Permian-based Rosehill Resources Inc. (ticker: ROSE) reported a Q4 2017 net loss of $5.3 million, or $(0.87) per diluted share. For the full year of 2017, the company reported a loss of $8.5 million, or $(1.43) per share.

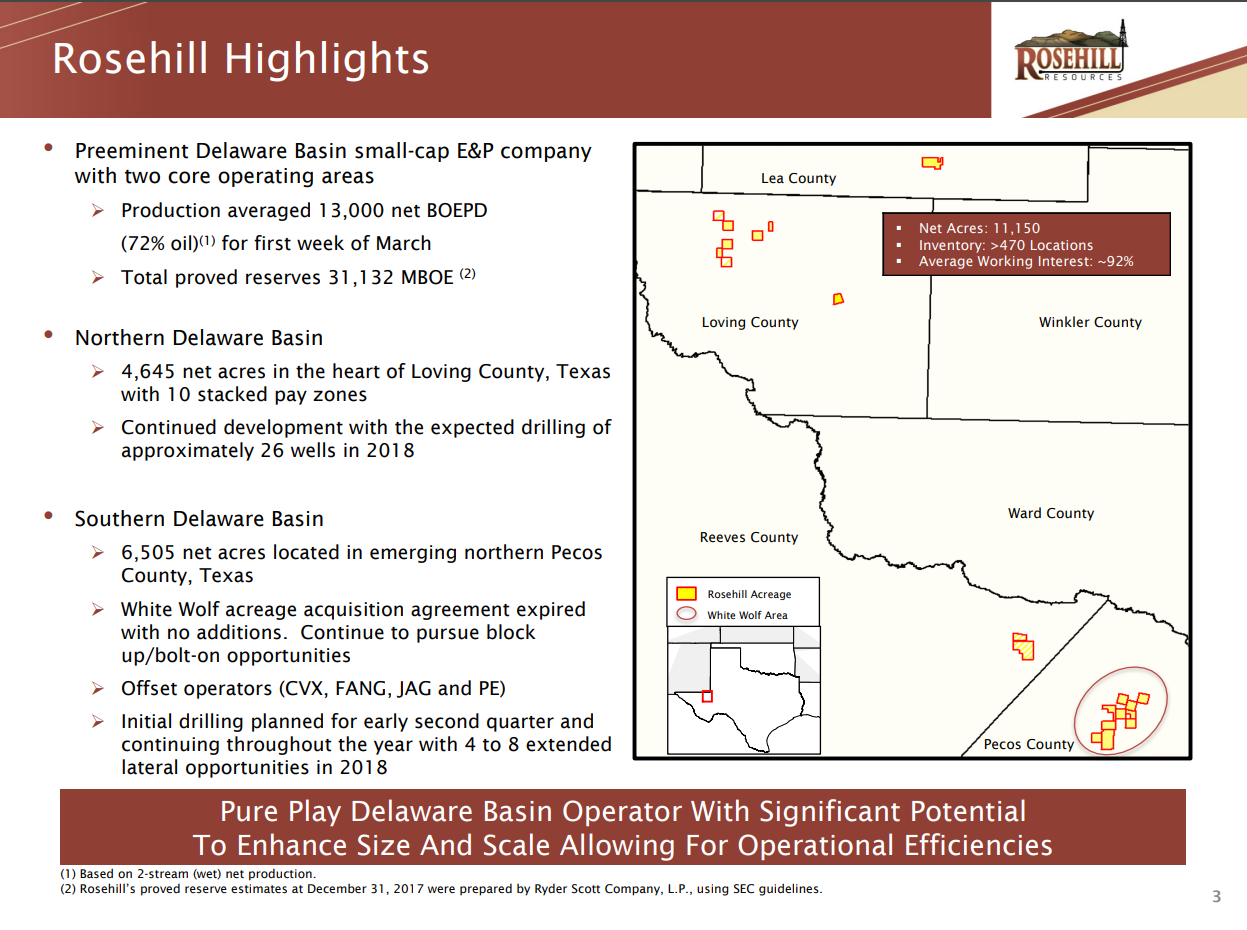

In 2017, Rosehill acquired 6,505 acres in the White Wolf acquisition, establishing a second core operating area in the Delaware Basin. The company has grown from 4,655 acres to approximately 11,150 acres. Rosehill expects to drill 16 to 22 new wells in the White Wolf area in 2018 and complete 12 to 16 of those wells.

Rosehill has 31.1 MMBOE of reserves with a PV-10 of $368 million at year-end 2017, which is up from 13.2 MMBOE at year-end 2016. Rosehill spud 10 operated horizontal wells and completed 12 wells in Q4 2017, producing on average 7,352 net BOEPD. For the full year of 2017, the company’s net daily production averaged 5,838 net BOEPD.

2018

- The company increased average production in March to more than 15,000 net BOEPD (72% oil and 86% total liquids), an increase of over 100% over the average for Q4 2017 of 7,352 BOEPD

- Rosehill has decreased drill times (spud to total depth) to under 15 days in Loving County, which used to take more than 30 days

- In March, Roshill entered into a new $500 million revolving credit facility (maturing in 2022), with an initial borrowing base of $150 million

President and CEO J.A. (Alan) Townsend commented, “2017 was a remarkable and exciting year for Rosehill Resources. Since our formation in April 2017, we have added significant value through the drill bit and with the White Wolf acquisition, which more than doubled our acreage position and location count in the Delaware Basin. Our production grew significantly in 2017, from just over 5,000 BOEPD in late April 2017, to over 10,000 BOEPD in late December 2017…”

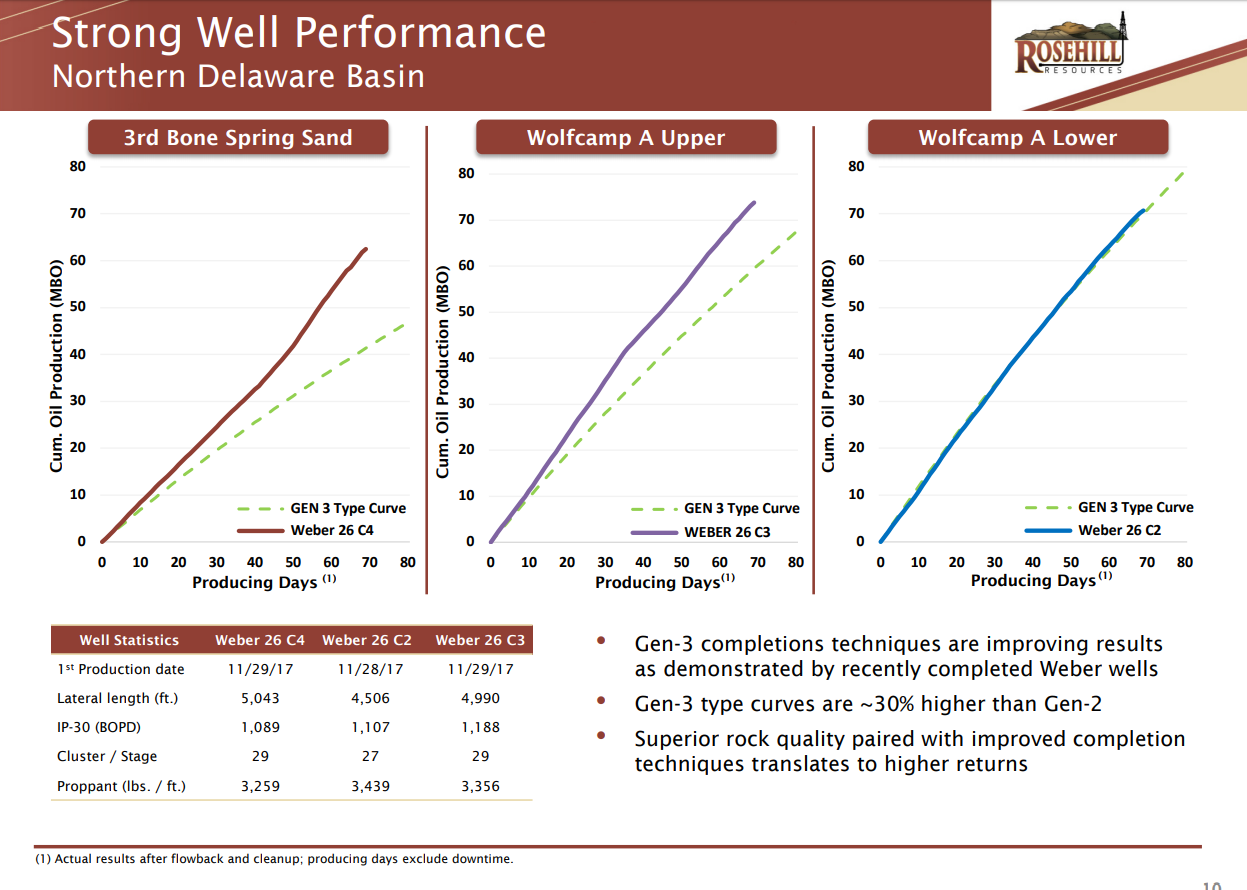

In early 2018, the company began flowback on a three well pad on the Weber lease in Loving County, with wells producing from the Wolfcamp and Bone Spring formations. These wells have performed at combined peak IP-30 rates of approximately 4,300 gross BOPD or 296 barrels of oil per thousand lateral foot.

Conference call Q&A excerpts

Q: Starting on the White Wolf area, as you spud the first well here… can you guys maybe talk a little bit about what zones you initially plan to target with these first batch of wells and the development plans in 2018?

Rosehill: Sure. The first four wells are kind of scattered out on the acreage. If you look at our IR deck, you can see the locations, and those first four wells will be drilled down through the Wolfcamp B and into the Wolfcamp C, we’ll be taking several full cores, we’ll be doing some sidewall coring, and we’ll be doing some extensive logging on it, including… logs to determine distressed fields that exist in each of those areas.

The reason for those are primarily to give us an idea of what horizontal direction north-south or east-west is optimal in each of those locations. Those wells will then be plugged back and drilled horizontally into Wolfcamp B zone, which has been basically de-risked by off, particularly direct offset operators, but in the area.

And after the analysis of the data collected from those four wells, we’ll be further delineating our development program, but you can expect it to be a little widespread initially before we go into full phase development.

Q: Can you give us an update on the status of the infrastructure build-out, and when it will open? I mean, you’re looking at a pretty steep ramp up in production, I was just wondering how that’s going to work with the existing infrastructure.

Rosehill: The infrastructure focus is on gas gathering and water both delivery and disposal obviously. The gas gathering is going to be installed by Brazos Midstream, we have some of the acreage we acquired was already dedicated to Brazos Midstream and so we expanded it. They are out in the field right now, laying the main trunk lines and then we’ll start relaying the lateral to the well locations where we’ll have our batteries for delivery. We don’t see any significant delays and immediate gas hookups at this point and our technical teams are working close with Brazos to do that.

On the water side, we are in the process of — in the same right to delay as the oil and – as the gas gathering will be putting in the water lines as well and that’s in process as we go. We’re also in the process of building frac pits and containment for water to enable to allow us to be able to hit the kinds of water rates needed during the frac job and of course, building location, staking well locations and building roads in place.

From the oil side of things, we’re in conversations with the market at this point to get that lined up and likely that would be piped in as well.