Energy growth triggers company expansions, community improvements

“When it comes to energy, no region, not even the Gulf, can compete with Ohio,” said Dana Saucier Jr., senior managing director of energy and chemicals at JobsOhio.

Ohio has emerged as a national leader in energy, largely due to the state’s shale industry, which has served as the biggest driver of energy growth in the country and has contributed to the attraction of over $70 billion in new private sector energy investments in Ohio alone.

When factoring in the rest of the Ohio Valley region, this number is significantly larger. These investments from the U.S. and abroad, combined with continued job growth, additional tax revenue and an abundance of low-cost, clean shale energy and electricity have resulted in a positive ripple effect on Ohio’s communities, businesses and consumers.

Much of this growth can be attributed to Ohio’s proximity to the Utica and Marcellus shale formations in eastern Ohio, offering an abundance of low-cost natural gas, natural gas liquids (NGLs) and oils, and accounting for more than 85 percent of U.S. shale gas production growth since 2011.

Additionally, the formations have helped Ohio’s shale gas industry lead the nation in growth for four consecutive years, according to the JobsOhio Shale Investment Report, compiled by Cleveland State University’s Maxine Goodman Levin College of Urban Affairs.

As many as 12,000 high-paying jobs in the state have directly resulted from this industry, and this figure exceeds 100,000 when indirect jobs such as welders, fabricators and logistical workers are included.

The money follow discoveries of oil and gas

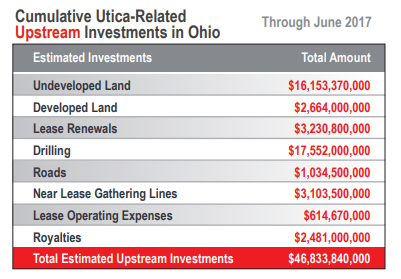

Shale-related investment in Ohio totaled an estimated $63.9 billion from 2011 through June 2017. Of this amount, $46.8 billion represented upstream investment (drilling, roads and lease-related investment). This amount is significant because it reflects the abundant presence of low cost natural gas and NGLs needed to supply current and future downstream job-generators such as petrochemical plants, plastics manufacturers, natural gas power plants and manufacturing across Ohio’s numerous industries helping to create a competitive advantage. Despite lower hydrocarbon prices, upstream shale investment remained active, with more than 130 new highly productive wells in the second half of 2016 alone.

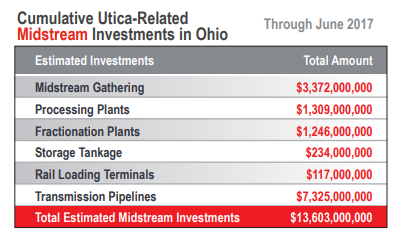

More than $13.6 billion has now been invested in Ohio midstream activities. In fact, the major shale story for the first half of 2017 was the investment into midstream infrastructure, especially for pipelines. Construction of natural gas, NGL and oil pipeline transmission systems represented investments totaling more than $4.7 billion. These projects are critical because they move our valuable feedstocks from the production region to the marketplace providing greater access across Ohio for existing companies and provide new opportunities for companies interested in locating in Ohio to construct on one of many development sites.

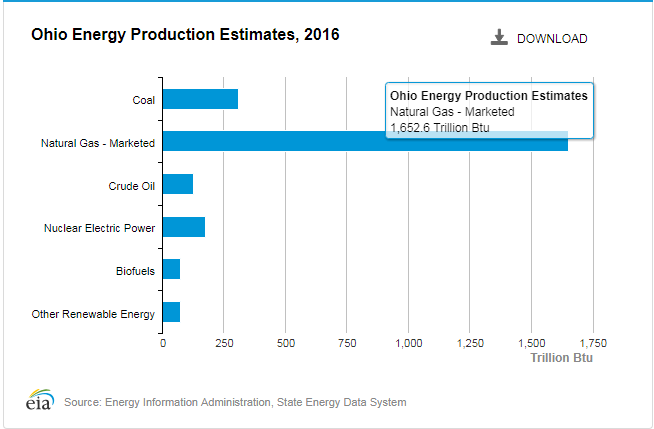

According to the EIA the Utica Shale accounts for almost all of the rapid increase in natural gas production in Ohio, which was more than 21 times greater in 2017 than in 2012. Ohio is also the eighth-largest ethanol-producing state in the nation, supplying almost 550 million gallons of ethanol per year.

“When it comes to energy, no region, not even the Gulf, can compete with Ohio,” said Dana Saucier Jr., senior managing director of energy and chemicals at JobsOhio.

“With natural gas prices at a cost lower than nearly anywhere else in the world, abundant fresh water from the Ohio River and other sources, an integrated infrastructure allowing for national and global market access, and many energy companies along the supply chain that call the state home, there is tremendous potential to further grow capital investment in Ohio in the energy industry,” Saucier said.

Thai-based PTTGC America and South Korean-based Daelim are still evaluating the feasibility of building a multibillion-dollar, world-scale petrochemical complex in Belmont County. If constructed, the project would create hundreds of permanent jobs and thousands of construction jobs in the Ohio Valley. This project would utilize regional and cost-advantaged ethane feedstock, as outlined in the Shale Crescent USA IHS study.