With shale production booming, why does the U.S. still import oil?

It’s a common question. The U.S. shale boom has had a profound effect on the U.S. energy industry, on world energy markets and on geopolitics—in little more than a decade.

It’s true that growing oil production from tight formations and shale beds has changed things in the U.S. Not only has shale production decreased the need for the U.S. to import as much oil as it historically has, but it has changed the type of oil that is being imported into the country.

Juggernaut global energy customer: as the world’s leading user of gasoline, the U.S. has imported more than 91 billion barrels of crude oil—that’s billion with a ‘b’

The EIA has carefully tracked crude oil imports since 1986, recording volumes, grade, country of origin and destination.

In total, U.S. crude imports from 1986 to 2016—30 years of recording every incoming oil delivery—amount to just under 244,000 separate records representing tanker cargoes from abroad, pipeline shipments from Canada and other deliveries of crude oil—both large and small.

The takeaway is this: during the last thirty years the U.S. has imported over 91 billion barrels of crude oil from the rest of the world.

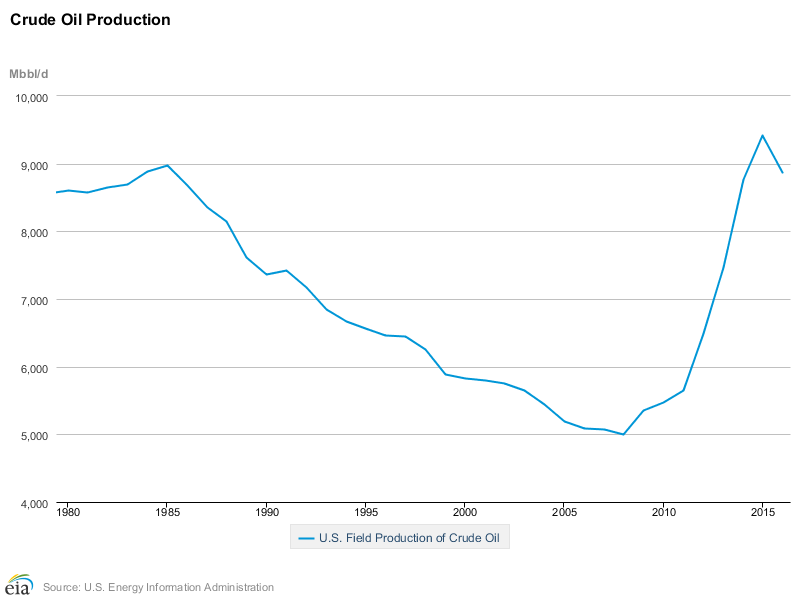

But U.S. production of oil has grown sharply in recent years, from a bottom of 5,000,000 barrels per day in 2008 to an average of 8,875.000 million barrels per day in 2016. This growth, more than 75% in eight years, has almost entirely been fueled by production from formations like the Bakken, Permian and Eagle Ford. These shale formations produce almost exclusively light sweet oil, which has filled U.S. markets.

Couple of decades ago: refineries panicked – shifted their massive infrastructure to refine heavy crude

U.S. refineries are in large part set up to handle heavy, sour crude. Here’s why: before the shale boom U.S. production was declining steadily, and because of the fact that oil fields have a natural decline curve for production, no one had any expectation that there would be a reversal (‘Peak Oil’ theory).

It appeared that the U.S would be reliant on imported crude, so refineries made large investments to improve heavy oil processing capabilities. Heavy oil requires much more extensive processing than light oil, and often sells for less than light, sweet oil. On the other hand, extensively processed heavy oil can yield more gasoline per barrel than less-processed light oil. And gasoline to power the millions of vehicles on U.S. highways was the name of the game.

Imports down 22%, type of imported oil flipping too

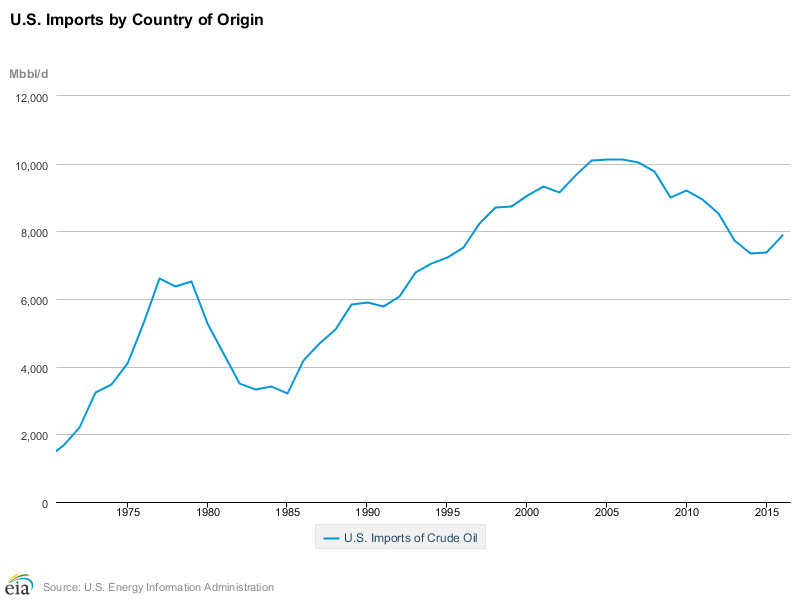

Levels of U.S. imports have significantly changed in recent years, as U.S. oil production displaces foreign oil. Total imports have dropped from a peak of 10.126 million barrels per day in 2011 to 7.877 million barrels in 2016. That’s a whopping decrease of 22% in just 5 years.

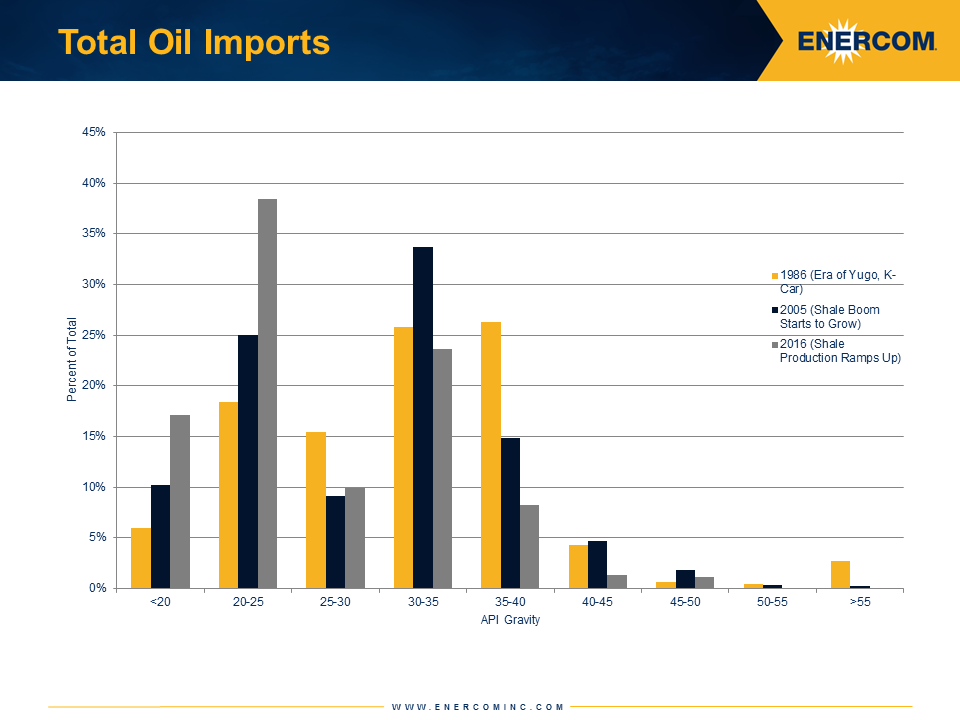

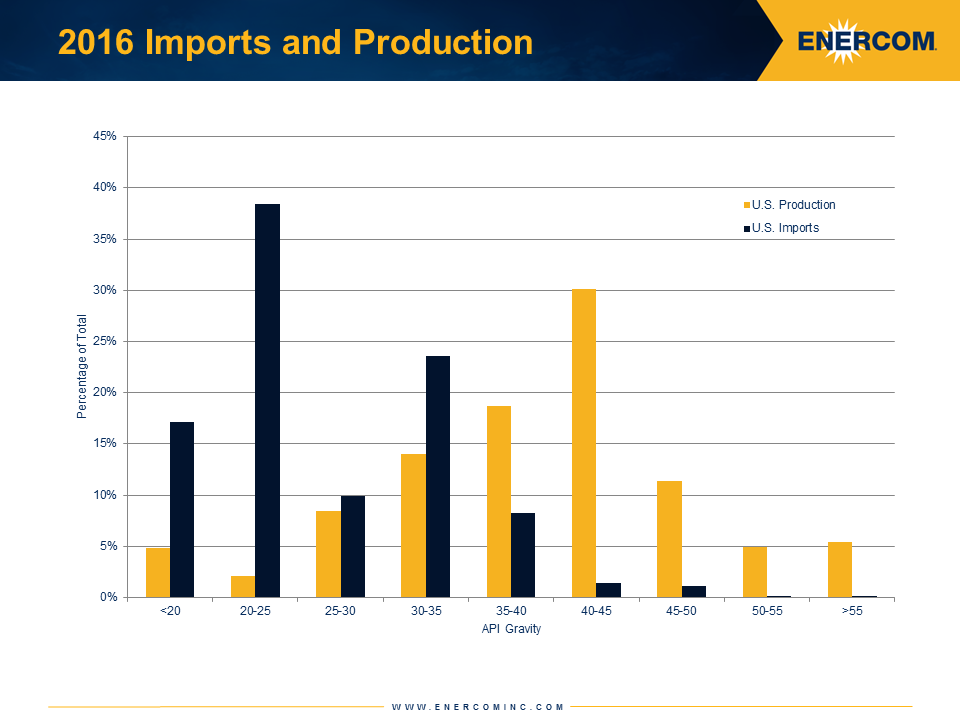

Beyond the decrease in volume of imported oil, the type of oil being imported has changed. Oil with an API gravity lower than 25 is often defined as “heavy oil,” while oil between 25 and 35 is “medium” and oil with an API gravity above 35 it typically called “light oil.”

Happy Hitchhikers: a ‘two for one’ sale allowed everybody to garage a second Yugo for parts to keep the first one on the road.

In 1986 (gold columns), the first year the EIA carefully tracked imported crude, the U.S. imported 371.9 million barrels of heavy oil, or just under one quarter of the total for that year. Medium oil accounted for about 41% of 1986 imports, while light oil made up the remaining 34%. Overall, the U.S. imported a broad range of crude in 1986, 1.525 billion barrels in total.

2005 (dark blue columns) presents a good snapshot of the U.S. before the shale boom began to take off. Imports had shifted somewhat, showing a slight preference for heavy oil as a result of the changed refinery crude slate. Absolute volumes of imports are much higher, at 3.874 billion barrels. Proportions are the mirror image of 1986, with heavy crude oil accounting for 35% of imports, 43% medium crude and 22% light oil.

Heavy oil now dominates imports

2016 (gray columns) presents a very different landscape. Oil production was hampered by the downturn, but at 8,875 MBOPD production still exceeded 2005 levels by nearly 3,700 MBOPD. Crude imports totaled 2.883 billion barrels, down more than 25% from 2005. Heavy oil dominates imports, making up 55.6% of import volumes. Medium oil has fallen to about one-third of imports, while light oil accounts for less than 11% of volumes.

The U.S. production spread was very different from the import spread last year. Oil lighter than 35° API makes up more than 70% of all U.S. production. 23% of all produce oil was of medium grade, while heavy oil accounted for only 7% of production.

In the current environment only California and the Gulf of Mexico produce meaningful amounts of heavy oil. Shale production hotbeds like Texas, North Dakota, Oklahoma and Colorado produce almost exclusively light sweet oil.

Average grade changed quickly since 2010

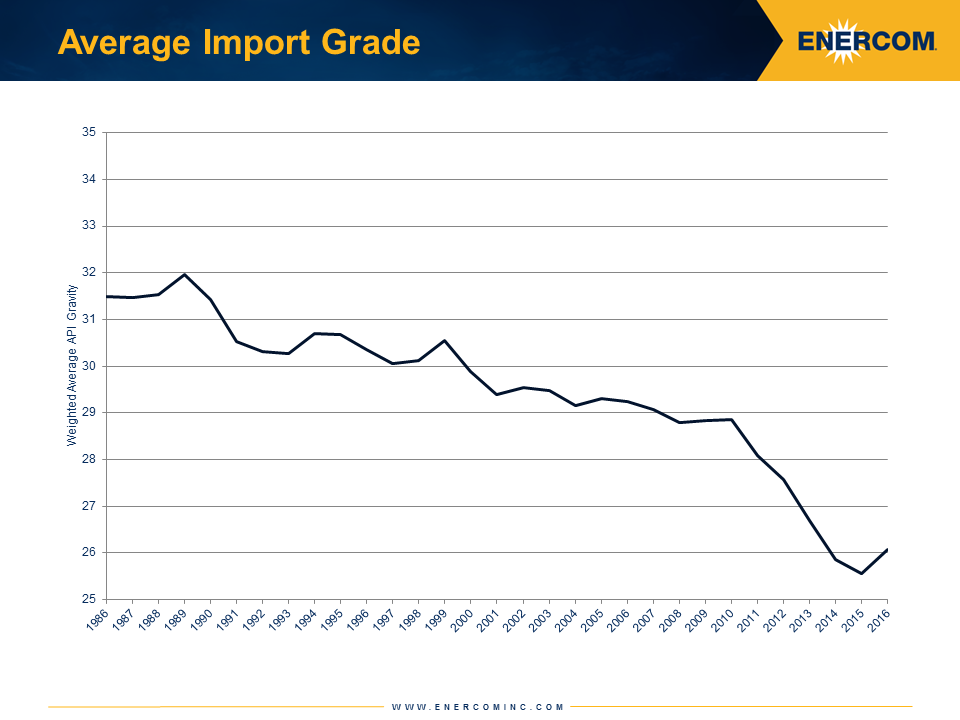

Other changes caused by U.S. shale production are clearly apparent when the density of the average imported barrel is examined for each year.

In 1986 crude averaged 31.5° API. This value gradually decreased as refineries shifted to accommodate heavier crude. By 2010, the average imported barrel was 28.8° API. The shale boom made itself noticed the next year, forcing out imports of light oil. Since then, continued growth in domestically abundant light oil production has virtually eliminated the need to import light oil. The average density of a barrel of imported oil has dropped by more in the last six years than in the 34 years from 1986 to 2010 combined.

U.S. production expected to rise further

The trend of domestic shale production forcing out imports is likely to continue as U.S. oil production grows further.

If the current growth rates can be sustained U.S. shale is projected to add more than 630 MBOE from today to the end of 2017. The shale boom may even make itself felt elsewhere in the world, as continually rising exports of U.S.-produced crude oil reach markets worldwide.

This article is first in a series looking at the volume and nature of oil imported by the U.S. and the impact of U.S. shale on the dynamics of the industry. In follow-up stories we will examine countries of origin for various types of oil imported by the U.S.—Oil & Gas 360®