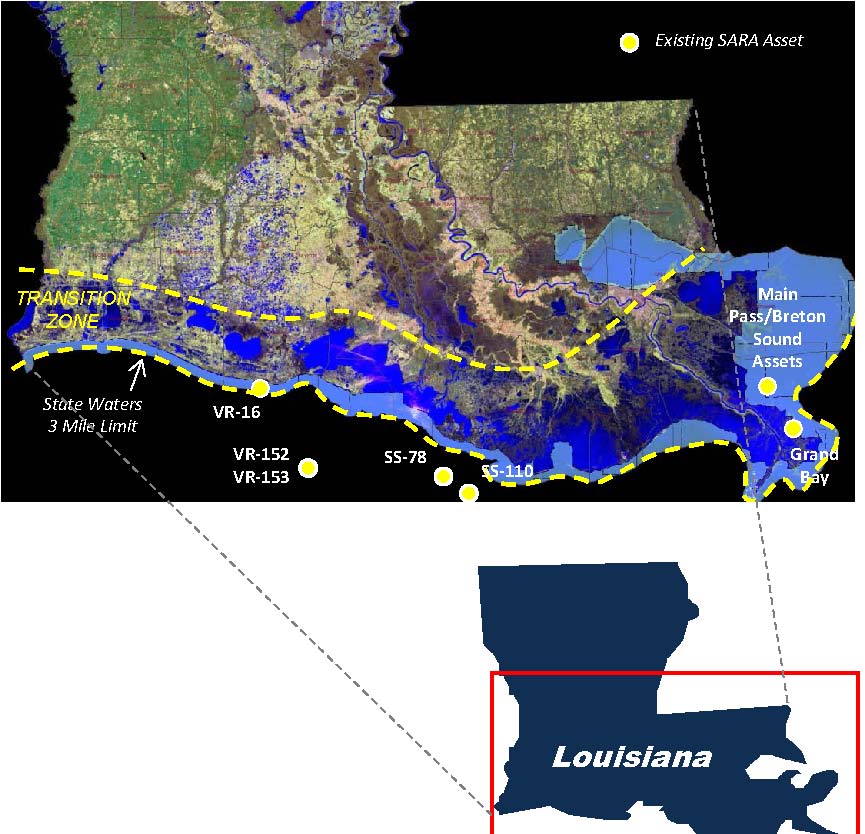

Saratoga Resources (ticker: SARA) is an independent exploration and production company with 52,103 net acres under lease in the Gulf of Mexico (GOM). Approximately 62% of its acreage is on the traditional Louisiana coastline and the remaining 32% is located in the shallow GOM. SARA operates and holds substantially 100% working interest in all of its wells.

Saratoga Resources announced results for Q1’14 on May 16, 2014. The focal point of the quarter was reevaluating the company’s direction, rather than operations. Large-scale transitions were implemented and SARA turns its focus to operations for the remainder of its 2014 campaign.

In a conference call with analysts and investors, Thomas Cooke, Chairman and Chief Executive Officer of Saratoga Resources, said: “Q1’14 was a challenging period during which our entire management team took a hard look at our field operations in order to ferret our issues that continued to plague Saratoga and result in unsatisfactory run times and production levels below those considered acceptable by management. As a result of our exhaustive review, we made a number of wide ranging changes that began to go into effect in early March. Those changes included extensive changes in field operating personnel and in our Covington office, investments in repairs and maintenance on our facilities in the field and a focus on adding gas lift gas and salt water disposal capacity that have curtailed our production in the past and, in particular, over the first two months of the current quarter.”

Q1’14 Results

Source: SARA April 2014 Presentation

SARA produced 119.7 MBOE (79% oil) in Q1’14, down 48% from Q1’13 results of 230.7 MBOE. In turn, revenues declined by roughly 45% during the same time period to reach $10.6 million for the quarter. SARA reported a net loss of $8.3 million ($0.27 per share). Development consisted of workovers and efforts to boost the life of the company’s legacy assets.

Changes Complete

Cooke said, “While the review of operations was time consuming and took us away from our planned development operations, the initiatives implemented as a result of that review began to show results almost immediately with run times and production growing markedly over the last month of the quarter.”

Daily production rates for the last week in March were 1,875 BOEPD compared to 1,330 BOEPD for the full quarter of Q1’14 (41% higher). The current production rates are even 4% higher than Q4’13 production of 1,800 BOEPD. The average run times in March increased to 76% compared to 54% in February and January.

A gas buyback agreement was also reached in order to provide resources for gas lift operations. Repairs and maintenance were performed on existing wells and various infrastructures to ensure more reliable future production growth.

Operations Review

Saratoga successfully completed seven workover wells and finished a recompletion in the quarter. Another recompletion was finished before the announcement of the earnings release. SARA had 90 gross wells in production as of March 31, 2014.

Source: SARA April 2014 Presentation

With operations seemingly back on track and a new perspective from management, SARA will continue to focus on low risk recompletions. The company has identified 56 workover opportunities in seven fields and an additional 85 opportunities classified as proved developed non-producing reserves.

New Phase

In the conference call, John Ebert, Vice President of Finance and Business Development for Saratoga Resources, said: “Much of our attention is going to be focused on bringing that baseline production up and arresting decline and then we’ll have the addition of the recompletions that we added. You’ll see Saratoga do some additional recompletions, but I think we’re going to try to focus on bang for our buck and driving our baseline production up through the end of the second quarter.”

Rigs are running in both the Breton Sound 32 and Grand Bay fields. The Rocky 3 in Breton Sound reached total depth on May 14, 2014, and is analogous to the Rocky 1, which produced 660 gross BOEPD in a test during August 2013. The Rocky 3, in addition to two wells nearing completion in Grand Bay, are all expected to be online by June 2014. The company is seeking partnerships and joint ventures for exploratory projects in the deep and ultra-deep sections of Grand Bay, Vermilion 16 and its new Central Gulf of Mexico leases. An undisclosed partner will participate in the Goldeneye prospect in Grand Bay. The region is currently being evaluated and well costs are estimated at $10 million to $12 million.

SARA held $21.0 million in cash balance at the end of April 2014 and spent just $1.3 in expenditures for Q1’14. Management said its budget for the current fiscal year will be adequately funded from its operating cash flows in addition to cash on hand.

“At the year-end, I think you heard us refer to the fact that we were looking at a pretty miserable quarter coming up or that not to expect any big turnaround,” said Cooke. “I am happy to announce today that we have affected a turnaround in our minds, and I think the numbers speak for themselves.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.