Good production from Lower Eagle Ford A & B benches

Sanchez Energy (ticker: SN) announced third quarter results today, showing a net loss of $62.6 million, or ($0.81) per share. After excluding the company’s mark-to-market hedging loss of $52.2 million and other special charges, the company posted an adjusted loss of $9.4 million.

Sanchez produced 73.8 MBOEPD in Q3, which is at the high end of guidance and is 43% more than the company produced in Q3 2016. The company has recovered from the effects of Hurricane Harvey, and is now producing more than 80 MBOEPD, a record production rate.

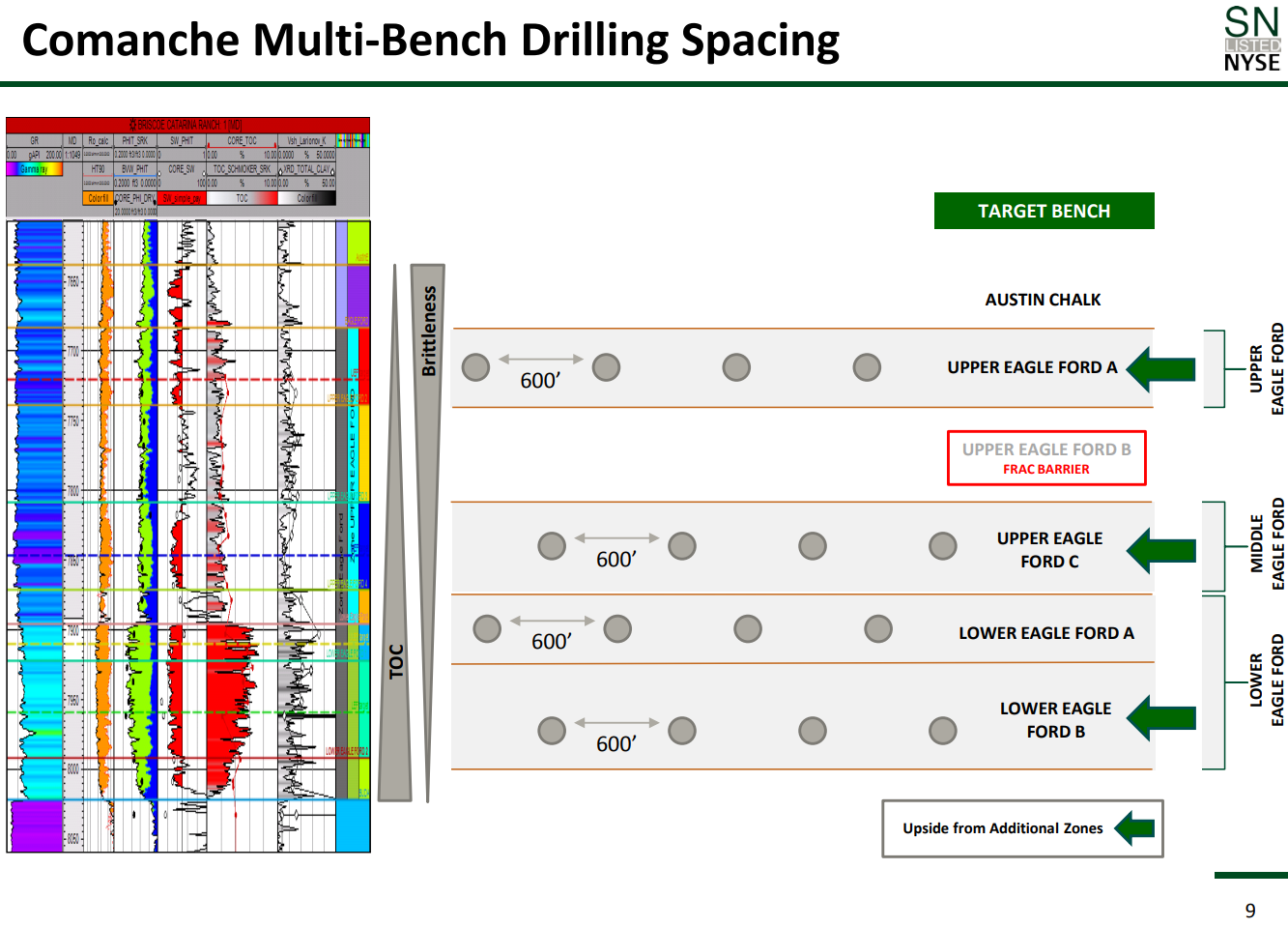

Sanchez has begun investigating multi-zone development of the Lower Eagle Ford, with encouraging preliminary results. The pilot project run by the company indicates there are two distinct intervals of independently productive reservoirs in the lower Eagle Ford. Targeting two benches of the Lower Eagle Ford would give Sanchez significantly more drilling inventory, up to 800 gross locations, so proving the potential of this zone is important.

Sanchez continues to develop the Comanche assets it acquired in early 2017 from Anadarko. The acreage has large amounts of drilled uncompleted wells when it was acquired, which Sanchez is gradually bringing online. The company expects to complete 132 DUCs within 12 months of closing, and has brought about 60 online so far. The company is also drilling its own wells, and currently has five rigs active in the area.

Sanchez CEO Tony Sanchez discussed the current debate between growth and returns in the earnings announcement, saying “Capital and operating focus has shifted to prioritize returns on invested capital as well as driving towards full-cycle free cash flow generation at the corporate level. With a continuing emphasis on higher rate of return projects that optimize capital efficiency, we have slowed the pace of drilling activity while reducing the large inventory of drilled but uncompleted wells (“DUCs”) acquired with the Comanche assets. The Company’s inventory of low-cost, high rate of return DUCs should continue to drive cash flow growth as we finish 2017 and plan for next year. Higher production levels and increased operating margins, combined with improving oil price fundamentals, should put us on a path to fully fund the Company’s 2019 capital program with operating cash flows while delivering growth from an extensive inventory of organic drilling opportunities. “

Q&A from today’s Q3 earnings call

Q: As you think about delivering growth within operating cash flow, or really even generating free cash flow in 2019 at the current strip, could you just give us some just big goalpost on whether this would be in the single digit, double digits, just something to think about?

SN: That’s a tough question to answer. I’d say it’s probably less than 20%. I know that doesn’t narrow it in too much, but I think that’s when we’re at a level of production of where we expect to be. By the end of this year and into next year and I realized we have not given any projections yet, so I’m not going to give you specific numbers. Growing at those high rates on a large production base is very difficult and it strains the balance sheet.

And so, whether it’s a high single-digits growth rate or a double-digit growth rate. I don’t know yet. But I’d be willing to say it’s less than 20%, back when we were a lot smaller we could grow at 20%, 30%, 40% year-over-year organically. But I think that you can’t have it both ways. You can generate free cash flow and grow at 30% or 40% when your production rates are 90,000 barrels a day to 100,000 barrels a day of production.

If we were at 30% I mean 30,000 barrels a day of production I’d probably be driving towards achieving both. But where if you just look at this – at this quarter’s revenue run rate for instance of almost $200 million and that’s with oil still in the very low 50’s and probably netbacks below it. We’re on – we’re on a annualized last quarter average of $800 million of revenue plus And so, growing that assuming prices stay stable, growing that at high double-digits is very difficult and that’s why we have shifted towards what I think ultimately every company’s goal is to generate excess cash that could be returned to the shareholders that could be return to the shareholders through a number of different avenues including through debt pay down. So that’s a very clear goal for us now. I think the last few years, have really been defined for us as accumulating our position and consolidating around this particular area of the Eagle Ford. I feel that culminated with the acquisition of Comanche, now it’s time to focus on generating returns for shareholders on a cash-on-cash basis.

Q: I think free cash flow neutrality has been a big theme this earnings season it appears that the companies that are able to achieve that sooner rather than later have been generally reported in the market. I know you’re talking about organically funding 2019. But can you give us a little sense of how you think about 2018 and I guess specifically are there any mechanisms that you’re kind of contemplating at this point that could pull forward that free cash neutrality to next year?

SN: I’d put 2019 out as the goal, I think that between where we are today 2018 it’s an important road to get to that in 2019. Keep in mind that the capital we’re spending right now through really the first half of next year is that initial integration of the Comanche asset. So, I view 2018 is being the first real level loaded year of us developing our assets. But even that said the there’s a good number of docs that are coming, that are going to there is a good number of DUCs that are coming, that are going to spill over into 2018. So, whether it’s a the first quarter – whether we finish them by the first quarter, second quarter, calendar 2018 itself will still be characterized by some capital being spent on DUCs, which drives growth.

So, when you look at calendar 2019, that’s the first calendar year when we don’t have any of the capital spending that’s associated with those projects that came with the initial acquisition i.e. the DUCs. So, I think 2018 – I think a lot of that ramp will be getting towards a production level by the end of this year. And so in our internal modeling, 2018 while still looking level loaded, I think is characterized by the first quarter and some of the second quarter still having the DUC influence in there.

So these assets are self-funding at the asset level but I think we’re getting to a point where we can generate not only self-funding assets at the asset level but enough to cover interest and G&A and other costs above the assets. And when you look at the first calendar year that that would occur with level loaded spending with no DUCs that came with the initial acquisition that’s 2019, because we’re still spending some on DUCs in 2018.

So whether that transition happens or is achieved in late 2018 or 2019, it’s still not quite clear yet, but it’s – you can almost think about it as mid 2018 to the end of 2019, in that timeframe.