Lower crude prices and higher demand for gasoline driving higher margins

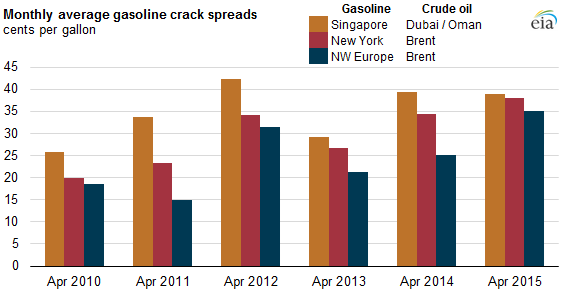

Gasoline crack spreads in the United States, especially on the U.S. East Coast, have reached several-year highs in recent months. A recent note from the Energy Information Administration (EIA), looked at crack spreads in order to get an idea of refiner profitability.

In April 2015, wholesale conventional gasoline in New York Harbor averaged $1.79 per gallon, and the Brent crude oil spot price averaged $1.41/gal ($59.39 per barrel, divided by 42 gallons per barrel). The difference in prices results in a crack spread of $0.38/gal, the highest crack spread for the month of April since 2007.

The refining industry in other parts of the world is also seeing increased refining margins. In the European gasoline market, the Northwest Europe gasoline market, the Northwest Europe gasoline-Brent crack spread averaged $0.35/gal in April, the highest since at least April 2010. In Asia, the Singapore gasoline-Dubai/Oman crack spread averaged $0.39/gal in April, similar to levels last year and $0.03/gal below the recent high in April 2012.

According to the EIA, the driving factors behind the increased global refining margins are low crude oil prices, robust U.S. gasoline consumption and exports, and higher-than-expected demand for liquid fuels in Europe and some countries outside the Organization for Economic Cooperation and Development (OECD).

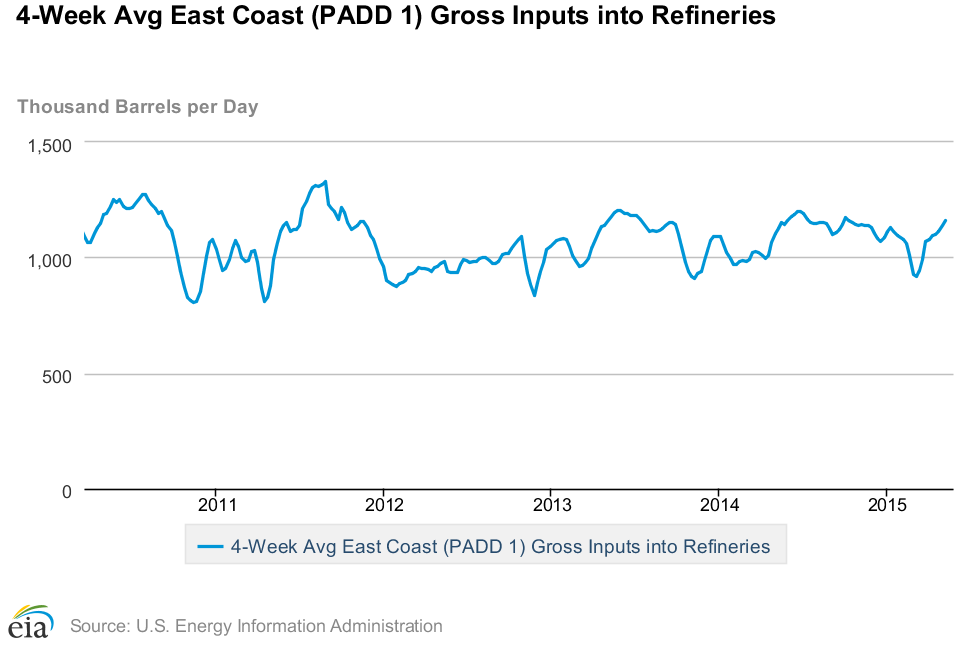

Refiners in many regions of the world have been processing larger volumes of crude oil to take advantage of these higher gasoline crack spreads. On the U.S. East Coast, average gross inputs to refineries in April were the most for that month of the year since 2010.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.