Legacy Eagle Ford player is kicking production into high gear with 132 DUCs to complete, infill drilling on tap

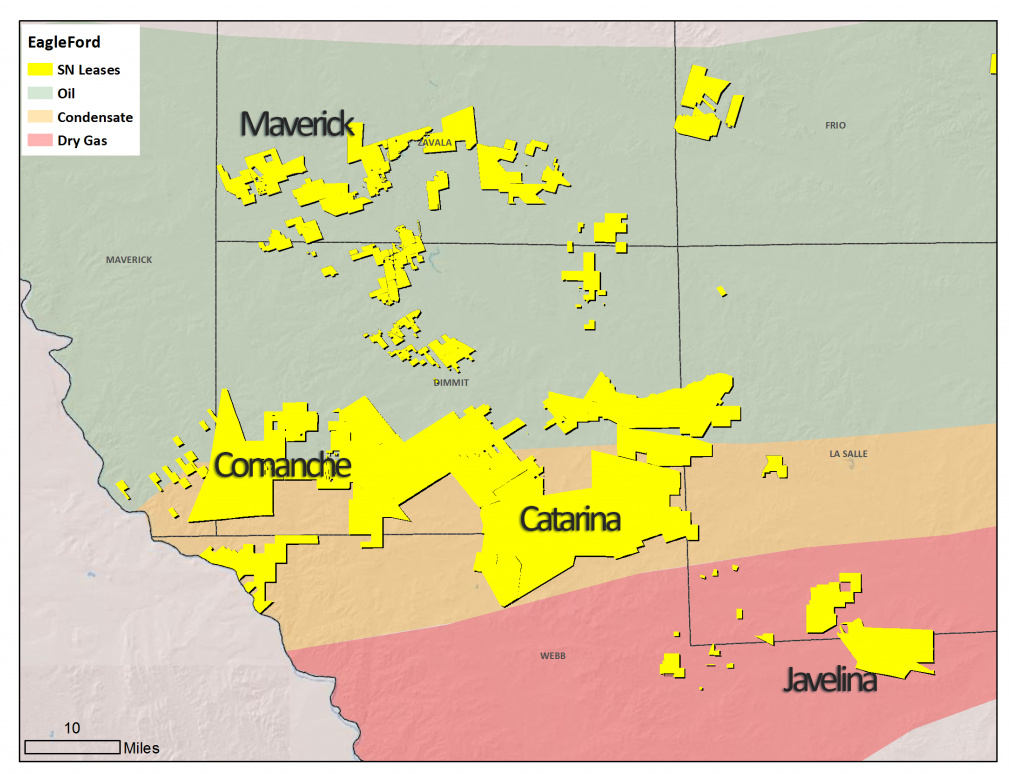

Venturing through the balance of 2017 and into 2018, Sanchez Energy Corporation (ticker: SN) is looking to take advantage of its $2.3 billion March, 2017 acquisition of the Comanche assets in the Eagle Ford basin, wherein it holds 77,500 net acres in Dimmit, LaSalle, and Webb counties, TX.

Sanchez has identified 4000 gross and 1000 net potential future drilling locations within the Comanche asset.

In its May 2017 investor presentation, Sanchez Energy outlined its intent to further develop its new acquisition in the coming year and likened it heavily to its previous Catarina asset acquisition. Sanchez compared the Proved Developed Producing (PDP) and Drilled Uncompleted (DUC) assets of the Catarina and Comanche as approximately 75% and 80% of the acquisition values, respectively.

The production guidance, as reported by Sanchez in its Q1 investor presentation, was between 78,000 and 82,000 BOEPD for 2017 and between 100,000 and 115,000 BOEPD in 2018.

Comanche: a scaled-up Catarina

Sanchez’s other major asset is the Catarina, which totals 106,000 net acres between Dimmit, LaSalle and Webb counties, TX. Sanchez holds 100% working interest in its Catarina asset and has identified between 1,300 and 1,650 potential drilling locations.

With a DUC inventory of 132 wells, and 4000 potential future development locations, Sanchez expects that it can treat the Comanche as a scaled-up version of the previous Catarina, which boasted 22 DUCs and 1,500 future development locations at the time of the acquisition.

Sanchez is treating the two acquisitions as similar and scalable due to the presence of developed water infrastructure, developed third party gathering infrastructure, and developed road/facility infrastructure for both assets.

Within the next four quarters, Sanchez intends to complete all of the 132 Comanche DUCs and has reported that nine have already been complete. The company also report that “several “of those nine demonstrated initial production rates over 1,000 BOEPD.

Looking beyond of the significant potential that completing its Comanche DUCs offers, Sanchez is planning to pursue infill drilling in the areas surrounding the current DUCs.

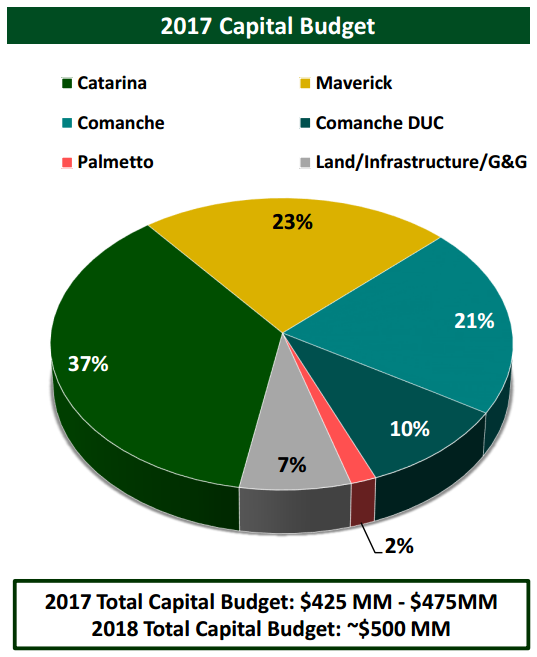

Sanchez’s focus on developing its new asset is reflected heavily in its 2017 capital budget—which Sanchez expects to be between $425 and $475 million—where it focuses approximately 10% of that budget on the Comanche DUCs, with another 21% on the Comanche asset as a whole.

Development in its core

Growth continues in Sanchez’s Catarina asset, where it reported the Piloncillo E33 well, which boasted the highest initial production in the asset at 1,500-1,800 BOEPD. The Piloncillo A25 and B1 both were successful step-outs used to further define and develop the Catarina asset.

Sanchez has undertaken testing in the western portion of the Catarina, which indicated a much larger oil-cut than the south-central portions of the Catarina. Sanchez hopes to further explore the potential of the western Catarina later this year with the ongoing completion of 11 wells.

In order to further develop its Catarina asset, Sanchez is also pursuing a Generation 3 completions design that it reports has delivered a 25% increase over previous production trends.

Sanchez presenting at EnerCom

Sanchez Energy will be presenting at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.