United States refineries are running at utilization rates well above 90%, but don’t count them as part of the oil and gas industry being squeezed in the current commodity market. The Energy Information Administration (EIA) still expects domestic production to increase in 2015 (albeit, at slightly lower numbers than before), and refiners are prepared to take advantage of margins that have suddenly swung in their favor.

Many E&Ps reported lower than expected earnings in Q3’14 – the first hard effects of dropping oil prices. ExxonMobil (ticker: XOM) and Chevron (ticker: CVX) were not part of that group – both operated at a quarterly profit, largely in part to financial success from their respective refinery divisions.

Bloomberg reported in November that XOM refineries ran a profit of $12 million per day in Q3’14 (73% higher than Q3’13) and CVX tripled profits in its downstream division. John Auers, Vice President of Turner Mason & Co., says products like asphalt are shielded from oil price swings, allowing refineries to capitalize on oil costs that have halved since July. Valero (ticker: VLO) plans on increasing its shareholder returns in 2015 while maintaining its capital expenditure level.

“Their refineries provide a counterweight to lower crude-oil prices,” Stephen Hoedt, Senior Research Analyst for Key Private Bank, said to Bloomberg.

No Rest for Refineries

Similar to the shale boom, refineries are also burning both ends of the candle to keep pace with the market. The EIA reported in the summer that refineries were running at all-time highs, with the Midwest PADD actually exceeding capacity at 100.3% utilization (made possible by lower than expected outage times).

The five U.S. PADDs operated at 93.9% capacity in the latest Petroleum Balance Sheet Report. The Gulf Coast PADD III led the group at 95.9% utilization while receiving crude inputs of 8.6 MMBOPD – more than half of the country’s operable capacity. Domestic production continues to increase, leading to a greater surplus in the market. Gasoline futures dropped below $1.50 per gallon in the EIA’s latest Weekly Petroleum Report. Prices in the Midwest and Gulf Coast regions averaged below $2.00 per gallon for the first time since 2009. Gasoline stocks are currently exceeding the previous five-year range.

Lower Prices = More Driving?

Some believe Americans may choose to drive more amid the lower prices, but the EIA has shown such prices generally do not influence the public. “Gasoline is a relatively inelastic product, meaning changes in prices have little influence on demand,” the Administration said in December. “The price elasticity of motor gasoline is currently estimated to be in the range of -0.02 to -0.04 in the short term, meaning it takes a 25% to 50% decrease in the price of gasoline to raise automobile travel 1%.”

It’s a good possibility the inelasticity of gasoline is the same as electricity or heat; it is generally a necessity, and consumers will pay for it regardless of the price.

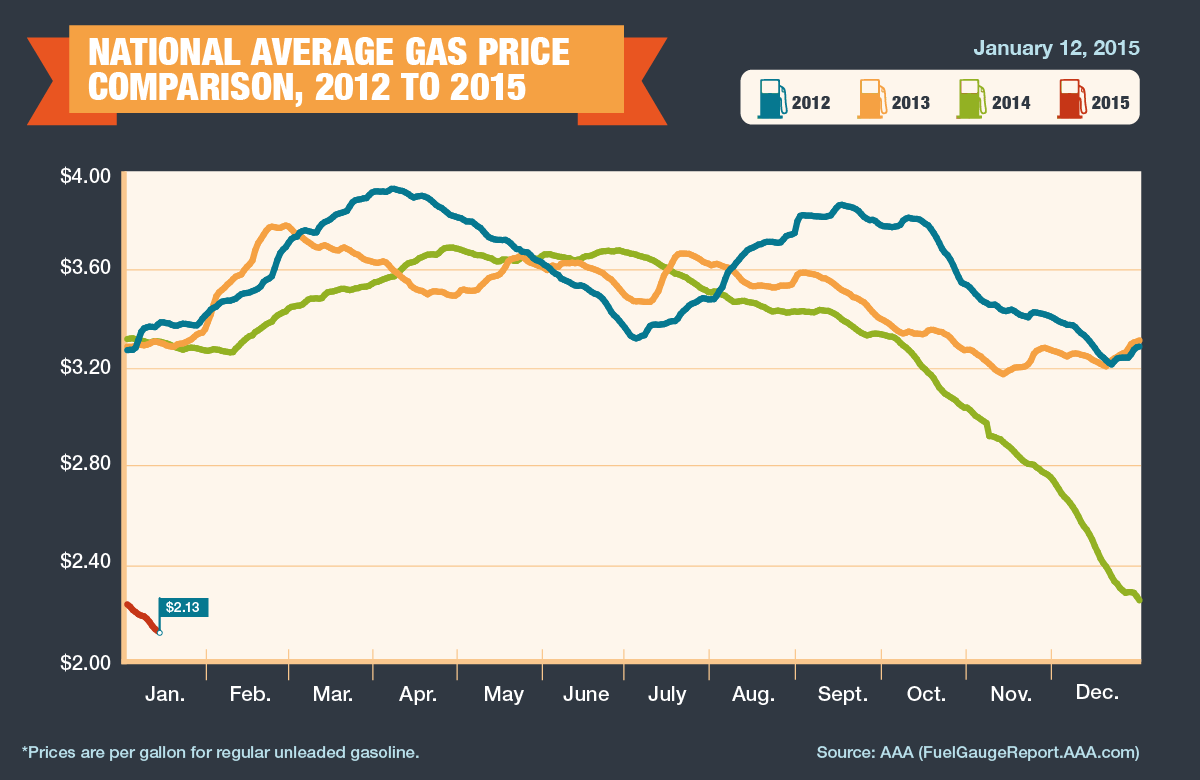

The EIA reports Americans used an average of 371 million gallons of gasoline per day in 2013, amounting to about 135 billion gallons for the entire year. By comparison, there were approximately 317 million Americans in 2013. On average, the typical American used 427 gallons. According to AAA, the average gas price in 2014 was approximately $3.34/gallon. If the average price hovers around the $2.00 mark for the majority of 2015, American consumers are looking at saving several hundred dollars per person. This is after AAA reported year-over-year consumer savings of $14 billion in 2014.

At today’s prices, you could drive your Chevrolet Silverado from Los Angeles to Las Vegas for less than $50. Those Ohio State fans who made the last second trip to Dallas can return to Columbus in the same vehicle for less than $140 – a can’t miss deal if you split it five ways between college students.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.