PetroQuest announces free cash flow and production increased 156% and 13%, respectively

Louisiana-based PetroQuest Energy (ticker: PQ) released its first quarter results Wednesday showing improving cash flow and stronger production. According to the company’s press release, free cash flow and production increased 156% and 13%, respectively, quarter-over-quarter.

Discretionary cash flow for the first quarter of 2017 was $9,206,000, as compared to a $2,210,000 loss for the comparable 2016 period, and $3,591,000 for the fourth quarter of 2016. This was due in large part to a 75% increase in realized pricing on a Mcfe basis, the company said in its release. PetroQuest reported $3.98 per Mcfe including the effects of hedges for the first quarter of the year compared to $2.27 per Mcfe in Q1 2016.

The company reported first quarter production of 5.2 Bcfe, a 13% increase quarter-over-quarter, PetroQuest said in the release. Production was down year-over-year with PQ reporting 7.6 Bcfe of production for the same quarter last year. The company said the drop in production was due to the sale of its remaining Arkoma assets in April 2016, as well as a significant reduction in capital spending last year.

For the second quarter, the company is planning on completing its three-well pad in East Texas with initial flowback expected in early June. In the Gulf Coast, the company had planned to recomplete a well at its Ship Shoal 72 field in May with initial production expected in June. Due to the timing of rig availability, this recompletion is now scheduled for June with initial production in July, the company said. As a result of the limited impact that these operations will have on second quarter production, PetroQuest is guiding production for the second quarter of 2017 at 62-65 MMcfe/d.

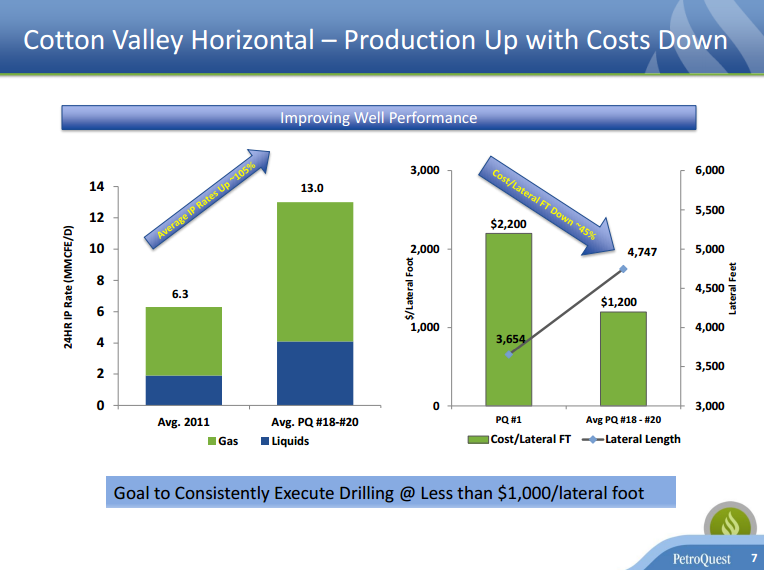

With a full quarter of production expected from the three well Cotton Valley pad, along with the anticipated impact of the Ship Shoal 72 recompletion, PetroQuest expects production for the third quarter of the year to reach 80-84 MMcfe/d. The midpoint of the Q3 guidance would represent a 64% increase from the average daily production of Q4 2016.

We are constantly growing – PetroQuest CEO Charlie Goodson

During the company’s conference call, PetroQuest’s management was asked if it might continue to expand in East Texas, PQ’s CEO Charlie Goodson replied the company is “constantly growing [its] acreage.”

Q: Any commentary at all in terms of what is the market look like in your area in terms of potential to continue to expand your Cotton Valley footprint? And any plans I know we’ve talked about Bossier going back several years now, but there is a lot more activity in both the Bossier and Haynesville in East Texas as well. So, curious if there is any commentary about what to look for in either acquisitions or deeper zones?

Charles Goodson: We are constantly growing our acreage position as we speak and in and around our core 50,000 plus acres. Secondly, as we continue to come back and are active and people see the results that we are getting in the Cotton Valley. There, we are getting calls and are talking to others let say may have a 1,000 to 5,000 to more acreage in an around the Carthage area that is held by production by verticals well that would like to access our ability to bring an entire team to that. So, we will definitely see growth it in and in addition to the acreage we have.

We basically have drilled one Bossier well on the very southern end of our acreage. And I think came online, it was the early lateral 6 million a day fairly dry and then we’ve watched with a lot of interest company’s just to the Southeast of us really increasing rates and stuff looked a lot like ours larger fracs. It is definitely something that we’re interested in and I think we’ve always said that we think at least 50% of our acreage looks very prospective for the Bossier because so far we’ve seen a very dry reservoir and one well and one penetration. It clearly is something that will be behind our Cotton Valley, but we’re going to start talking probably on our next conference call about 2018, both us and our partner are looking at budget for 2018 and over time, hopefully, we can start talking about Bossier when we could effectively drove back into the mix and start drilling that.