The oil market is showing signs of recovery as of late, with oil topping $50 a barrel during intraday trading today for the first time since November 2015 (the brief piercing of $50 ended quickly).

The ascent has been slow but steady and aided by slowing production in the U.S., and production outages in Nigeria and Canada. However, it has become fairly well known that most oil producers around the world are clamoring for the price to reach a more ‘sustainable’ level for the foreseeable future.

This sentiment was ripe on the mind of Mohammed bin Saleh al-Sada, oil minister of Qatar and current president of OPEC, this week in a discussion with the Associated Press. The countries of OPEC are set to meet next week in what may become a tense discussion on production and oil prices. In preparation for this meeting, countries are lining up their initiatives and oil price is at the top of many peoples list.

Mohammed bin Saleh al-Sada said a minimum price of $65 a barrel is “badly needed at the moment.” He cautioned that the security of future supplies is as risk because of the price slump that has squeezed oil producers since 2014. “The oil market is recovering slowly but steadily. Luckily, the fundamentals show it is heading in the right direction,” al-Sada said. “I don’t think we are yet at a fair price. We need to have a fairer price so that we can have the ability to invest more in order to secure the energy supply to the world and avoid any price shock.”

KLR Group released its own findings recently saying median breakeven price for oil is $55 per barrel in the U.S.

Don’t Step on My Toes

However, discussions have been swirling around OPEC for a number of months on how to raise the oil price, with discussions of production freezes and agreements to not step on each other’s toes. Nothing has come to fruition from these discussions. However, nothing is off the table either as al-Sada said, “Nothing actually is canceled but we are reacting to the parameters of the market. If OPEC and non-OPEC major producers think that the revival of [a production freeze] is necessary, it’s all open and on the table all the time.”

Rumor has it that talks fell apart as Iran was resistant to freezing production following the lifting of sanctions. Saudi Arabia has responded to the price drop by increasing production to secure market share and warned recently that the country could increase production even more, and rapidly.

Therein lies the catch-22 of the current market environment. Everyone seems to want higher oil prices, but also to retain market share without cutting production. In similar situations, OPEC has guided production and prices by cutting production and providing stability to the oil markets. But after decades of maintaining strong control of the valve that sets global oil prices (the supply), the omnipotent hand of OPEC no longer wields that type of power over the market.

The New Kid on the Block

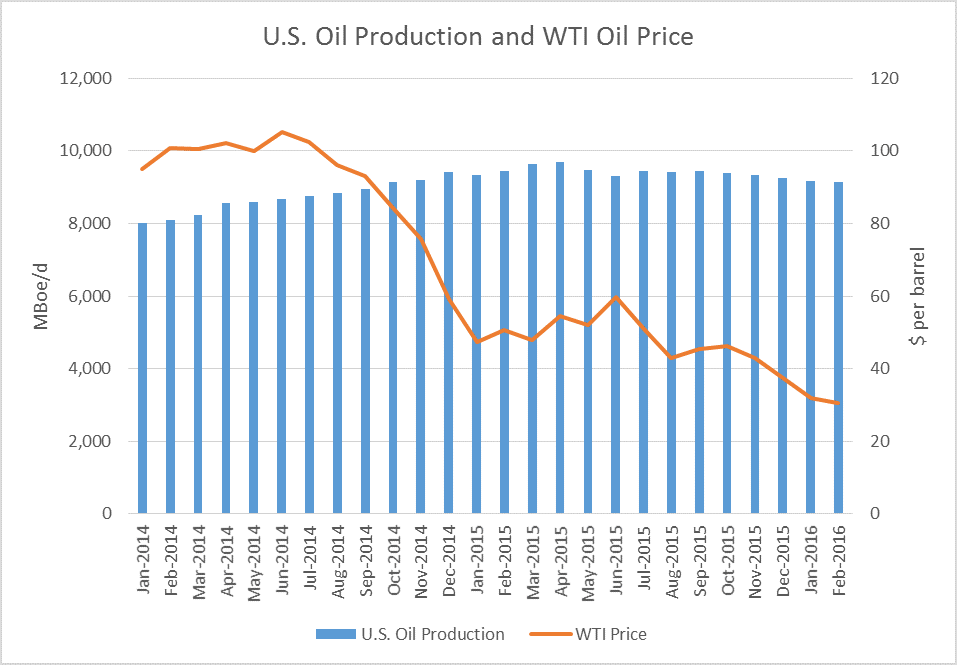

In June 2014, The United States overtook Saudi Arabia as the largest oil producer in the world, adding to its already established crown of top natural gas producer worldwide. Consequently, Saudi Arabia waved its supply wand not long after and tanked the oil price in a move seen by many as an attempt to push U.S. producers to the brink of bankruptcy or beyond.

The unique aspect in the U.S. is the capitalist market that dictates oil and gas production. There is no regulation on production volumes dictated by the U.S. government as is the case in many oil producing countries. Restrictions on production come from cash flow and capital spending. Declines in oil price restrict spending and cash flow. As Mohammed bin Saleh al-Sada said, the concern is that capital injections needed to secure future production is limited during low oil prices.

The catch-22 present in the U.S. market is that E&P companies will keep drilling to generate cash flow, and once oil price rises beyond a particular level (relative to company and location), then more oil will flow from beneath U.S. soil. Increased production will curtail price gains, and the cycle will repeat.

The past two years in the oil markets have made one thing clear, the U.S. has become the world’s swing producer and the Middle East cartel no longer has dictatorial control over the oil price. They certainly can have significant influence on global oil prices, as evidenced in the current predicament, but not total control.

Okay, So Who is the Captain of this Ship?

The oil market, as with any commodity market, has an inherent volatility present within the construct of supply and demand. Gold, copper, corn, etc., etc., all fluctuate based upon the market conditions. The oil market had not been as volatile due to the control of OPEC over the level of production (and therefore prices) in the market. But the cartel exerted its influence and the market adapted.

However, the power of OPEC is waning. Although there remains hope among participant countries that at next week’s meeting in Vienna on June 2, they will be able to contrive a plan to exert their influence on the market to achieve their desired ends. After last month’s OPEC summit in Doha failed to construct a united front against low oil prices, the head of Rosneft, Russia’s largest oil company, commented that the cartel “has practically stopped existing as a united organization.”

The implication is if OPEC no longer has control over market forces and the ability to control prices, if the U.S. has become the swing producer, the oil price volatility—or lack thereof—now resides in the realm of the free market. In the free market, balance will be reached through the balancing of supply and demand in due time, not via an external influence.

To what effect? High cost, highly leveraged providers stand to be driven from the market, and while this does not bode well for short term volatility, there is a good possibility that long term stability can be established by the natural forces of the market.