Retiring Pioneer Natural Resources (ticker: PXD) CEO Scott Sheffield hosted his final earnings call this week

Scott Douglas Sheffield

As most of you all know, this is my last earnings call after 25 years of being public.

I want to extend a special thanks to all shareholders and to all analysts on the call and our great relationship that we’ve had over the years. I’d like to give a brief message before I review the first two financial and operating highlight slides. As a continuing large long-term shareholder and board member, I have 100% confidence in Ken and the management team that we’ll continue to make this company the premier shale company in the world. We have the best rocks and balance sheet and the best employees in the industry. What company can easily grow 15% per year for ten years and move up to over 1 million barrels of oil equivalent per day in a $47 to $57 oil price environment?

If you look the Permian only, that growth is well over 20% over those ten years. What company has over 10 billion barrels of oil equivalent with over 20,000 locations at an average net revenue interest of 85% and essentially has zero basis on those locations except for the recent Devon transaction, in an environment where companies are paying $40,000 to $60,000 per acre. In addition, we are growing our oil mix from 57% this year to 62% next year and over 70% over the next 10 years.

OPEC: 40% Chance of an agreement

With regard to oil prices, we are obviously not out of the woods yet. I give OPEC a 40% chance of reaching an agreement on November 30 and, if they do, everyone will cheat. I’ve seen this over my 42-year career. The market will not balance until 2018. That is why Pioneer is best positioned among all companies, with great hedges in place for 2017 and the best balance sheet in the industry.

Now we will go to slide number three and financial and operating highlights. We had adjusted income for the quarter of $22 million or $0.13 per diluted share. Third quarter production, 239,000 barrels of oil equivalent per day, 56% oil, above Pioneers guidance range of 232,000 to 237,000, an increase of 6,000 barrels a day or 3% versus second quarter, obviously driven by the Spraberry/Wolfcamp horizontal program and our completion optimization program. We did have unplanned downtime at Fain gas plant, which affected the quarter by 2,000 barrels a day from West Panhandle production.

Placed 46 horizontal wells in production in the Spraberry/Wolfcamp in Q3

We did place 46 horizontal wells in production in the Spraberry/Wolfcamp during the third quarter, with strong performance, including 28 wells from 3.0 Version. Again, the 3.0 Version significantly outperforming 2.0. We did expand our 3.0 from 80 wells to 100 wells, continuing to realize significant capital efficiency gains in the Spraberry/Wolfcamp, again, through completion optimization, longer lateral lengths, enhancing well productivity. Drilling completion efficiencies and cost reduction initiatives are continuing to drive down cost per lateral foot.

On slide number four, reduced production cost per BOE by 6% since second quarter of 2016 and 32% since third quarter of 2015. And, yes, as some people may question, our horizontal Permian operating costs are $2 excluding taxes. Enhanced Martin County acreage position by closing purchase of 28,000 net acres from Devon for $429 million. With the export ban removed last year, we did sell our first two Permian oil cargoes for export to Europe in the third quarter.

We paid mid-July a debt maturity of $455 million with cash on hand. And with the recent run-up of course obviously three or four weeks ago with oil prices, we did increase our 2017 derivative coverage to 75% for oil and 55% for gas, up from 50% from last quarter.

I’ll now turn it over to our next CEO, Tim Dove.

Timothy L. Dove

Thanks, Scott. I share Frank’s good wishes for you going forward. As we’ve been discussing for some time, we are in the midst of increasing our horizontal rig count. We have a couple more rigs that need to come in November to complete the total addition of five rigs. That’ll put us with 17 rigs in the northern Spraberry/Wolfcamp area by year end.

Our capital program remains essentially unchanged. It’s been that way for some time since the Devon transaction was announced of $2.1 billion. The rigs that I mentioned a moment ago will not really have any significant production adds until 2017. However, just the fact that we’re improving our productivity in the Spraberry/Wolfcamp field area with the horizontal drilling campaign and completions optimization is allowing us to actually increase our forecast for this year’s production from 13%-plus to 14%-plus.

We see now, even with the 17 rig count maintained flat, that we would expect to deliver production growth ranging from 13% to 17% next year. Really what we’re finding, of course, is we can continue to do more with less as we continue to optimize our program. The 2017 campaign of drilling is well-funded already, with our balance sheet on the one hand and also, as Scott had mentioned, our strong derivatives position having been built up considerably over the last few weeks and our cash flow assumptions based on strip prices.

Current 2017 capital budget is far from finalized. There’s a lot of discussions, of course, that are ongoing with our partners and internally as to where we’re going to land the budget. But suffice it to say, we’re currently looking at numbers that are in the range of $2.7 billion to $2.8 billion for 2017.

One of our more critical messages in this whole presentation is in the yellow box at the bottom of slide five and it’s the fact that, as Scott had mentioned, we’re on a plan here to increase our annual production growth rate to about 15% for several years and, in doing so, keeping exceptionally strong balance sheet, in this case net debt to operating cash flow below 1x, even using only strip prices. And in addition to which, if we grow production at that 15% rate, our actual compound annual growth rate of cash flow exceeds that and is approximately 25%. That has to do with drilling projects that are high-margin, oil-based in terms of their returns.

And one of the major components of this is, and our internal modeling certainly supports the fact that we can do this while spending within cash flow as early as 2018 and that’s assuming about a $55 per barrel oil price case. So this is what we’re focused on really for the next several years, one of the main components of which is at minimum, cash flow neutrality, which as I said I think we can reach 2018.

Turning now to slide six. I mentioned a moment ago our capital budget remains essentially unchanged in 2016 at $2.1 billion. The splits, as shown on this slide, are also essentially the same. Our cash flow number appears to be coming in as we had projected, maybe $1.5 billion. With cash on hand, we easily can fund this $2.1 billion this year. As we look forward, we would say the same thing about 2017.

Turning then to slide seven, and this is our production growth forecast and history. You can see that essentially we’re right on schedule when it comes to our production growth. The new forecast for 2016 being moved up to 14% from 13%, as I had mentioned. That gives us approximately a new number of 233,000-plus BOE per day.

If you look at the quarters, quarter three was, again, substantially above our range. The fourth quarter production range we show here is a bit of an estimate only because, as has been evidenced by some of our earlier commentary and the material Frank put out last night, we have had an upset at our Fain plant in the West Panhandle field area. That is in the process of being rectified, but it’s unclear how many more days that’s going to take before we can get to full production. So what you see here is us being relatively conservative to make sure that we can get that plant back and in full operation.

But as you look forward, and if you look towards the future growth, we’re reflecting on this slide the 15% CAGR growth rate through the end of the decade. If you do the math on this, this gets us over 400,000 barrels a day by 2020. And oil growth is, of course, a considerable component of that. There’s been some discussions and questions that are raised by where we came out in terms of our oil content of production for the third quarter, showing it 56% where we had 58% in the second quarter.

This is relatively easily explained by the fact that we put in our targeted gas plant in the Martin County area, referred to as the Buffalo plant, in April of this year. And, of course, in doing so, we had to assess and project what sort of NGL recoveries we could get from that plant. It turns out they were substantially better than what we thought and so we had to go back in that sense in the third quarter and do an accrual adjustment for those additional NGLs. So that’s a very big positive in our NGL [ph] fraction (13:12) out of that plant is significantly higher than what we thought.

In addition, if you then match that up with the fact that we had really substantially higher offset frac shut-in wells, we had about 5,000 barrels a day shut-in if you few average for the second quarter, that increased to 10,000 barrels a day in the third quarter. We’re obviously very busy out in the field. We’ve got more rigs running, we have our own frac fleets running. We don’t adjust down in terms of the quarter, and those frac leases continue to work and our shut-in production numbers move up and down every week. But suffice it to say on average much higher shut-in production in the second quarter. And that’s a good thing because that means we’re actively working on new wells.

The final thing I’d say in that regard is that our new wells do continue to show initial production percentages of about 80% for oil. And that’s a good thing. The GORs do increase slightly through the course of the life of the wells, but suffice it to say we’re still seeing IPs at 80% oil. So that is all going exceedingly well.

And I would also follow up by saying there’s some discussions surrounding our oil growth. It was substantially higher in the second quarter than the third, and that has to do with a couple of factors. One is, our POP numbers were substantially higher in the second quarter, about 69 wells were put on production, where, in the third quarter, as scheduled, we have a lesser number, in this case we POPed 46 wells. By definition your oil growth rate will be a little bit less in that scenario.

And then in addition to which the same effect occurs vis-à-vis in the shutting-in of offset frac wells that has about a 5,000 barrel a day increase from the wells that are shut-in in the third quarter compared to the second quarter. But all in all, I guess the message is we are right on schedule on this forecast and I think it bodes well for our ability to keep running the factory and keep moving forward with it with even a higher level of activity.

With that, I’m going to turn the call over to Joey Hall, who is our EVP of Permian Operations.

J.D. Hall

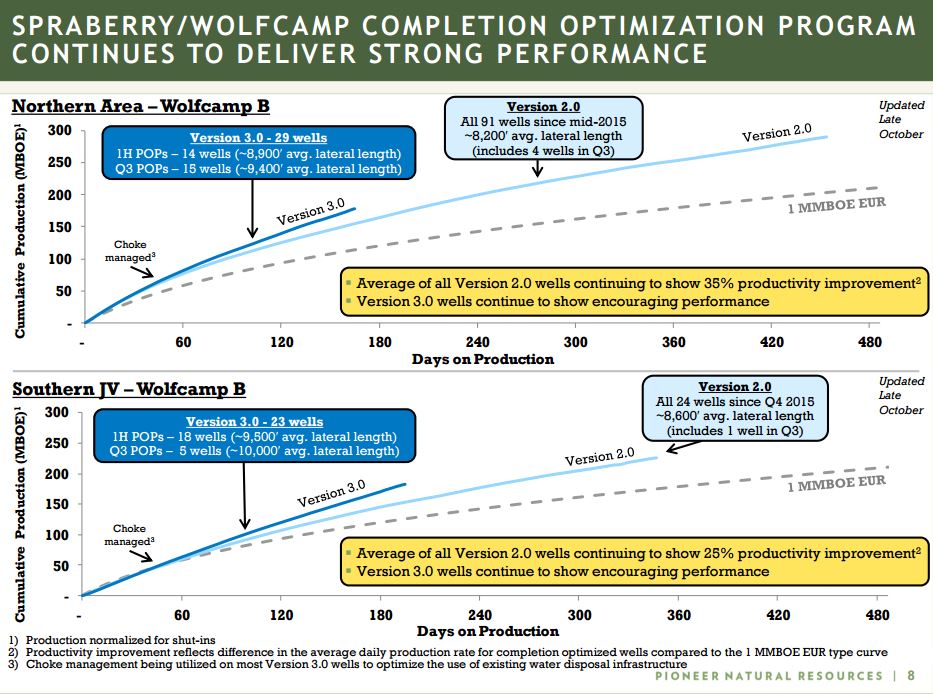

Thanks, Tim. I’m going to be picking up on slide number eight. Here you can see the impressive performance from our Version 2.0 completions continues. We’re still trending 35% above the 1 million barrel a day equivalent type curve in the north and 25% in the southern JV area, with four more wells added in the north and one in the south.

We also continue see a positive bounce for our Version 3.0 completions when compared to 2.0 in the north, with three additional months of production data and 15 more wells. Same story with Version 3.0 completions in the south, with five additional wells added in Q3. And as we mentioned last quarter, the early results of the new POPs were masked somewhat due to choking, but we’re now starting to see some good separation for our 3.0 completions.

Moving to slide number nine. Similar to the previous slide, we continue to see the improved performance from our Wolfcamp A wells in both the north and the south. In the north, Wolfcamp A Version 2.0 still showing a 25% productivity improvement with two additional wells added to the mix. Wolfcamp A Version 3.0 wells in the north are also showing a performance improvement over 2.0 with three more months of production data and eight new wells.

There were no new 2.0 or 3.0 wells added in the southern JV area in Q3. And, of course, the same caveats apply on early choking at the new wells.

Moving to slide 10. Same story on lower Spraberry shale wells for our version 2.0 completions, which are still tracking 10% above the 1 million a day type curve with 10 new wells added. Just reiterating the messages from our recent well performance. 2.0 completions continue their strong performance in all intervals with no retraction on our performance that’s been stated in the past. And early favorable returns on our 3.0 completions has led us to expand our optimization program from 80 to 100 wells. And we will continue to use choke management going forward to optimize the utilization of our water disposal infrastructure, so some of the early results may be somewhat held back. But long term, performance is looking very good.

Turning to slide 11. D&C costs have continued their downward trend, even though our completion sizes have increased materially with Version 2.0 and 3.0 completions, which can add between $500,000 to $1.5 million to the cost of a well. For perspective, I recently compared this quarter to Q3 of 2015. And we were placing on average 25% more sand and 50% more water per well and drilling longer laterals for $145 less per foot than we were that Q3 of last year.

I’d also like to emphasize the range of well costs in the upper right corner, which shows lower Spraberry shale wells averaging $670 per foot and also highlight that we’ve delivered Wolfcamp A wells for an average of $5.8 million. The bigger graph of course only reflects Wolfcamp B wells, which also includes a growing population of what we refer to is as lower Wolfcamp B wells, which are typically slower drilling than the upper B targets. Bottom line, when coupled with the improved well performance, our capital efficiency continues to improve.

Moving to slide 12. This is the new slide, so I’ll spend a little time explaining it. The data comes from IHS and it captures new wells with at least three months of production data between September of 2015 in June of 2016. It’s important to point out that the data is not normalized for lateral length, which will be an important point here in a moment. And the Y-axis illustrates the number of new wells with at least three months of production, with the first production date after September of 2016. The X-axis is the average cumulative oil produced per well over a three-month period. So whenever you look at this, some key takeaways, no surprise, the scale of activity is significantly above that of our peers in the Midland Basin, with Pioneer putting on nearly twice as many wells as our nearest competitor.

So the next question is, at this high activity level, is there any dilution of inventory? However, in this case, you can see Pioneer is consistently delivering strong wells which highlights the quality of our acreage position. The fact that the data is not normalized further highlights the lateral length is important because it illustrates the contiguous nature of our acreage and our ability to consistently drill longer laterals. And then lastly, it demonstrates that our completion optimization efforts to continue to be successful.

Moving to slide 13. Just a few highlights here, some of which have already been covered. We are in the process of increasing to 15 rigs near term and will be at 17 rigs by year end. We remain on target to put 230 horizontal wells online with the mix of wells shown there. Version 2.0 completions remain the standard, with another 20 wells moved to Version 3.0 from the original 80. And we’re now forecasting 50% to 65% IRRs with Version 2.0 and 3.0 completions and late October strip pricing.

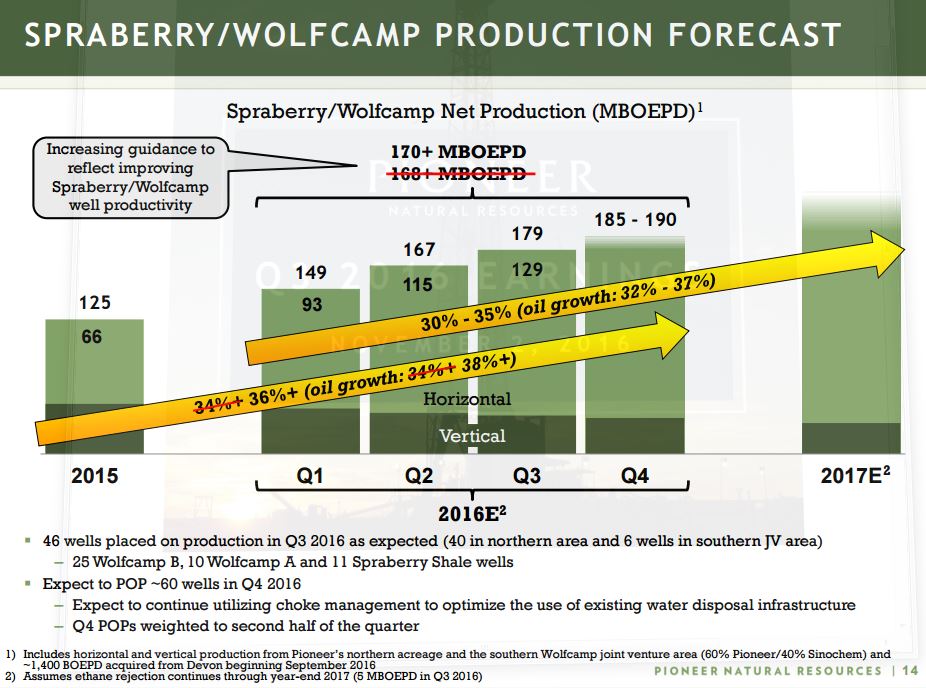

Moving to slide 14, and my last slide. Production growth remain strong, with production up to 179,000 barrels of oil equivalent per day in Q3. We are planning to put 60 new wells online in Q4, which will be weighted mostly late in the quarter, with production between 185,000 to 190,000 barrels of oil equivalent per day. This raises our year-end outlook in the Permian to 170,000-plus barrels of oil equivalent per day and 36% production and 38% oil growth over 2015.

The Pioneer Q3 slide deck is available here.

Scott Sheffield

Scott Sheffield has held the position of Chief Executive Officer for Pioneer since August 1997 and assumed the position of Chairman of the Board of Directors in August 1999. He was President from August 1997 to November 2004. Sheffield is a distinguished graduate of The University of Texas with a Bachelor of Science degree in Petroleum Engineering. He was the Chairman of the Board of Directors and Chief Executive Officer of Parker & Parsley, a predecessor of Pioneer, from January 1989 until Pioneer was formed in August 1997. Sheffield joined Parker & Parsley as a petroleum engineer in 1979, was promoted to Vice President – Engineering in September 1981, was elected President and a Director in April 1985, and became Parker & Parsley’s Chairman of the Board and Chief Executive Officer in January 1989.