Thwarted by Oil Market, SLB Posts first Quarterly Loss in More than a Decade

Fourth quarter earnings season is officially underway, and, expectedly, Schlumberger (ticker: SLB) opened up the forum with a not-so-pleasant outlook on the oil and gas market.

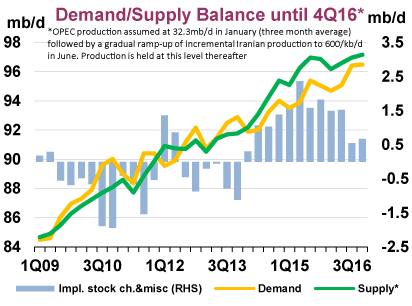

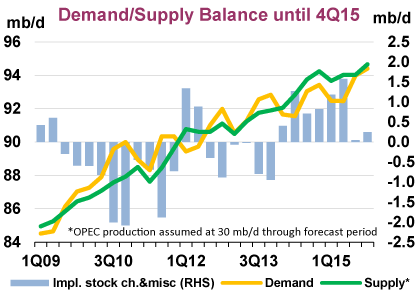

Paal Kibsgaard, Chairman and Chief Executive Officer of the world’s largest oilservice company, essentially echoed all of the problems that have plagued the market throughout the commodity downturn. High volumes, along with an incoming surge from Iranian production and reduced growth from emerging countries like China, have Kibsgaard and fellow SLB management bracing for another difficult year.

“For many of our customers, available cash and annual budgets were exhausted well before the halfway point for the fourth quarter, leading to unscheduled and abrupt activity cancellations, creating an operating environment that is increasingly complex to navigate, and where the traditional year-end product and multi-client site mix sales were largely muted,” said Kibsgaard in a conference call on January 22, 2016.

Although many oil and gas investors and professionals happily turned the page on 2015, the persistent headwinds are not expected to alleviate any time soon. “The market also for oilfield services in the coming quarters will remain challenging as the pressure on activity and service pricing is set to continue,” Kibsgaard predicted. “It also means that 2016 E&P levels will fall for a second successive year and that any significant recovery in our activity levels will be a 2017 event.”

The Oil Price Crash has Taken No Prisoners

Schlumberger is one of the strongest names in the energy industry, backed by metrics that make it one of the most attractive companies in EnerCom’s OilService Weekly Benchmarking Report. Its operating profit (12%), return on invested capital (24%) and EBITDA margin (28%) are all significantly above the industry median, even though SLB’s market cap is larger than its next five competitors combined.

However, SLB was not immune to the effects of dramatic activity declines, directly affecting its balance sheet and workforce. For fiscal 2015, full year revenue was 27% lower compared to 2014, with North America and international revenue sliding by 39% and 21%, respectively, with Kibsgaard adding the declines were in-line with projecting E&P spending reductions.

Restructuring and non-cash impairment charges led to pre-tax writeoffs of more than $2.1 billion in the quarter. “The asset impairment charges largely relate to our North America business which, as you know, has been the hardest hit during this downturn,” said Simon Ayat, Chief Financial Officer of Schlumberger, in the call. However, Kibsgaard says the headwinds on international activity are fully absorbed into SLB’s results to date, making the market a “highly compressed coiled spring” for his company in the event of a commodity rebound.

Until then, SLB will have no choice but to continue to cope with the current environment. The oilservice major said it has laid off more than 34,000 employees throughout the downturn, and anticipates a similar annual budget of $2.4 billion in 2016.

Cautious Optimism

SLB offered a few glimmers of hope for a rebound, but overall expects the depressed market to persist in the near term. Some analysts and competitors have speculated of a rapid recovery, aided by the market essentially overcorrecting itself and tipping the scales to the shortage side, rather than supply.

“Dramatic cuts in E&P investments are starting to take effect,” explained Kibsgaard. “The apparent resilience in production outside of OPEC and North America is in many cases driven by producers opening the taps wide open to maximize cash flow, which also means that we will likely see higher decline rates after these short-term actions are exhausted.”

Management did mention technological sales are at a “significantly higher level” than previous downturns – more proof of what we already know, that producers are using every last bit of expertise to squeeze every barrel out of the ground. SLB will further integrate its “pore to pipeline” business once it completes the acquisition of Cameron International (ticker: CAM), a well-head specialist. The merger is expected to be finalized in the upcoming quarter.

…Will it Get Any Worse?

Kibsgaard does not believe so, but admitted it is too early to predict. “I’m still optimistic and I would hope that 2016 is the trough, but I’m not ready to rule on it yet,” he said. “The coming quarters will remain challenging as the pressure on activity and service pricing is set to continue. It also means that 2016 E&P spending levels will fall for a second successive year and that any significant recovery in our activity levels will be a 2017 event.”

KLR Group admitted the call was not encouraging on a recovery level, but did offer some upside in a recap note issued on the day of the conference call. “In our view, a dour tone in the earning release and call may not mark the bottom of activity, but may mark the bottom in sentiment… The bears may be running out of negative catalysts with oil under $30 and the consensus outlook so bleak.”