It’s small when you compare it to the top ten largest U.S. refineries, most located on the Gulf coast, all having capacities between 300,000 barrels and half a million barrels per day, but a small Texas-based energy company has announced its intention to build a 50,000-barrels per day crude oil refinery in a well-selected location: in the heart of the Permian basin.

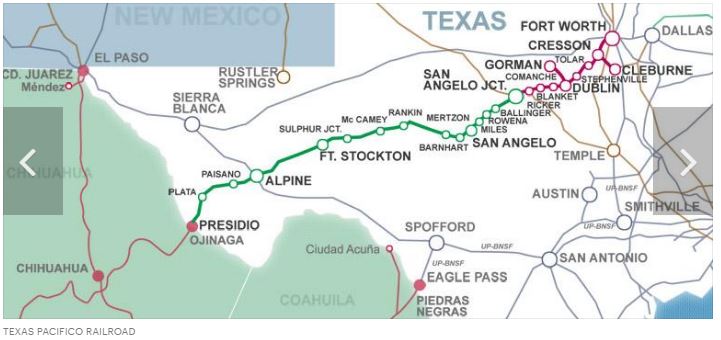

MMEX Resources Corporation (ticker: MMEX) said it will need $450 million to build the proposed refinery 20 miles northeast of Fort Stockton, Texas, near the Sulfur Junction spur of the Texas Pacifico Railroad. MMEX said the 250-acre facility intends to utilize its connection to existing railways to export diesel, gasoline, and jet fuels; liquefied petroleum gas; and crude oil to western Mexico and South America.

Why is this important?

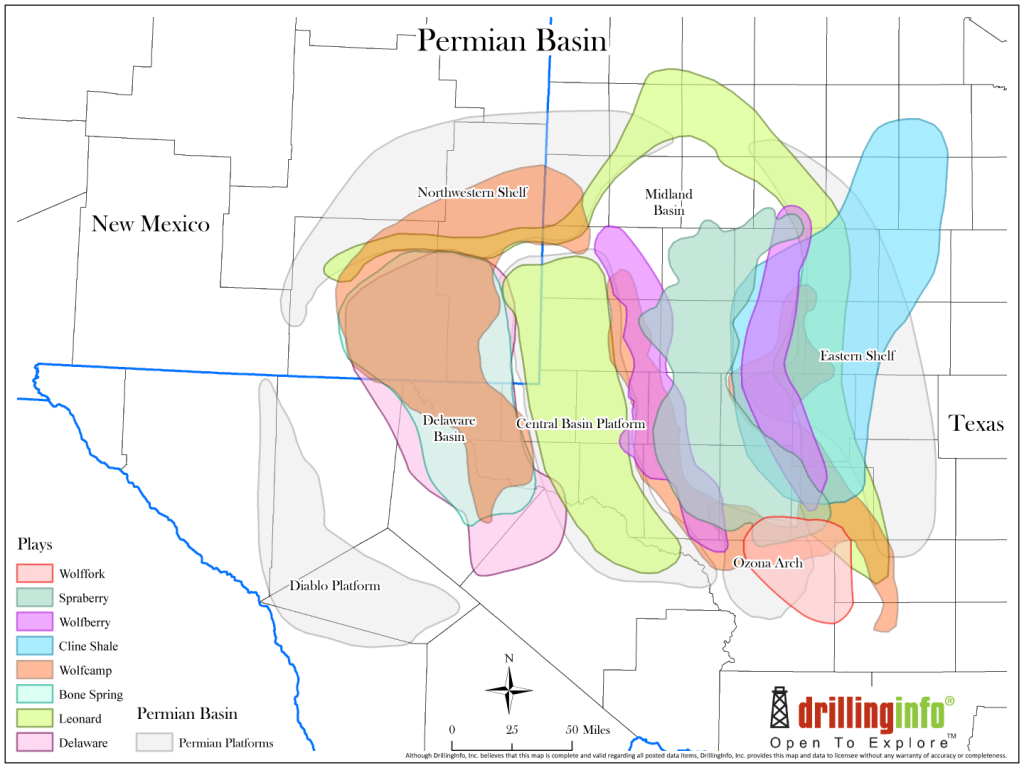

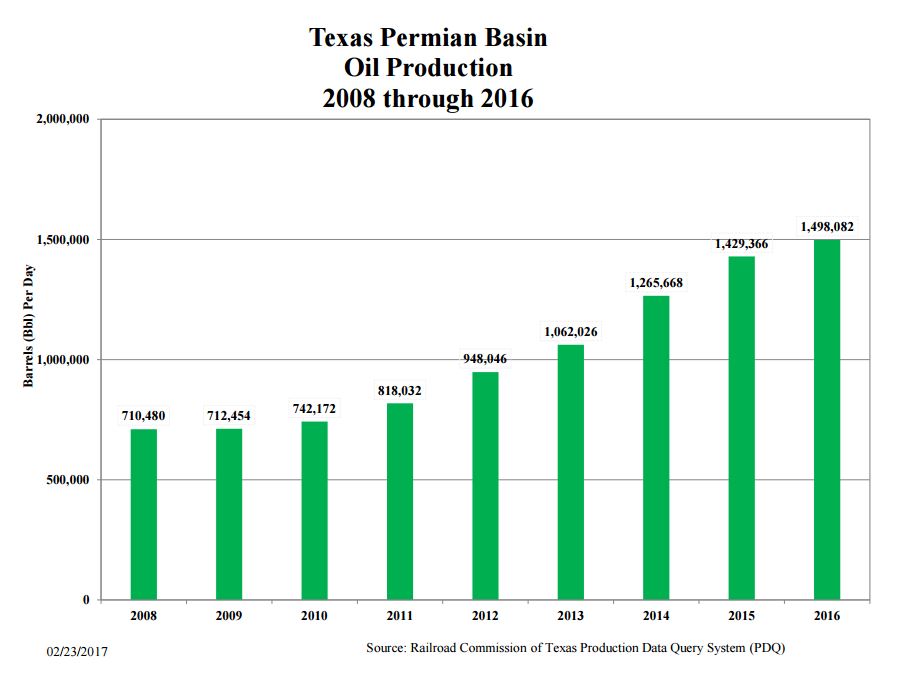

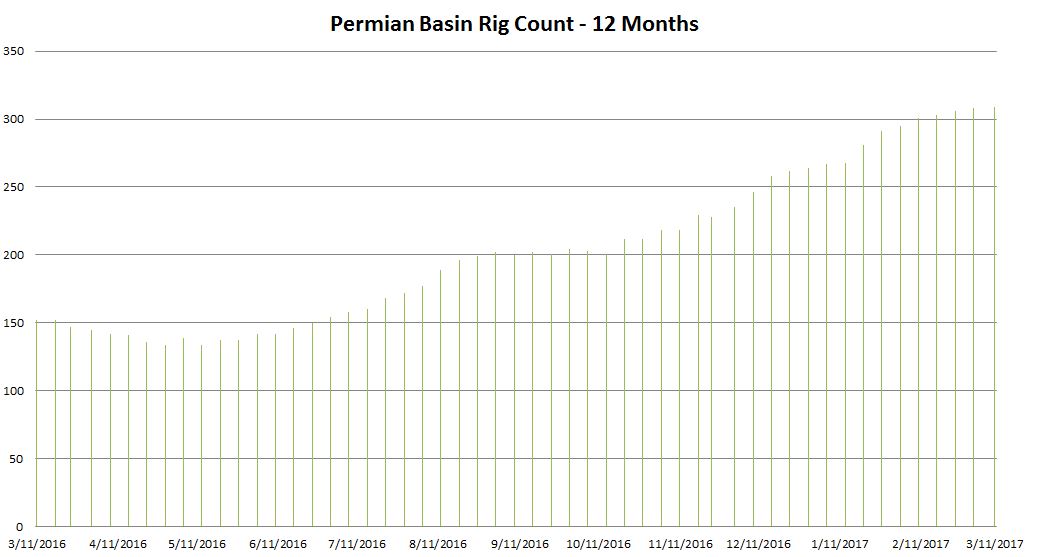

Because the Permian basin, and the Midland basin within it, are extremely fast growing oil plays in which many independent E&Ps can drill wells, produce oil economically at today’s commodities prices—or at least at last week’s oil prices. (Prices for West Texas Intermediate dipped below $49 this week after a larger than expected inventory build, following a consistent ride in the $50-$54 per barrel range in recent weeks.) But takeaway capacity is not keeping up with the Permian basin’s growing oil production.

Calling the Wolfcamp “the largest estimate of continuous oil that the USGS has ever assessed in the United States,” the USGS last fall pegged the Wolfcamp formation in the Midland basin at 20 billion barrels. E&Ps have cemented the reputation by making the Permian a favorite target of M&A and A&D activity. And rig counts have been growing fast.

MMEX Resources President & CEO Jack Hanks said, “The existing facilities and pipeline networks are largely unequipped to handle this growth and are limiting where products can be transported. By building a state-of-the-art refinery along the region’s existing railway infrastructure, we hope to bring a local and export market for crude oil and refined products.”

MMEX said it plans to surround the Pecos County refinery with an additional 250 acres of buffer property and leverage state-of-the-art emissions technologies to yield minimal environmental impact. It also expects to feature closed-in water and air-cooling systems, which will require very little local water resources.

The company anticipates the 18-month construction process will create approximately 400 jobs in the area during peak construction, as well as foster a significant number of indirect jobs and revenue for companies in catering, workforce housing, construction, equipment and other industries.

Once operational, the facility is expected to provide an estimated 100 permanent jobs and generate substantial tax revenue for Pecos County, the company said.

MMEX purchased the rights to the project from Maple Resources Corporation. Construction is slated to begin in early 2018, following the permitting process, and the facility is projected to begin operations in 2019.

MMEX is involved in oil, gas, refining and electric power projects in Texas, Peru, and other countries in Latin America. The company’s ability to build the proposed Permian refinery is subject to the receipt of required governmental permits and completion of required debt and equity financing, MMEX said.

Top 10 U.S. Refineries* Operable Capacity

(As of January 1, 2016)

Rank |

Corporation |

Company |

State |

Site |

Barrels per calendar day |

| 1 | Motiva Enterprises LLC | Motiva Enterprises LLC | Texas | Port Arthur | 603,000 |

| 2 | ExxonMobil Corp. | ExxonMobil Refining & Supply Co. | Texas | Baytown | 560,500 |

| 3 | Marathon Petroleum Corp. | Marathon Petroleum Co. LLC | Louisiana | Garyville | 539,000 |

| 4 | ExxonMobil Corp. | ExxonMobil Refining & Supply Co. | Louisiana | Baton Rouge | 502,500 |

| 5 | Marathon Petroleum Corp. | Marathon Petroleum Corp. | Texas | Galveston Bay | 459,000 |

| 6 | PDV America Inc. | Citgo Petroleum Corp. | Louisiana | Lake Charles | 427,800 |

| 7 | BP PLC | BP Products North America Inc. | Indiana | Whiting | 413,500 |

| 8 | ExxonMobil Corp. | ExxonMobil Refining & Supply Co. | Texas | Beaumont | 344,600 |

| 9 | WRB Refining LP | WRB Refining LP | Illinois | Wood River | 336,000 |

| 10 | Carlyle Group | Philadelphia Energy Solutions | Pennsylvania | Philadelphia | 335,000 |

*Only refineries with Atmospheric Crude Oil Distillation Capacity

Source: Refinery Capacity Report – EIA