Horseshoe-1: massive Alaska North Slope oil discovery

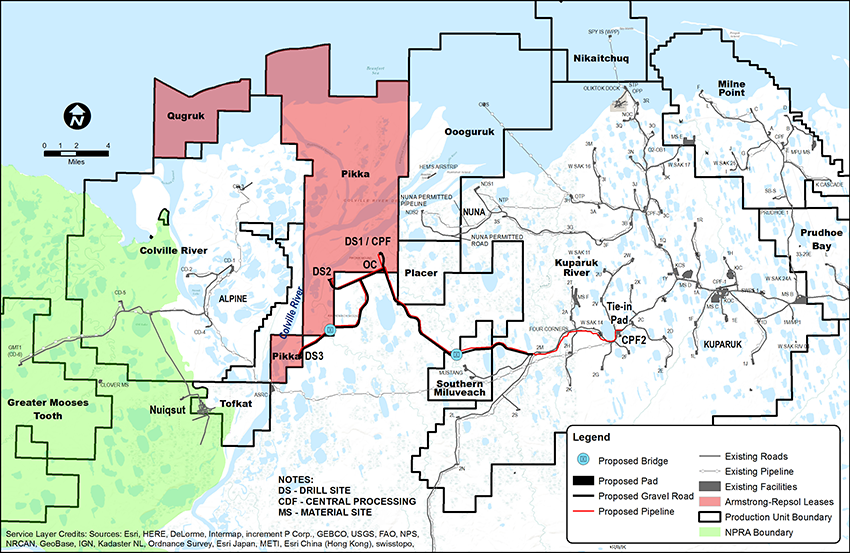

Repsol (ticker: REP) and privately held Denver based Armstrong Energy LLC announced today the discovery of a massive oil field in Alaska, with an estimated 1.2 billion barrels of oil recoverable. This is the largest U.S. onshore conventional hydrocarbons discovery in the last 30 years, Repsol said in a press release.

Drilled during the 2016-2017 winter campaign, the Horseshoe-1 discovery well encountered more than 150 feet of net pay in several reservoir zones in the Nanushuk section. A sidetrack, Horseshoe-1A, also encountered more than 100 feet of net pay.

Repsol and Armstrong Energy

Repsol has been active in Alaska since 2008 and has made several discoveries in the North Slope with its partner Armstrong Energy.

- Multiple exploratory wells have been successful in the Pikka area, where the company has drilled 13 wells.

- Armstrong is the operator of both the Pikka unit and the Horseshoe discovery, holding 51% and 75%, respectively.

- The Horseshoe discovery extends the Nanushuk play more than 20 miles south of the existing discoveries achieved by Repsol and Armstrong in the same interval within the Pikka Unit.

- Repsol and Armstrong are currently planning to develop the Pikka area, and have submitted permits to develop the play. Preliminary plans for Pikka anticipate first production there from 2021, with a potential rate approaching 120,000 barrels of oil per day.

Last August at EnerCom’s The Oil & Gas Conference in Denver, Bill Armstrong, President and CEO of Armstrong Energy, made a presentation to a packed room of institutional investors and oil and gas company executives about his company’s operations in Alaska. Oil & Gas 360 covered Armstrong’s talk in a story entitled “What Does Your Dream Field Look Like? Armstrong Oil & Gas Believes You Might Find it in Alaska.” The story, which gives further background on the Pikka area, is republished below.

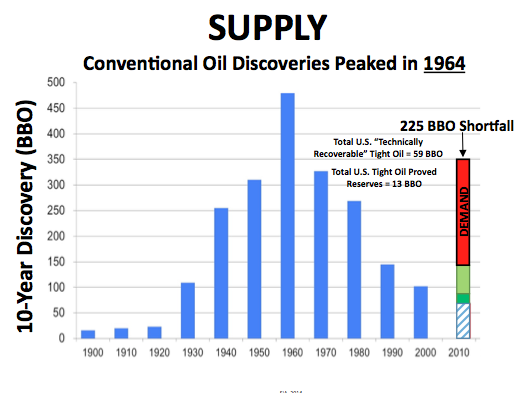

Demand could outpace supply by 225 billion barrels by the end of this decade

“You all have been steeping in unconventionals. It truly has been a revolution, but I want to provide something different for you today,” Bill Armstrong, president and CEO of Armstrong Oil & Gas, said to the audience at EnerCom’s The Oil & Gas Conference Monday in Denver, Colorado.

Providing some context for the audience, Armstrong put up a chart showing the 93 MMBOPD of oil produced by conventional production compared to the 4 MMBOPD that comes from unconventional production each day.

“We’re living off the inventory found in the ’50s, ’60s, and 70s,” said Armstrong. By the end of this decade, production from those sources will not be enough to match demand, even if you include technically recoverable tight oil, he said. “That’s not the oil that’s economic to produce, that’s all of the technically recoverable tight oil out there. We’re going to fall 225 billion barrels short of demand by the end of this decade, even considering that technically recoverable oil.”

The “dream field” may be in Alaska

To help meet the growing demand Armstrong sees coming later this decade, his company is exploring Alaska’s North Slope.

Armstrong’s Alaskan acreage was purchased jointly with Repsol on the North Slope and comprises 750,000 acres. In the Pikka unit the peak oil production is expected to be 120 MBOPD. The reported probable contingent reserve holding is estimated at 1.4 billion barrels of oil.

“Let me ask you,”Armstrong said to the audience, “what does your dream field look like? It’s probably in the U.S., it’s onshore, oil-weighted, high resource concentration, material in size, great porosity, great permeability, it has big individual wells, and it has robust economics… Well, we have all of that.”

The mean field size in Alaska is 590 million barrels of oil, with mean well sizes of 5 million barrels of oil, and the state is relatively unexplored, said Armstrong.

Sharing a bit of West Texas oil field wisdom, Armstrong shared the saying “the best place to find oil is under the oil tree,” which he explained really meant the best place to look was where oil had already been discovered.

“This is why people are moving to SCOOP and STACK and the Delaware Basin, but Alaska has two of the five largest oil fields in the country, plus five more of the top 50 fields, all on the North Slope. So we’ve decided to look there instead.”

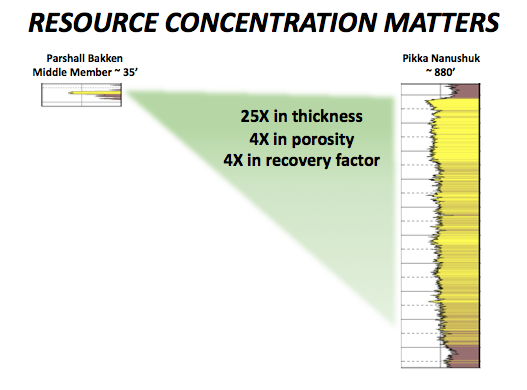

Comparing the Pikka’s 880 feet of pay to the Parshall Bakken, Armstrong pointed out that not only was the pay 25-times thicker, the porosity was four-times better, as was the recovery factor. Also adding to the attractiveness to the wells, most are less than 8,000 feet deep, and require limited stimulation, Armstrong said.

“A lot of guys have made a lot of money in the Bakken, but to have the equivalent kind of production from one of our wells, they would need to drill a well every month for 50 months,” Armstrong said.

Assuming no delays, Armstrong expects Pikka oil to start flowing in 2021.