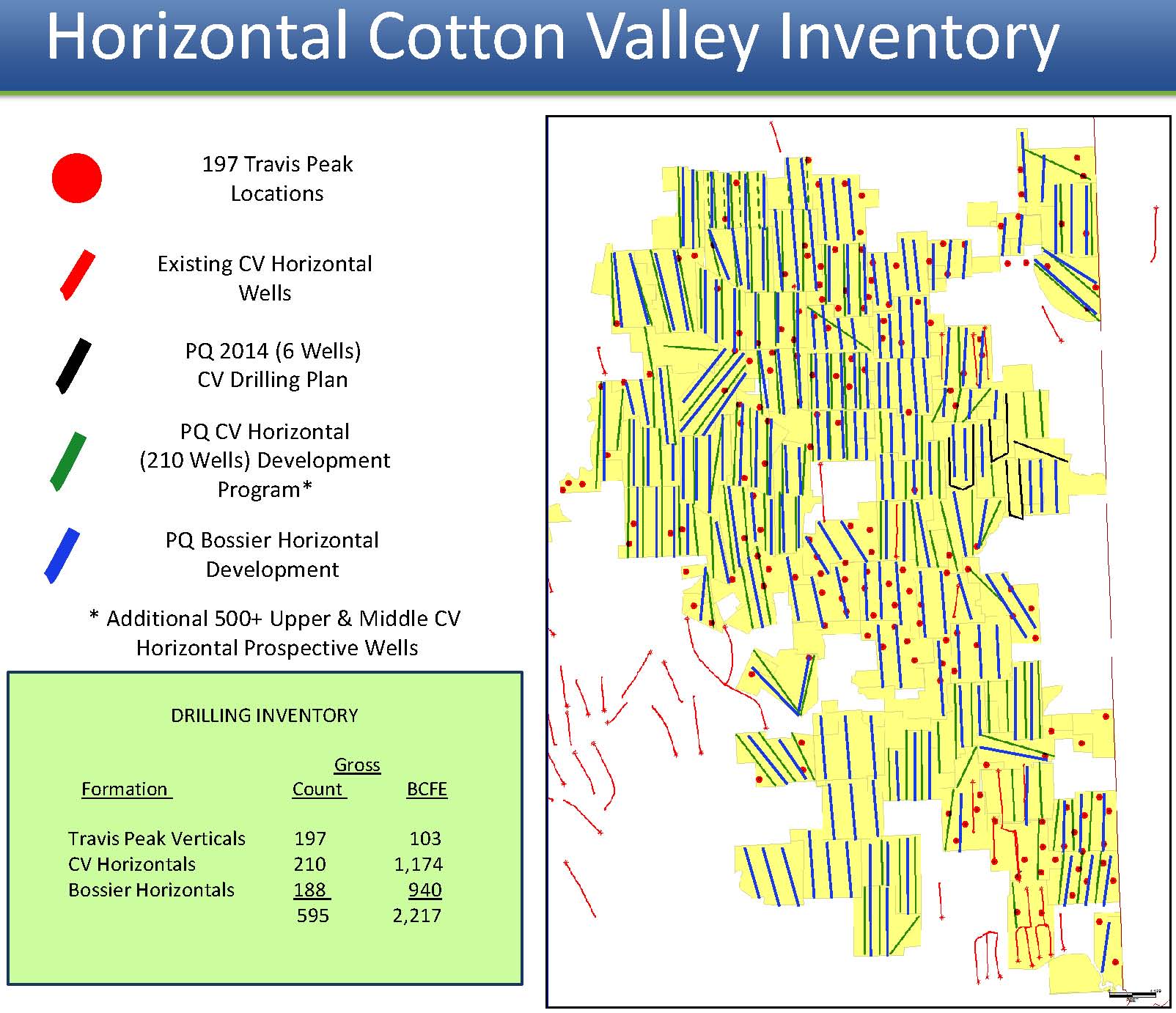

Cotton Valley Horizontal Complete

In an operations update on June 9, 2014, PetroQuest announced its PQ #10 horizontal well (41% net revenue interest) returned a peak 24-hour rate of 1,859 BOEPD (33% liquids). The well is the company’s best in the region to date. Five additional horizontal Cotton Valley wells have either been spud or are in various stages of completion, with production results expected from one of the wells in about a week. Completion operations will begin on another well in approximately two weeks and an additional well has reached total depth.

Source: PQ June 2014 Presentation

At EnerCom’s London Oil & Gas Conference™ 6, Charles Goodson, Chairman, President and Chief Executive Officer of PetroQuest Energy, said: “We feel like we probably have a total of about 500 potential locations in the Cotton Valley and probably 300 to 400 in the Bossier shale. This area is as big, for us, on a relative basis, as the Woodford shale.”

Thunder Bayou on the Horizon

PQ’s Thunder Bayou prospect (50% working interest) located near the largest discovery in PetroQuest’s history, the La Posada CRIS R in Vermilion Parish, will spud during the month of June and is expected to be complete by Q4’14. Its proposed depth is 21,000 feet. The Vermilion Parish well produced a peak gross rate of 5,310 BOEPD (25% liquids) when it was brought online in March 2012.

The Eagle Crest prospect (47% NRI) located in Assumption Parish was recently completed and logged 29 feet of net oil pay. PQ expects the well to go online in July and produce an average of 300 BOPD to 500 BOPD. Capital One Securities believes the well will boost PQ’s stock by $0.10 per share, according to its Morning Energy Summary for June 10, 2014.

Click here for a list of PetroQuest’s operated wells in the Gulf of Mexico.

Source: PQ June 2014 Presentation

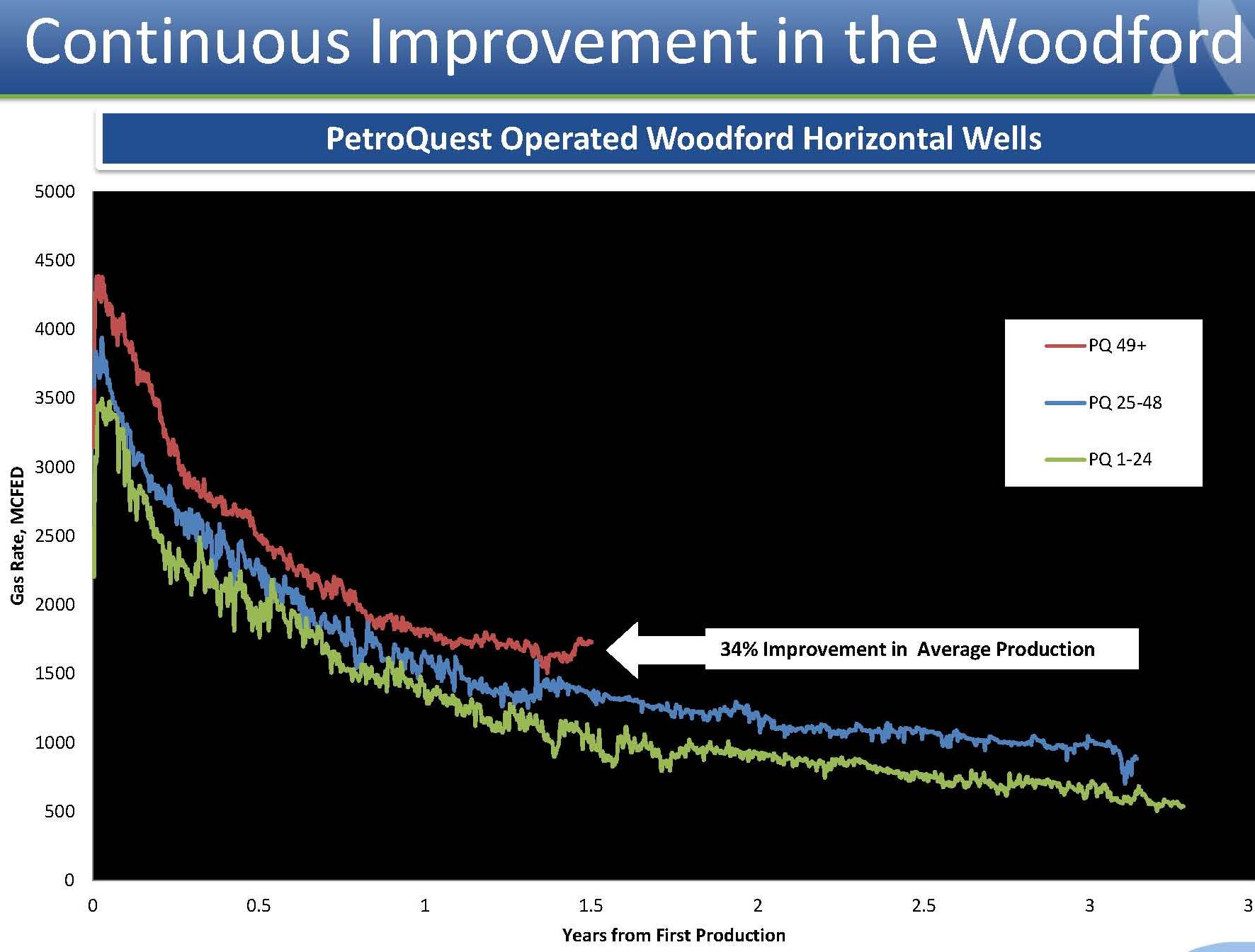

Woodford Program Continues in Oklahoma

Two new wells (average of 36% NRI) in West Relay field are online and reached a peak 24-hour gross rate of 1,199 BOEPD (48% liquids). The company has drilled 11 total wells in the West Relay field to date which have averaged 1,170 BOEPD (48% liquids). By comparison, 35 North Relay wells averaged 669 BOEPD (41% liquids).

“The initial wells here have been 50% better than the initial wells we drilled in the North Relay, and we’re just getting started,” said Charles Goodson, Chairman and Chief Executive Officer of PetroQuest Energy, at EnerCom’s London Oil & Gas Conference™ 6. “We have probably now de-risked about 250 locations. It’s basically 50 wells per year. That’s a five-year drilling inventory and probably about 60% of our acreage. We’ll still continue to buy acreage, so we think we have about a 10-year inventory in our West Relay area.”

Source: PQ June 2014 Presentation

One rig is currently running in the play and is completing three additional wells. Flowback on those wells is expected in June 2014, and a second rig will be added in Q3’14 to accelerate operations. Management said wells are now being completed in as few as six days at a cost of $3.75 million per well.

Goodson said the company will be announcing a new type curve in the near future. Its current estimated ultimate recovery is 4.5 Bcf per well. Goodson also said PQ is being careful not to overdrill the shale and maintain a 60% decline rate.

The Remainder of 2014

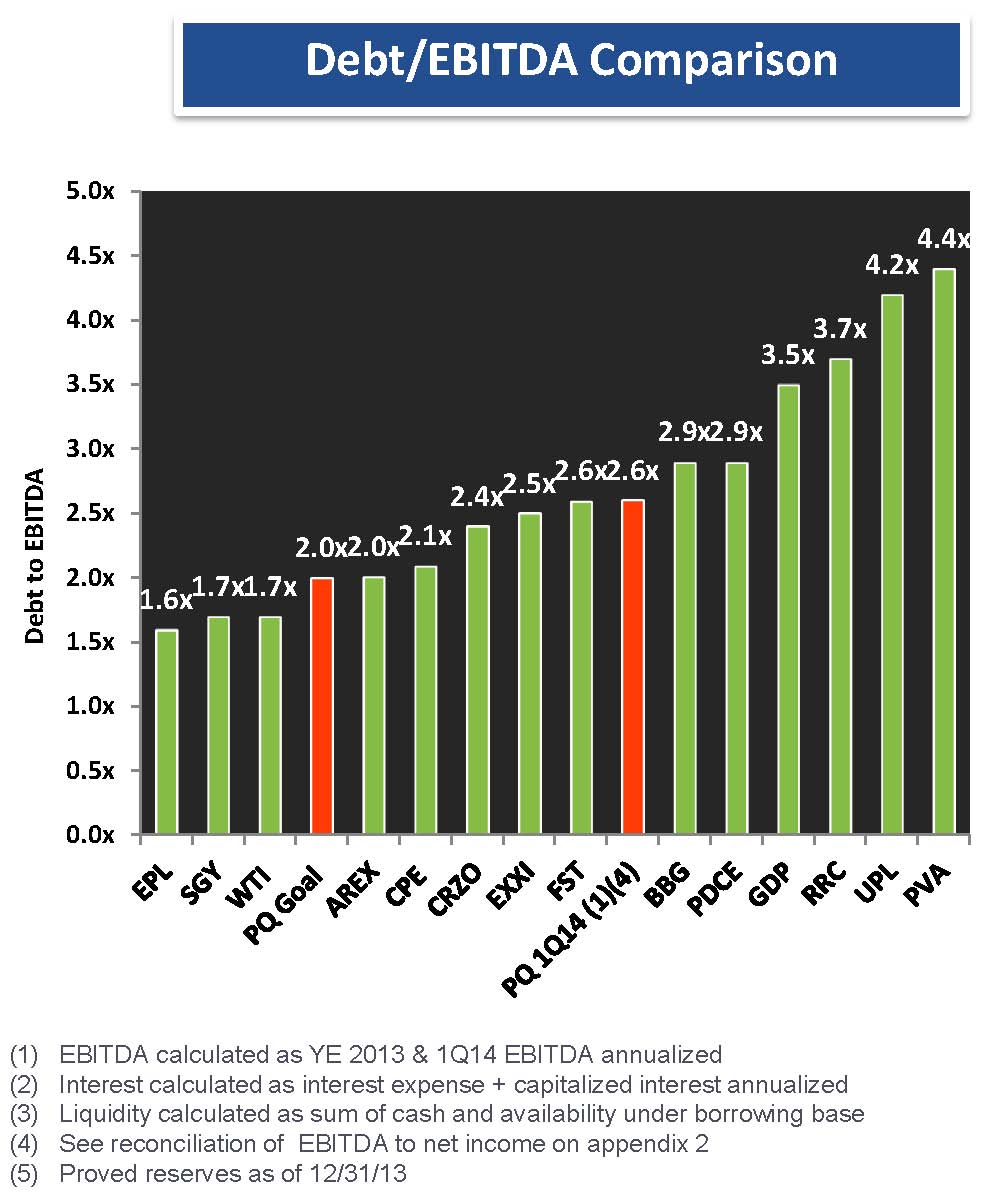

PetroQuest was cost-effective in setting up its current program. In EnerCom’s E&P database consisting of 87 companies, PQ’s three-year finding and development costs of $2.93 are below the industry median of $3.32. Similarly, its trailing twelve months operating expenses and general administrative costs per Mcfe were $1.99 – well below the industry median of $3.07. The company is aiming to drop its debt to EBITDA ratio to 2.0x by the end of 2014. Bond Clement, Chief Financial Officer of PetroQuest Energy, said: “We were 2.6x at the end of first quarter. But our budget is fully funded this year and we have over $100 million in availability in our credit facilities that we don’t expect to use, so liquidity is not an issue at all.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.