Improved Liquidity, Lower Operating Costs Stand Out in Q3’15 Results

The challenges presented to the 2015 oil and gas industry are undeniable. Resolute Energy (ticker: REN) and its management have adopted various measures to cope with the new commodity environment, and the company has progressed on those initiatives to date.

“We entered 2015, not unlike many of our peers, facing significant challenges,” said Nicholas Sutton, Chief Executive Officer of Resolute Energy, in the company’s Q3’15 results. “We have met these challenges and enter the fourth quarter in a much stronger position.”

Resolute Bullet Points

Resolute Bullet Points

An overview of Resolute’s development through the commodity downturn is described below.

Added Liquidity: Resolute’s long term debt as of September 30, 2015 is actually lower than it was at year-end 2014, aided by asset sales and significant decreases in operating expenditures. The company, pending the closing of its Hilight Field sale, will have raised approximately $100 million on the year by divesting non-core properties. Management says it will have reduced borrowings by $150 million once the sale is finalized.

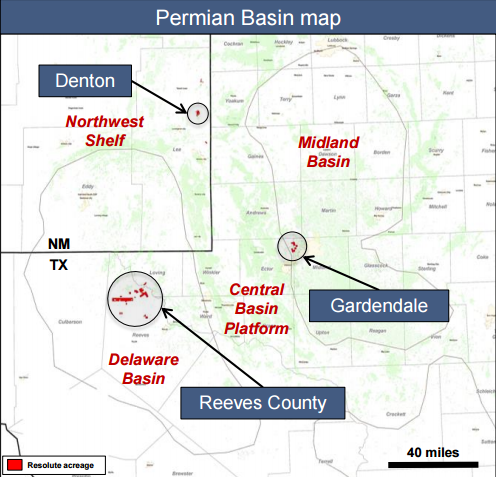

The Gardendale assets in the Midland Basin are also being marketed on a limited basis. Callon Petroleum (ticker: CPE) acknowledged its interest in the properties last month. Capital One Securities says the acreage holds many legacy vertical wells and horizontal development to date is minimal. Three horizontals targeting the Wolfcamp B formation delivered average 30-day rates of 536 BOEPD, and the play holds potential for stacked pay. A note from Johnson Rice & Co. believes the properties could fetch anywhere from $125 to $175 million, if Resolute decides a divesture is within its best interests.

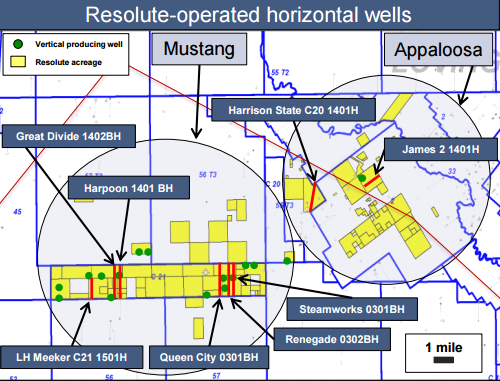

The Drilling Program is Up and Running: Citing the liquidity improvements listed above, REN management is investing in growth by approving a four-well horizontal program (average working interest of 55%) in its Delaware Basin asset. All four wells will target the Wolfcamp B formation in Reeves County, with the first planned to be spud in mid-November.

The Drilling Program is Up and Running: Citing the liquidity improvements listed above, REN management is investing in growth by approving a four-well horizontal program (average working interest of 55%) in its Delaware Basin asset. All four wells will target the Wolfcamp B formation in Reeves County, with the first planned to be spud in mid-November.

The first two wells, located in the Mustang area, will be each be drilled to 7,500 feet, cost $9.6 million, and yield estimated ultimate recoveries of 1,000 MBOE. REN believes the wells can generate an internal rate of return of 22%, based on the project economics in its October 2015 presentation. The next two wells on the development program will be drilled to 10,000 feet at its Appaloosa project.

Maintaining Production … : Volumes for Q3’15 were 12,439 BOEPD, just 2% below volumes from Q3’14. However, Resolute has incurred only $37.5 million in oil and gas capital expenditures for the first nine months of 2015. That is only 29% of the $12.6 million incurred in the first nine months of 2014. The company remains on track to deliver flat production on a year-over-year basis while funding capital expenditures through its internally generated cash flow.

… While Lowering Operating Costs: Lease operating expenses of $17.75/BOE are 27% lower on a year-over-year basis, and the improvements were recognized by the lenders. In Resolute’s call from the previous quarter in Q2’15, management expected the borrowing base redetermination to be positive based on the sole fact that they “had run so much cost out of our system.” Ultimately, the borrowing base was reduced by only $15 million to reflect the $55 million sale of the Hilight Field in the Powder River Basin.

… While Lowering Operating Costs: Lease operating expenses of $17.75/BOE are 27% lower on a year-over-year basis, and the improvements were recognized by the lenders. In Resolute’s call from the previous quarter in Q2’15, management expected the borrowing base redetermination to be positive based on the sole fact that they “had run so much cost out of our system.” Ultimately, the borrowing base was reduced by only $15 million to reflect the $55 million sale of the Hilight Field in the Powder River Basin.

Resolute Leaning on Aneth Field as Sun Sets on 2015

Resolute did not rule out the potential for joint ventures on its existing acreage, and added its infrastructure may also be available for the right price. The consistent production volumes are noteworthy, considering the lowered investment levels. In a note covering the release, Johnson Rice & Co. said, “Despite a sharply constrained capital budget, Resolute’s production levels in both the Permian Basin and at the Aneth field have remained relatively robust, with lower than expected sequential natural declines.”

“Permian” is one the industry’s favorite words among geologists, analysts and investors alike, but Resolute’s Aneth Field continues to support the company’s asset base. Production has declined only 2% compared to Q3’14 despite “minimal” investment and continues to make up about half of REN’s output. The Field holds 54.2 MMBOE of proved reserves and is recognized by REN management as a low-maintenance, reliable source of cash flow. The play has an annual base decline of just 7% and is cash flow positive in the current commodity environment.