SandRidge Energy (ticker: SD) is the largest independent operator in the Mississippian Lime formation and plans on drilling 460 wells in the Mid-Continent in 2014. The company divested approximately 11.3 MMBOE (33% of production) of assets in 2013 to centralize its focus on the play which consists of shallow wells and generally inconsistent geology.

In a conference call with investors and analysts, James Bennett, President and Chief Executive Officer of SandRidge, said: “In February, we closed the divestiture of the Gulf of Mexico assets. Now our focus is completely on the Mid-continent: Oklahoma, Kansas and Permian Basin. We want to operate and focus where we have real competitive advantages such as our acreage position and scale, the knowledge base of our team and well set of over 1,200 horizontal wells, having the lowest well cost in the basin, and our extensive infrastructure.”

Q1’14 Results

Inclement weather hampered SandRidge operations in the first quarter of the company’s 2014 campaign.

Source: SD May 2014 Presentation

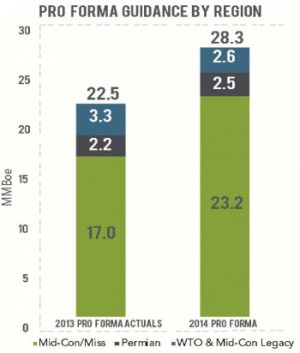

SandRidge announced production of 7.1 MMBOE (79.2 MBOEPD), including 1.3 MMBOE of divested Gulf of Mexico assets, in its Q1’14 earnings release on May 8, 2014. Capital expenditures for the quarter were $276 million, which is well below the company’s estimated 2014 full-year expenditures of $1.475 billion. Production was slightly lower than expected but SD reaffirmed guidance rates of 28.3 MMBOE (23.2 MMBOE from the Mid-Continent) due to increased operational levels following 56 days of downtime. The company brought online 45 wells in the month of April and has current production rates of 55 MBOEPD – up from a 51 MBOEPD quarterly average that included bringing online 71 wells in all of Q1’14.

The Gulf of Mexico transaction officially closed on February 25, 2014. Net cash to SD was $365 million following considerations for hedge contracts and liabilities. The proceeds were used to fund SD’s drilling program and the company has no amount withdrawn on its $775 million credit facility. Liquidity is currently $1.9 billion ($1.2 billion in cash) and the majority of production is hedged (87% liquids and 63% gas) for the remainder of 2014.

Overall revenue dropped by 15% on a year-over-year basis, but SD divested approximately 20% of its producing assets during the given period. Production from the Mid-Continent is up 28% from Q1’13. Adjusted net income, calculated to exclude the impairment charges of the GOM deal, is $37.8 million ($0.05 per share) for the quarter.

Production Breakdown

The 71 wells brought online in Q1’14 returned an average 30-day IP rate of 410 BOEPD – up 12% from 2013’s average and 29% above the type curve. Overall, Mid-Continent wells produced 50.6 MBOEPD for the quarter. Seven of the wells produced more than 1,000 BOEPD for the same period, which, according to SD management, is the largest number of high rate wells in a single quarter since the inception of the play. A total of 87 horizontal wells were drilled in the quarter with 25 rigs in operation. Oklahoma was on the receiving end of 58 wells and 14 rigs while Kansas drilled 29 wells from 11 rigs.

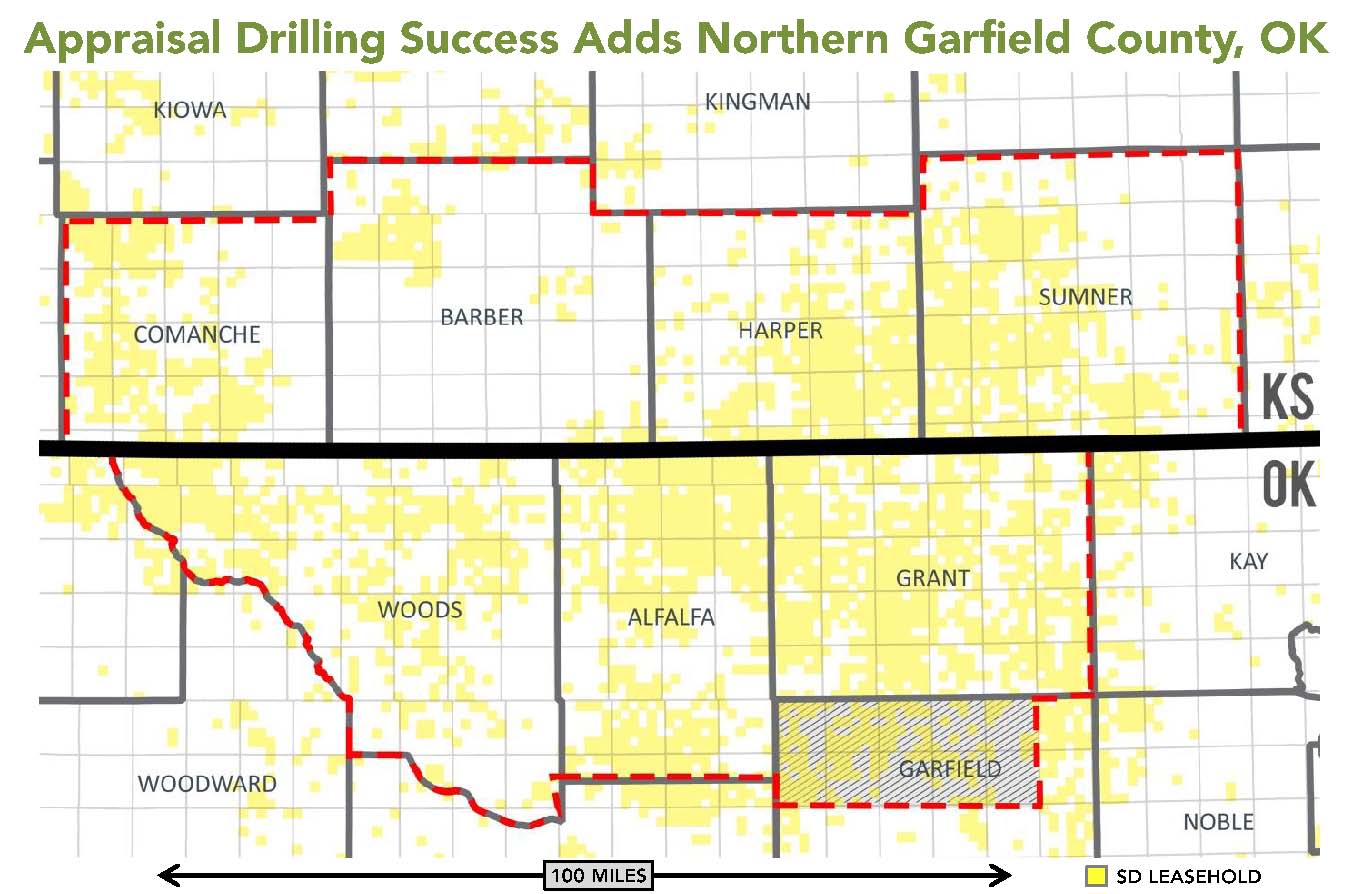

In Oklahoma, 11 test wells in southern Grant County returned 406 BOEPD (28% above the type curve). SD has expanded its focus to north Garfield County (40,000 acres) and believes the region holds stacked pay potential.

Source: SD May 2014 Presentation

In Kansas, a dual stacked lateral well produced a 30 day rate of 707 BOEPD at $5.2 million, as opposed to typical costs of $6 million for two separate wells. Sumner County (117,000 net SD acres) remains a focus area and currently holds six running rigs, with five intended for horizontal drilling. Four laterals in the region produced 30-day IPs of 353 BOEPD (67% oil) and five wells drilled in Q4’13 returned 30-day rate of 601 BOEPD (90% higher than 2013 type curve). Dave Lawler, Executive Vice President and Chief Operating Officer of SandRidge, said, “Learning from our initial work on the dual lateral and tri-lateral projects, we plan to develop two full sections by the end of Q3 that will have four to five laterals each and will extend from a single wellhead positioned in the corner of a section.” The company is using an open hole packer completion method on its wells, which can be completed in as few as two days, compared to a traditional times spanning five to seven days. Lawler said: “We anticipate that our average well cost will be under $3 million the next few quarters as we improve efficiency and drill more second and third wells from multi-well pads. For reference, 20% of our Q1 wells were on single pads and 80% were drilled from multi-well pads.”

Other regions

SandRidge holds properties in the Permian Basin and legacy assets in West Texas. The two areas produced combined for 12.1 MBOEPD in the quarter. A total of 51 wells were drilled in the Permian and oil consisted of 87% of the stream. SD was obligated to drill 14 of the wells as part of a royalty trust and expects to complete such obligations by Q3’14.

Moving Forward

In the conference call, management said it prefers to release results per township rather than per well because of the tightness of the play. The company is also analyzing 1,100 miles of seismic shoots and expects to conduct tests on another 700 miles within the year. Downspacing operations will continue with four wells per section for the time being.

Bennett said, “We’re still confident in our ability to deliver 20% to 25% compound annual growth in production and a higher growth in EBITDA and cash flow over three years.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.