U.S. Growth Will Lead the Global Economy

Export Development Canada’s (EDC) Assistant Chief Economist and Director of Economic and Political Intelligence Centre, Stuart Bergman, gave a presentation in Denver this morning on the state of the global economy. The bottom line: the recovery is real and it is taking place now.

Undaunted by the recent beat-down in his country’s oil patch, Mr. Bergman’s talk to a room full of Denver oil and gas executives was surprisingly optimistic, even as many in the industry were lamenting the price of WTI dipping at one point below $45 per barrel today. “Relax, it’s going to be okay,” Bergman told the crowd.

The Ontario-based economist said that despite the price of oil, the overall health of the world economy is noticeably improving. Mr. Bergman gave a presentation illustrating the upward trends led by strong economic growth in the United States. He outlined key indicators that signal an economic recovery is underway.

Oil Downturn Temporary

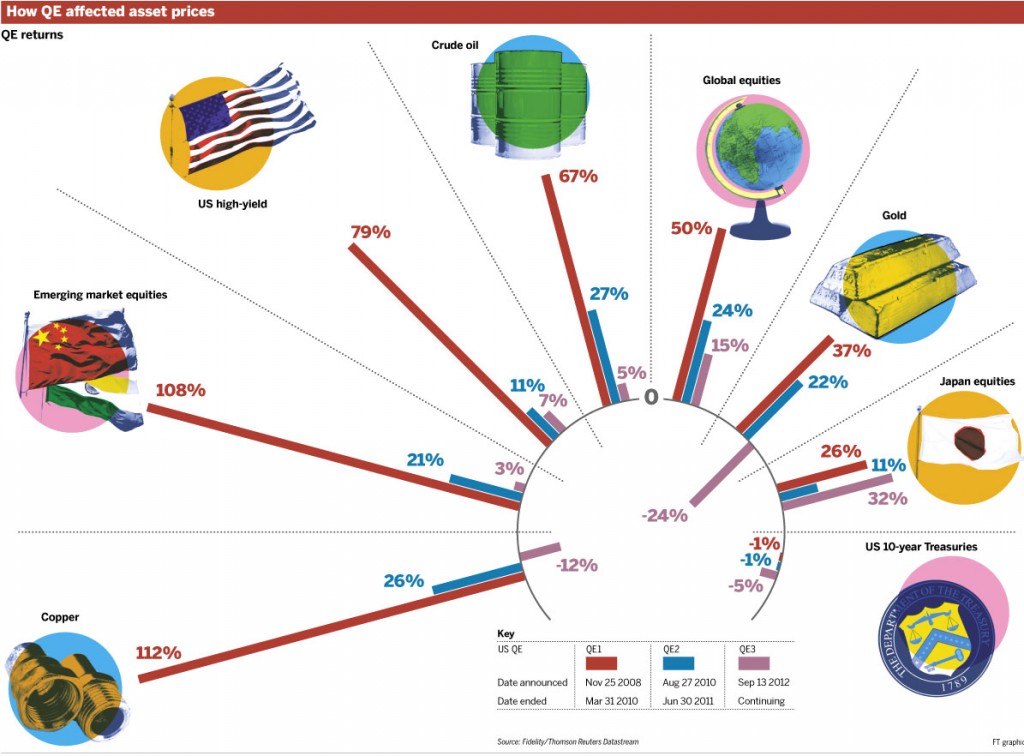

Bergman assured the crowd that the current downtrend that the oil industry is seeing is only temporary. In his group’s view, composite leading indicators (CLI) from the Organization for Economic Cooperation and Development (OECD), pent up demand in the U.S. housing market, increasing consumer confidence, the end of austerity in Europe, the unwinding of central bank monetary policies like quantitative easing (QE) and positive chatter about the economy in the financial sector are signs of an economy on the upswing.

Companies Sitting on Mounds of Cash

Bergman pointed out that companies “are still sitting on mounds of cash— six trillion dollars.” He said that money will start to go toward investment to increase capacity. “The U.S. spare manufacturing capacity is disappearing; U.S. industrial production is on a tear,” Bergman said. “When increasing demand bumps up against a lack of investment, it uses up spare capacity.” Bergman said not only the U.S., but Japan and Europe are starting to invest in rising capacity.

16 Years of Excess Inventory to Work Down

Bergman defined a basic recession as “working down of late cycle inventory.” He said the latest recession came after 16 years of unprecedented growth, leaving 16 years of excess inventory to work down. “You can’t hold an economy down forever; an economy is like a cork held underwater—its tendency is to rise.”

Housing Starts Point to Economic Growth

The OECD’s CLI index indicates stable growth in major countries like the U.S., Canada, China, France, Brazil and the Euro Area. Source: OECD

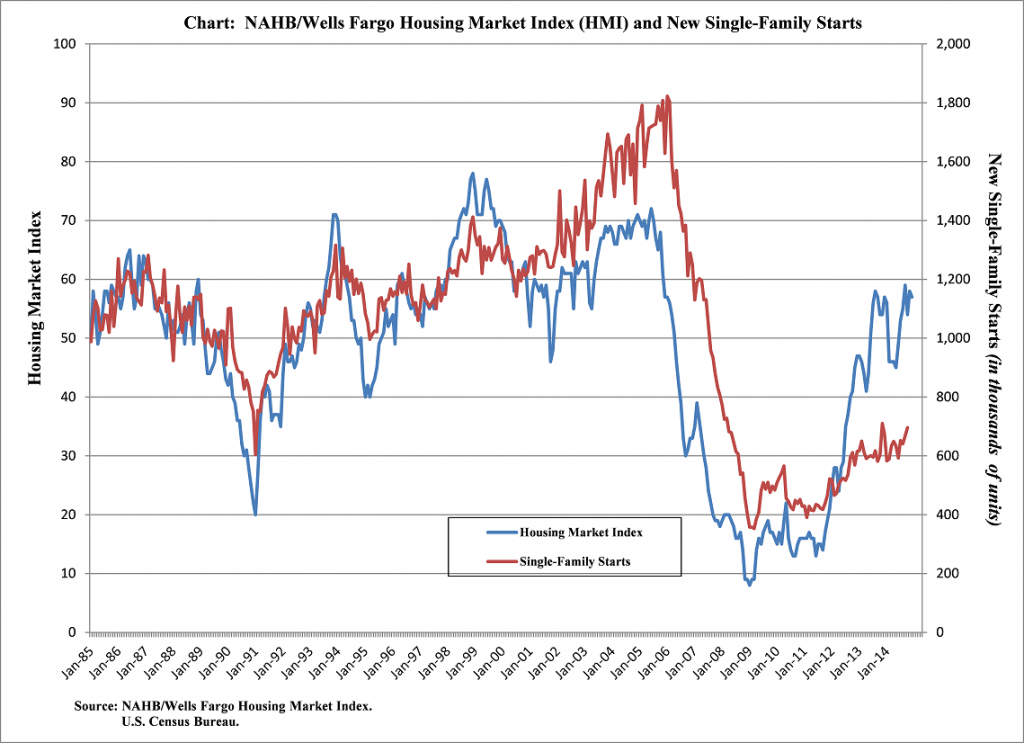

Bergman said the best measure of real growth is the U.S. housing market, which has seen a 40% increase in housing starts. “Housing drives demand: people need stuff to put in their houses; more manufacturing is required which leads to jobs, which leads to more hiring, which leads to more people with money in their hands.” Bergman pointed out that during the recession housing starts sank to levels below the number needed to service baseline population growth, but that’s no longer the case.

Bergman said the U.S. housing market has recovered back to the number of houses built per annum at 1.3 million, meeting the approximate growth in population per annum. “The inventories that were built up at the housing market’s peak before the 2008 crash have been worked off, allowing the industry to grow again.” Bergman said this trend would hold true for most sectors of the economy, but that the picture painted by the U.S. housing market was especially telling.

Cash is King

When you go into a downturn, the “Cash is King” mentality sets in, Bergman said. “After the 2008 financial crisis hit, businesses started hoarding cash, tearing up contracts they worked hard to get and laying off people they wanted working for them in order to protect their cash.” Bergman said companies were sitting on $9 trillion in cash with nowhere to invest it. “CEOs told CFOs our shareholders want to see yield.” So companies began putting their cash into riskier investments in order to generate any visible return, but at increasing levels of risk—carry trade, the stock market, commodities, risky emerging market paper. But now that money is starting to move back. “Business and governments are going to have to invest,” Bergman said.

Mr. Bergman said that EDC upgraded its U.S. GDP forecast to 3.6%. The unwinding of monetary policies like QE, which essentially took money for growth off the table, will allow economies to grow moving forward. All of that, combined with “chatter” in the financial sector, has led Mr. Bergman and EDC to champion an optimistic outlook for the health of the world economy moving forward. The chatter is evidenced in part by the latest Gallup poll, in which 50% of Americans believe the economy is on the rise – the highest number since the start of The Great Recession.

Downside Risks in the Forecast

Bergman said the downside risks include (1) heightened geopolitical risk, (2) unwinding QE and (3) geographic risk differentiation. “Brazil is struggling, India has infrastructure risk, Russia is obvious, Indonesia is a concern, and China is highly leveraged,” Bergman said. “Any growth in China GDP above 5% is going to be debt-fueled,” Bergman said, “which I believe is unsustainable. The shine is coming off the halo of the emerging markets.”

What’s the Bottom for Oil?

Although Mr. Bergman lacked the crystal ball everyone hoped he might have had to predict where the floor for oil prices might be, he did think that it would be set by the Saudis. “We have a ceiling because of shale, and now we’re finding the floor with the Saudis,” he said.

Good News for the Economy Ahead

“The return of momentum to U.S. growth will lead Europe and the rest of the world. We really do see things turning around led by a strong U.S. economy,” Bergman repeated. “The next two years will be extremely exciting and rewarding for those companies who invest in opportunities for growth,” Bergman said in closing.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.