Largest combination since the $80 billion Exxon+Mobil deal in 1998

Royal Dutch Shell (ticker: RDS.B) announced the recommended takeover of BG Group (ticker: BG) in a 75-page release issued on April 7, 2015. The cash-and-share purchase valued at roughly $70 billion – the largest proposed oil and gas deal since Exxon’s (ticker: XOM) $80 billion acquisition of Mobil in 1998. Shell’s offer represents a 50% premium to BG Group’s closing share price on April 7, 2015, and a 52% premium if the 90-day average trading price is considered.

BG shareholders are in line to receive a value of $20.12 per share, consisting of $5.13 in cash and 0.4454 Shell B shares. Upon completion, BG shareholders will account for 19% of the combined company.

Shell’s Annual General Meeting is currently scheduled for May 19, 2015, in the Netherlands. The scheme is conditional on shareholder approval of at least 75% and must pass antitrust laws in various countries. The Board of BG Group recommended Shell’s offer, citing the ability to accelerate growth opportunities and provide “substantial cash return” to its existing shareholders.

Opinions of future deals varied among firms, with Capital One saying the merger was “likely a sign of consolidation to come in the industry” while UBS Investment Research was skeptical of a consolidation wave “as most E&Ps maintain the bid-ask spread is too wide.” Competing offers from companies like ExxonMobil (ticker: XOM) and Chevron (ticker: CVX) are unlikely, UBS believes, due to the respective companies’ limited interest in offshore Brazil.

“The recent $12bn wave of E&P equity bailed out some potential distressed sellers,” said Williams Featherston, Managing Director of UBS. “Nonetheless, the Shell deal highlights one major’s willing to do a deal seemingly assuming a robust recovery in oil prices.”

|

Purchase Date |

Buyer |

Seller |

Price (including debt) |

Premium |

| April 8, 2015 | Royal Dutch Shell | BG Group | $69.6 billion |

50% |

| December 16, 2014 | Repsol | Talisman Energy | $13.0 billion |

56% |

| July 13, 2014 | Whiting Petroleum | Kodiak Oil & Gas | $6.0 billion |

5% |

| February 6, 2014 | Baytex Energy | Aurora Oil & Gas | $2.4 billion |

52% |

| June 28, 2012 | Petronas | Progress Energy | $5.36 billion |

77% |

| October 28, 2011 | Statoil | Brigham Exploration | $4.4 billion |

36% |

| December 14, 2009 | ExxonMobil | XTO Energy | $41.0 billion |

25% |

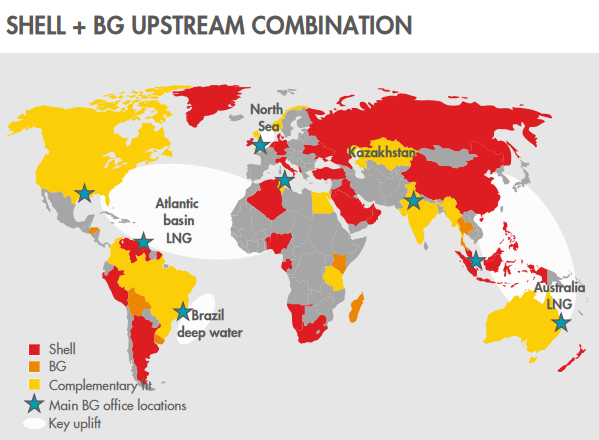

What Shell Gains

A huge position in the natural gas revolution.

In a company press release, Ben van Buerden, Chief Executive Officer of Shell, said: “BG will accelerate Shell’s financial growth strategy, particularly in deep water and liquefied natural gas: two of Shell’s growth priorities and areas where the company is already one of the industry leaders. Furthermore, the addition of BG’s competitive natural gas positions makes strategic sense, ahead of the long-term growth in demand we see for this cleaner-burning fuel.”

Two projects singled out include Brazil deepwater and Australia LNG opportunities. BG’s assets will increase Shell’s production and proved reserves by 20% and 25%, respectively, based on 2014 totals. Shell’s bolstered portfolio will consist of around 3.7 MMBOEPD of production with a proved reserves base of 16,693 MMBOE. According to Simon Henry, Chief Financial Officer of Shell, the pro forma cash flow of $52 billion is the highest in the industry.

Shell’s reasons for the recommendation, as outlined in the press release, include:

- BG’s exploration track record, which has added approximately 900 MMBOE every year for a decade. Management said its organic proved reserves replacement ratio for the past three years is 158%.

- A “highly competitive” LNG business, including its Queensland LNG project in Australia that went online in December 2014 and has delivered nine cargos to date. Production from the second train is expected by Q3’15.

- A “competitive” position in deepwater Brazil that will allow the company to become the principal partner of Petrobras’ development of the Libra Field, which is believed to hold up to 15,000 MMBOE of reserves.

- Upstream production base in ten different countries, and

- Nearing the end of a high capital expenditure cycle

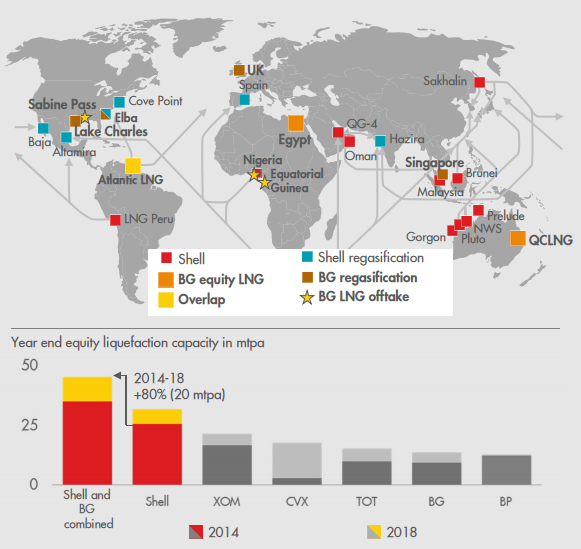

LNG: Mega-Growth Coming

Combined equity LNG capacity is expected to increase to 45 million tons per annum by 2018, compared to Shell’s 2014 capacity of 25.6 million tons per annum. BG shipped 11 million tons in 2014 and sourced LNG from 15 countries – not including the United States, which will be added in 2016 once Sabine Pass comes online. “This is a scale-business and clearly, there is potential to add more value here as well as cost synergies from a combined shipping operation and trading platforms,” said van Buerden. Shell’s LNG sales have increased by 40% since 2010.

LNG has been an acquisition priority for Shell in recent years. The company acquired the LNG assets of Repsol in February 2013 for $6.7 billion. Referring to the deal, van Buerden said, “We’ve delivered over $1 billion of additional cash in 2014 ahead of our expectations for that deal and that gives us also the confidence that we can successfully integrate the BG portfolio together with the Shell portfolio.”

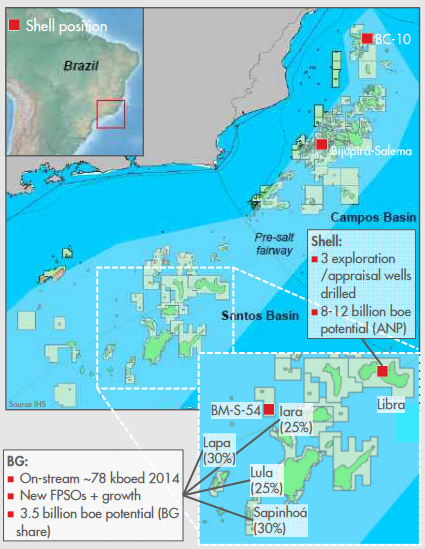

Brazil Overview

Shell’s production from deepwater Brazil is expected to jump more than tenfold to 550 MBOEPD by the end of the decade compared to Shell’s standalone 2014 volumes of 52 MBOEPD. Brazil is BG’s highest producing country, with reported production of 130 MBOEPD in January 2015 from five floating production storage and offloading vessels (FPSOs). BG expects its FPSO count to reach 15 as the offshore activity ramped up.

Shell management mentioned the company has conducted business with Brazil for more than 100 years and has been involved with deepwater ventures since the 1990s. Its entry into the Libra Field in 2013 cost $1.4 billion, and resource appraisals are currently underway.

The interesting difference between Shell and BG’s Brazil positions are that BG’s position is non-operated, but Shell management said the opportunity to expand in the Libra was an opportunity they could not afford to pass up. “I can only conclude that at Shell, we are insufficiently exposed,” said van Buerden. “We have some production there, but it’s relatively insignificant. It’s our own operated production… but it can be a whole lot more. Even if you take Libra to its full development scale, in my mind, we would still not be a fully-flexed deep water international profitable company if we wouldn’t go one step further.”

Shell mentioned its close relationship with Petrobras (ticker: PBR) several times throughout the call, with van Buerden saying: “Although the headlines may not be very attractive at the moment, this is a long-term proposition we’re talking about. And I’m absolutely confident that Petrobras, being the company that it is, will come out of this being a stronger company as well.”

Shell’s 2020 Vision

The combined group is expected to generate $15 to $20 billion in annual cash flow from deepwater and integrated gas operations by the year 2020, with its upstream and downstream engines potentially matching the projected flow. Long-term positions could “potentially” add another $10 billion to the list. If achieved, the new cash flows would approximately double Shell’s 2014 net cash flow of $45 billion ($20 billion from deepwater and integrated gas, with the remainder from upstream/downstream/long-term sectors).

“Over time, that will enhance our future dividend potential and underpin a much higher rate of share buyback from Shell,” said van Buerden.

Shareholders in Mind

Shell reiterated its intentions to issue an annual dividend of $1.88/share in 2015, with its 2016 dividend to be at least the same amount. The company plans on commencing a four-year share buyback program in 2017, involving the purchase of at least $25 billion in stock. The benefits are expected to be seen beginning in 2017, and then becoming “strongly accretive” to earnings per share in 2018 and beyond. Shell made the estimates on Brent price assumptions of $67 in 2016, $75 in 2017, and $90 in 2018 through 2020. The company expects to dial back on its $40 billion capital expenditure plan in both 2016 and 2017.

“The initial priority for surplus cash in this period will be debt pay-down in 2016 and beyond, but expect the emphasis to shift through 2017 and later as the cash flow grows, the new production and some recovery in the oil price,” said Henry.

Part of the dividends and buybacks will be funded by a $30 billion divesture plan, expected to be completed from 2016 to 2018. The company said debt reduction will be its top priority, followed by attention to its shareholders. The divesture plan is nearly double its previous sales plan from 2011 to 2013, in which the company sold $16 billion in assets. Shell management cautioned that sales may be slow in 2015 due to the weak commodity environment.

Despite the heavy investment into the assets of BG Group, Henry reiterated the importance of Shell’s shareholder program. “We basically wanted to make it very, very clear there is no change in the dividend policy, certainly not for this year, and the year thereafter.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.