From a $261 million IPO, to a top-20 publicly traded E&P, to possible bankruptcy

Linn Energy (ticker: LINE, LinnEnergy.com) became one of the largest publicly-traded U.S. E&P companies over the course of its now 13 years of operations. Started in 2003 by Michael Linn, the company first listed on the stock market in January 2006 before going on to make billions of dollars in acquisitions, and grow into a company with more than 7 Tcfe of reserves at the end of 2014.

The company’s IPO raised approximately $261 million, giving Linn Energy an initial equity market capitalization of about $584 million.

In its first year of operations, Linn completed five acquisitions totaling approximately $450 million, beginning a string of 62 transactions totaling approximately $17 billion that would eventually make Linn Energy the company it is today.

In 2007, Linn doubled its holdings with the acquisition of Dominion Energy for $2.05 billion. The acquisition added 2,500 producing wells in Oklahoma, the Texas Panhandle and Kansas, bringing the company’s profile pro forma to 1.6 Tcfe of proved reserves and over 5,000 drilling sites.

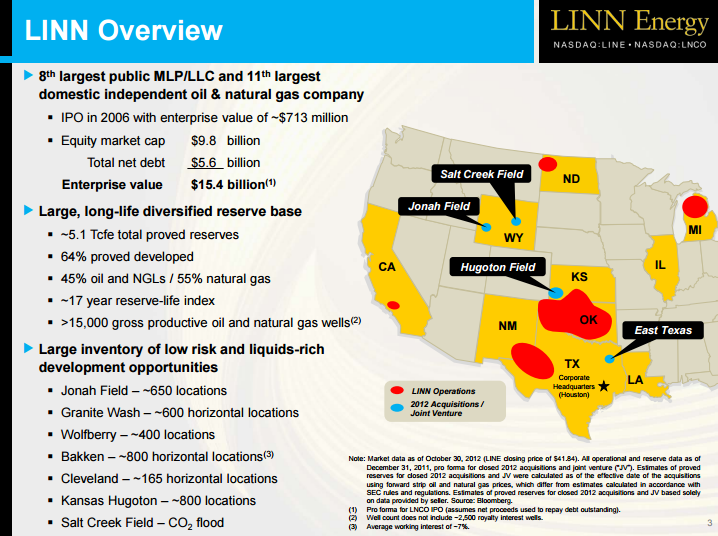

By 2012, Linn had become the eighth largest public MLP and eleventh largest domestic independent oil and natural gas company through major deals that same year. The company acquired 2,400 active wells, 600,000 acres, and a gas processing plant in the Hugoton Basin for $1.2 billion in March; purchased another 750 active natural gas wells and 12,500 acres from BP in June for $1 billion; and spun-off LinnCO, which owned 15% of LINE’s stocks.

Linn Energy as of Dec. 2012

In February of 2013, the company made a $4.3 billion acquisition of Berry Petroleum. The press release the company issued following the acquisition said, “the transaction [was] expected to be highly accretive to distributable cash flow per unit… in excess of $0.40 per unit.”

The asset base that Linn created was able to generate dividends for investors through a master limited partnership structure, which allowed dividends to be paid out to investors without being taxed at the corporate level. This model became very popular in the energy industry, particularly with midstream companies that were looking to maximize unitholder value for their long-life assets.

Accelerated growth leaves company exposed to commodity price changes

The speed at which Linn grew was impressive, but it left the company highly levered, and extremely vulnerable when the price of oil cratered. Large acquisitions like the one made for Berry Petroleum left the company with a weak balance sheet, which has put the company in a position where bankruptcy may be “unavoidable,” for Linn, according to LINE CEO Mark Ellis.

The company has hired financial and legal advisers “to address our liquidity and capital structure, including strategic and refinancing alternatives through a private restructuring,” but added that bankruptcy may be its only option, reports The Wall Street Journal.

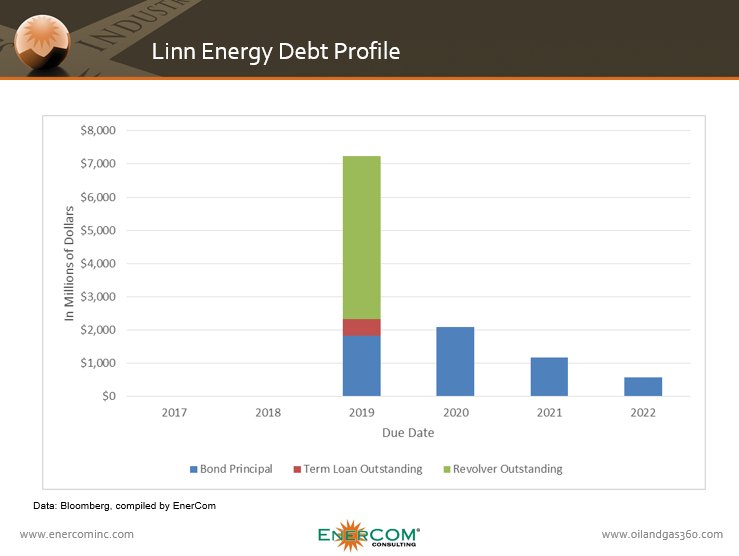

The warning that Linn may join the ranks of bankrupt oil and gas companies, which in 2015 had debt totaling some $17.85 billion, came alongside an announcement that the company would not pay $60 million in interest payments on bonds maturing in 2021 and 2022 and would enter a 30-day grace period. If Linn fails to pay before the end of the grace-period, the company could trigger a default.

On February 4, 2016, Linn drew down the remaining $919 million of its revolving credit facility as the company appears to gear up for Chapter 11 proceedings. Following the decision, total borrowings under the company’s credit facility are now $3.6 billion. Including the rest of the company’s debt, Linn Energy owes in excess of $11 billion, with the majority of its debt due before 2020, according to information from Bloomberg.

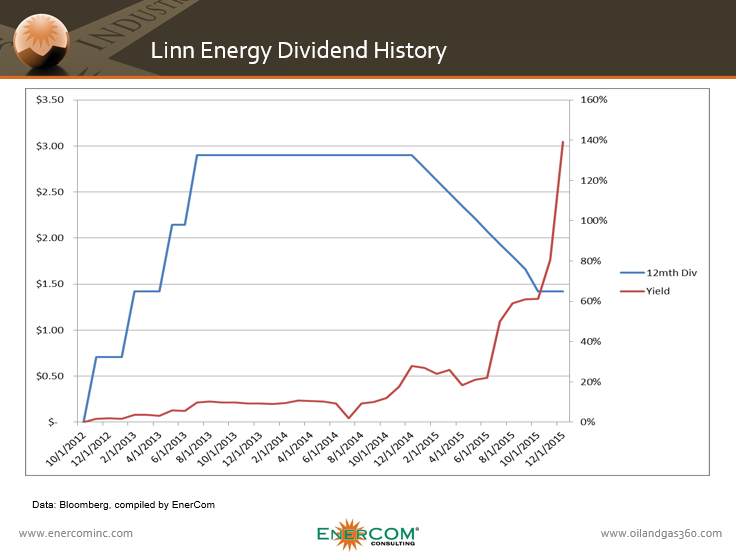

The massive debt load held by the company, combined with fears of an impending bankruptcy, have sent units in the company from $30 two years ago, to less than $1 following the credit revolver news in early February.

Linn’s debt-to-market cap in EnerCom’s E&P Weekly for the week ended March 11, 2016, was 2440%.

A fourth quarter miss

The company’s fourth quarter financial results also painted a grim picture, with the company reporting a loss of $2.47 billion, or $7.05 per unit, compared to a loss of $154.5 million, or $0.47 per unit, a year earlier. The company booked $3 billion in noncash impairment charges, $83 million in noncash impairment charges, $83 million in noncash losses related to changes in the fair value of unsettled commodity derivatives, and $506 million on the extinguishment of debt for the quarter.

Revenue dropped to $647 million from $2.2 billion a year earlier.

Analysts polled by Thomson Reuters had forecast earnings of 14 cents a unit on $748 million in revenue.

Linn Energy resigned to restructure

While the path ahead of Linn Energy is certainly daunting, some analysts were still surprised that the company appeared so ready to jump in bankruptcy. “In our view,” said analysts at Raymond James, “management has options that would provide it more time for oil prices to rebound, given its $1.8 billion hedge book and forecasted strong free cash flow in 2016… [But management] seems tired of trying.”

Among the many problems facing Linn as it edges towards restructuring is its MLP structure. Touted as being an excellent return vehicle for investors because it allows free cash flow to pass along to unit holders, the structure also leaves those same unitholders on the hook for taxes on debt that is forgiven in a bankruptcy or an out-of-court restructuring.

Debt forgiven in a restructuring counts as noncash income, or “cancellation of debt income,” which creates a tax liability for investors without the associated cash distribution.

Linn’s advisors are currently searching for workarounds that could spare investors the bill following the company’s restructuring, however, reports The Wall Street Journal. Among the options being considered is merging Linn with LinnCo, or letting investors swap Linn units for LinnCo shares ahead of restructuring, thus using the corporate structure of LinnCo to shield former unitholders in Linn from liability.

Linn hopes helping investors avoid the tax hit will reduce the chance they will band together and complicate a potential bankruptcy, sources told the Journal. How exactly such a plan might work remains unclear though, as MLPs are a relatively young group of companies, and there is little precedent regarding the legal rules around such a move.

Linn Energy may already have a picture of its future

In its fourth quarter earnings release, Linn reported that the company plans to spend 38% of its $340 million capital budget ($129 million) on the SCOOP/STACK play, and also plans to spend $75 million in building out midstream projects in the play. These decisions may indicate how the company hopes to come out of Chapter 11, said Raymond James.

“Given that Linn has 86,000 net acres in this area and the fact that this play is not quite in development mode for the company, it seems that Linn’s capital budgeting decisions are foreshadowing what the company wants to look like on the other side of bankruptcy.”

The SCOOP/STACK play in Oklahoma is also becoming a more prominently mentioned name in the oil and gas universe. Devon Energy (ticker: DVN) forked over $3.45 billion to increase its STACK footprint in December, amounting to approximately $23,750 per acre. Management describes the region as the “best emerging development play in North America.”

The SCOOP play has already brought in $697.5 million in capital from the companies currently operating there, according to EnerCom Analytics. Private equity players like Tailwater Capital have also said that the SCOOP/STACK formation remains an attractive target for their capital.

The Linn Energy story is not over yet.