Resolute Energy sold off midstream assets for a $50 million payment and up to $60 million in earn-out payments

Resolute Energy Corporation (ticker: REN) announced an agreement to sell certain Permian Basin midstream assets for roughly $110 million. The purchaser — an undisclosed Permian Basin midstream company – entered into a series of agreements with Resolute and an existing minority interest holder to purchase the gas gathering and water handling systems currently operated by Resolute in its Appaloosa and Mustang project areas in Reeves County, Texas. The consideration for the deal is comprised of a $50 million payment for the assets currently in place and up to $60 million in earn-out payments tied to field drilling activity through 2020 that will deliver gas and produced water into the system, according to the press release.

Resolute will receive $32.85 million of the initial payment while the company’s partner in the Mustang area will receive the balance of $17.15 million. In addition, Resolute will receive an initial payment of $2.3 million in earn-out payments for wells previously completed as part of its 2016 program.

The proceeds from the sale will be used to pay down debt initially and to fund development activity in the company’s properties in the Delaware Basin in west Texas. A note from Wells Fargo Securities today said the deal “provides much needed … liquidity to REN which had just $2.9M of cash and $105M in undrawn revolver capacity as of Q1’16.”

The earn-out payments will be based on the completed lateral lengths of wells and the year in which a well is spud, according to Resolute. Payments are available through 2020, with a ceiling of $60 million. The payments for Appaloosa area wells will be paid 100% to REN, while payments for Mustang area wells will be split 60/40 between Resolute and its partner, respectively.

The purchaser has also agreed to expand the gathering system in a manner to accommodate all current and future volumes of gas and water produced by Resolute and its partner in the Appaloosa and Mustang areas. REN and its partner have agreed to dedicate and deliver all gas and water produced from their acreage within the two areas to the purchaser for gathering, compression and disposal for the next 15 years. The press release also said “the parties anticipate that the purchaser will also provide gas processing services to Resolute and its partner in the future,” as well.

Updated well results, increased EURs by more than 50%

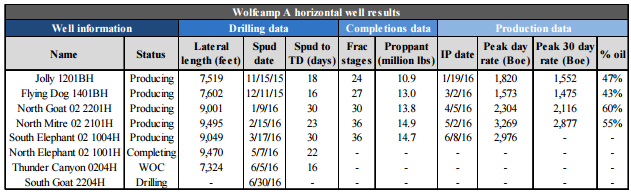

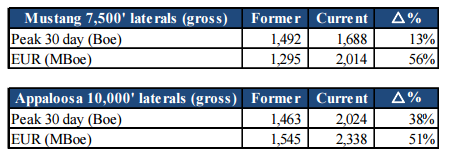

Also included in today’s press release was an operational update for Resolute’s Permian wells. The company’s first Appaloosa area well established a peak 30-day production rate of 2.1 MBOEPD (60% oil), while the company’s fourth well, a 10,000 foot Wolfcamp A lateral, has established a current peak day rate of 3.3 MBOEPD and a current peak 30-day production rate of 2.9 MBOEPD (55% oil). REN’s most recently completed well has shown a peak day rate of 3.0 MBOEPD (57% oil). The well has not established a peak 30-day production rate yet, the company said.

The company continues to drill wells under AFE as well, according to the press release. The two Mustang 7,500 foot laterals were brought in at an average of $8.6 million, or $1 million (12%) under AFE, and the three Appaloosa 10,000 foot laterals were brought in at an average of $9.6 million, or $2.2 million (18%) under AFE.

“We continue to see cost improvement in our drilling and completions operations and are now targeting drill and complete costs of $8.2 to $8.5 million for 7,500 foot lateral and $8.8 to $9.2 million for a 10,000 foot lateral,” REN said in the press release.

The improved well results and costs mean the company is able to generate PV10 values over $10 million per well with “current economic inputs” on its 10,000 foot laterals. Because of the strong economics of the wells, the company said it may drill additional wells this year.

Previously, Resolute’s plan was to drill nine wells in 2016. It expects the ninth well to reach TD by August at the current drilling pace. If that does prove to be the case, “the rig that (Resolute has) used this year will remain active for (the company) through the remainder of 2016,” the company said in its release.

The well results mean the company will exit second quarter with production of approximately 15.4 MBOEPD, exceeding its prior production record of 14.9 MBOEPD despite selling roughly $275 million of properties during 2015.

Resolute has approximately 22,420 gross (12,940 net) acres under lease in Reeves County, approximately 65% of which is held by production. Working interests average 60% and range from 3% to 100%.

In addition to its Wolfcamp A locations, Resolute believes that the Wolfcamp B and other formations are also productive. Making baseline assumptions about spacing and formation productivity, REN estimates that the company has an inventory of approximately 255 gross Wolfcamp A and Wolfcamp B locations to drill in Reeves County.