Gennady Timchenko, Russian billionaire and holder of 23% of the stake in Rosneft and Novatek, and Igor Sechin, chief executive of the Kremlin-controlled oil group Rosneft, seem confident that their companies will survive and prosper despite financing sanctions imposed by the United States in July. According to the Financial Times, “Novatek, Russia’s largest independent gas producer, is sitting pretty. It has a $350m syndicated loan falling due within the next 18 months, but generates enough cash flow to repay it in full if refinancing proves impossible. Like Rosneft, it can tweak its capital expenditure program to conserve cash if it has to.”

The Financial Times says the most effective actions taken thus far are the E.U. and U.S. denying Russia access to shale oil exploration technology, which would be particularly effective for their oilfields in Siberia and deep water opportunities. Moscow plans to extract resources from Siberia’s Bazhenov shale and natural gas in both the Yamal peninsula and Sakhalin Island since production in conventional Siberian oilfields is declining.

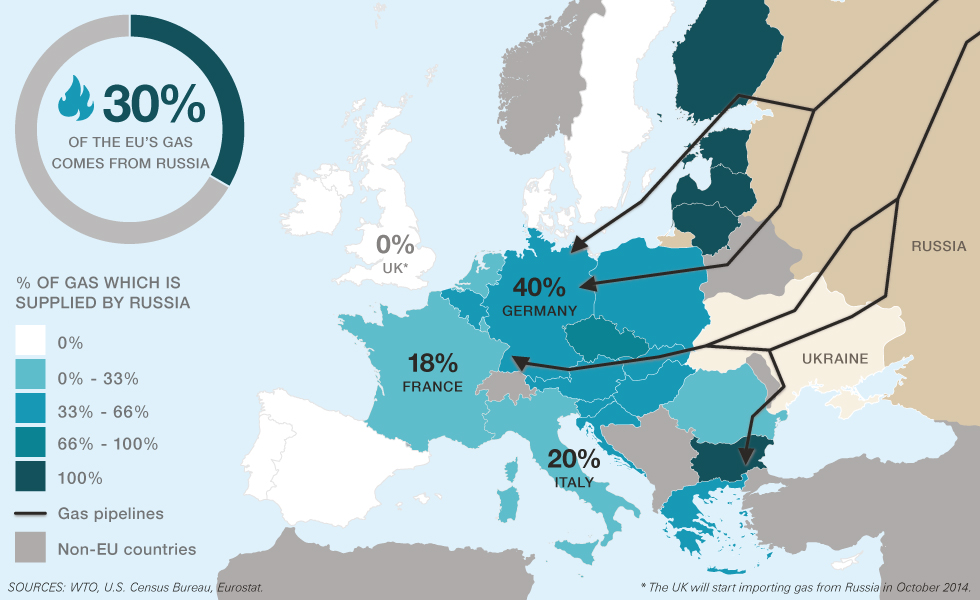

On August 8, Ukraine threatened to block Russian oil and gas supplies to Europe. According to a February bond prospectus, Ukraine transported 86.1 billion cubic meters of Russian natural gas and 15.6 million metric tons of oil last year. Russia’s Gazprom cut off its energy supply to Ukraine on June 16, 2014 due to its recipients’ outstanding debt.

Gas prices in Western Europe rose on the news of Ukraine’s sanctions plan, which requires parliamentary approval.

Source: The New York Times

Russian ways around sanction pains

Russia has navigated through foreign restrictions before. Bloomberg reports that “Gazprom stopped shipping gas through Ukraine for almost two weeks in 2009, leaving several EU states including Bulgaria and Slovakia without supplies. (Gazprom) has since worked on other transit routes, including opening Nord Stream, which pumps gas under the North Sea, in 2011. Gazprom also plans to complete the South Stream project with European utilities such as Italy’s Eni SpA (ticker: E)and France’s Electricite de France SA, by 2019.”

Igor Dyomin, a spokesman for Russia’s oil pipeline operator OAO Transneft, told Bloomberg that Russia also has oil routes that bypass Ukraine, and any imposed restrictions would have a bigger effect on the budget of Ukraine and EU countries than Russia itself.

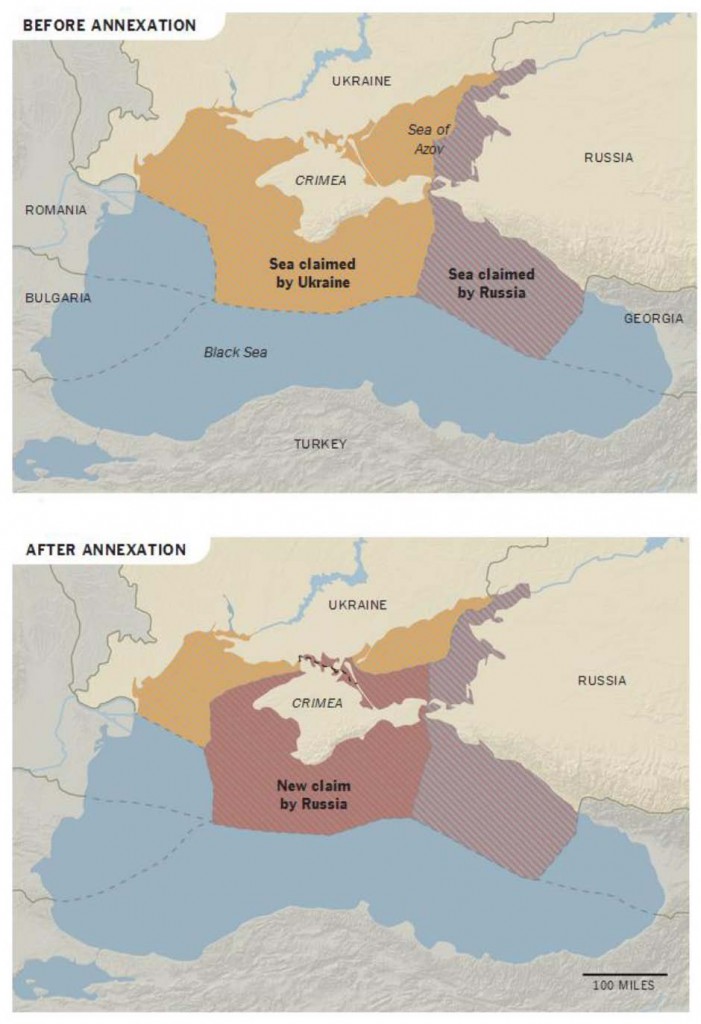

Also, ExxonMobil and Rosneft started drilling their first offshore platform well in the Kara Sea this Saturday, giving Russian engineers experience in the offshore technique. Bloomberg reported that on August 9, Putin lauded Exxon as Russia’s “old and reliable partner.” Equipment is also readily available from the rest of Asia, although it can be argued that it is inferior to U.S.-made products. Russia gained a tremendous amount of offshore drilling territory upon annexing Crimea, and the Universitetskaya well with Exxon is the first of as many as 40 offshore wells that Rosneft plans to have by 2018.

According to AFP, the shares of Sberbank (up by over 4%) and VTB (up by 3%), Russia’s two biggest banks, soared on August 11 on Moscow’s main exchange following an announcement by the New York-based MSCI index provider. The index provider will continue to offer shares as long as no more stock is issued, basing its decision after “consultation with the investment community.” Investors now expect other main exchanges in Europe to keep the two stocks.

Still, the Financial Times says that analyst companies like Morgan Stanley and Barclays “are downgrading their forecasts for Russian oil production growth.” Morgan Stanley had assumed Russia would be producing an extra 250,000 barrels per day from its shale deposits and virgin Arctic fields by 2018, but those prospects are now at risk.

Russia’s central bank said net capital outflows had reached about $75 billion in the first half of the year – odd, since the number is more than the entire figure for 2013, which was $63 billion according to the Wall Street Journal. Such growth might be plausible if the country was not under sanctions and huge political stress, but given the current situation, this $75 billion claim seems suspicious at best.

The International Monetary Fund withdrew its earlier Ukrainian growth prediction of 1.0% due to the uncertainty. The latest report offers no prediction, and says, “In Ukraine, output will likely drop significantly as the acute economic and political shocks take their toll on investment and consumption. Toward the end of 2014, net exports and investment recovery should bring back moderate growth.”

Russian Sanctions Against The West

In mid-July, Moscow warned that it would target the EU farm business, automobile, aircraft and shipbuilding industries if sanctions continued. Russia created its first counter-sanction on August 6, 2014, when it banned meat, fish, dairy, fruit and vegetable imports from the United States, Norway, Canada, Australia and the 28 member states of the European Union.

According to the International Trade Centre, a joint venture between the United Nations and World Trade Organization, Russia imported $17.2 billion of food from the countries targeted by the ban, of which $9.2 billion are now banned products. Analysts at London-based Capital Economics said that this is just 0.05% of the EU economy.

The ban exempts baby food and will last at least one year, leaving a hole in supply that domestic companies and developing nations will have to fill. Reuters said that Russia has developed its own food industry over the past 20 years which consists of both home-grown firms and local units of foreign companies, including Pepsico and Nestle. Agriculture Minister Nikolai Fyodorov acknowledged the ban would cause a short-term spike in inflation but no medium or long term danger.

CNBC reports that France is worried that the excess supply of agriculture will crush local food prices and the heavily subsidized EU farm sector. Brussels promised that “up to €400 million” could help compensate the sanction-hit farmers, but CNBC calls this “wholly inadequate,” saying “Russia is the second-largest market for EU farm exports. It takes 10 percent of EU farm products representing annual sales of €12 billion. France alone accounts for about €1 billion of that export trade with Russia.”

Arseniy Yatsenyuk, the politician, economist, and lawyer whom became Ukraine’s new Prime Minister in the 2014 revolution, said, “In the most negative scenario for Ukraine, losses during the first year may reach $7 billion, not only because of sanctions but also because of the Kremlin’s aggressive policy.”

Finland is also in a difficult position, and elected to support the sanctions despite enduring its second recession since 2008. It supported the sanctions because “it wants to be in the EU’s core,” said Pasi Kuoppamaeki, chief economist at Danske Bank. “Finland may have disagreed with the means, but it’s had to go along with others.” Bloomberg reports 14% of Finland’s trade currently comes from Russia. The euro-area average trade with Russia in 2013 was 3.4%. About 5%of Finland’s goods exports to Russia are now banned, according to the Bank of Finland.

The prospect of an internal squabble over which countries deserve economic compensation may weaken the EU’s ability to strike accords, said Danske Bank.

Russia Digging In

CNBC said that Russian farmland “hasn’t performed particularly well since the Soviet era, as farms struggled with the move from collective farming to a more capitalist system, and young rural Russians moved to cities in droves.” The Kremlin acknowledged that the average Russian consumer is going to be hit by rising food costs, and that it will take months or even years to replace those goods banned under sanctions. CNBC added, “With inflation already at 7.9 percent in the first half of 2014, purse strings will have to tighten.”

Igor Nikolayev, head of the Moscow-based FBK Strategic Analysis Institute, said, “We could see a minimum of 20 to 30 percent rise in prices, especially for produce.” This is extremely dangerous for Russian civilians, who already spend the majority of their income on food. Nikolayev also said that “Substituting imports with Russian food is nothing but tall tales,” citing government policies of the last decade which have wiped out farmers with exorbitant taxes. As food prices rise, spending in all other parts of the Russian economy will decrease.

On August 9, a Putin spokesman said, “The sanctions were forced. We did not want them. They are retaliatory.” If new sanctions against Russia are approved, “we will retaliate,” he said.

Airspace is also in question. Flight costs could increase by as much as $30,000 if Russia withdraws overflight rights. However, this would also hurt Russia’s flagship Aeroflot, which receives the overflight fees. Forbes said an imposed airspace ban by Russia could be easily countered with the E.U. enforcing the same ban, thus hurting Russia far more than its sanctioning countries.

Neil Shearing and William Jackson at Capital Economics said that “The upshot of all this is that the biggest loser from the ban looks set to be Russia.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.